Bitcoin’s volatility spills over to Futures market as BitMEX soars

The latest UpBit hack has caused BTC to drop below $7,000. As Bitcoin hovers around this region, longs worth 13.2 million have been liquidated over the last 6 hours. However, the volume of Futures products is soaring.

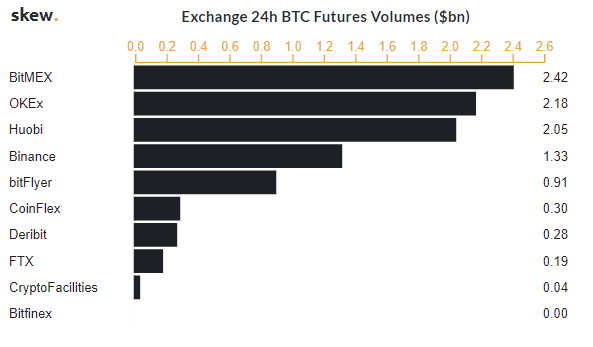

According to Skew markets’ tweet, the 24-hour trading volume on BitMEX dominated the Futures market to a tune of $2.4 billion.

Source: Skew

OKEx’s Futures market recorded the second-highest 24-hour trading volume worth $2.1 billion. Following it were Huobi, Binance, and bitFlyer.

Open Interest and Futures Market

BitMEX is the first platform to develop perpetual contracts that have gained huge popularity and have been adopted by almost all exchanges getting into the derivatives market. The open interest [OI] on BitMEX, at press time, was very close to hitting $1bn. According to Delphi Digital’s October 2019 report, OI hitting the mark in the past represented trend exhaustion.

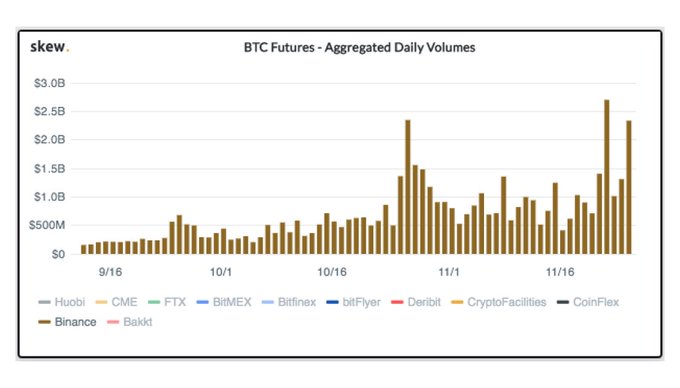

Additionally, the aggregate Futures volume since November 2019 hit a high of $20+ billion on 22 November. As of 26 November, this volume had hit $10 billion, which includes Futures exchanges like BitMEX, Deribit, Binance, OKEx, FTX, Huobi, Bitfinex and more.

Source: Skew

Binance’s Futures market, which was launched on 13 September, has grown at an exponential rate and has consistently maintained a volume of over $1 billion, which is a feat in of itself, considering the competition present in the futures market. $2.5 billion was the highest trading volume recorded on 18 November.

The short-term narrative of Bitcoin’s price might flip and cause the price to push higher, especially with the formation of a potential inverted head and shoulder pattern.

Source: BTC/USD TradingView

The pattern, if adhered to, could push the price of Bitcoin above $7,300 and even higher. However, a major resistance stands guard at $7,400 and breaching this could signify a short-term reversal.