Bitcoin’s rising price might be a ‘huge buy signal’

2020 has already left a mark on the cryptocurrency industry for various reasons, be it Bitcoin’s initial bullish movement or the recent fall. COVID-19 changed the path.

Will Bitcoin continue to be correlated with traditional risk assets?

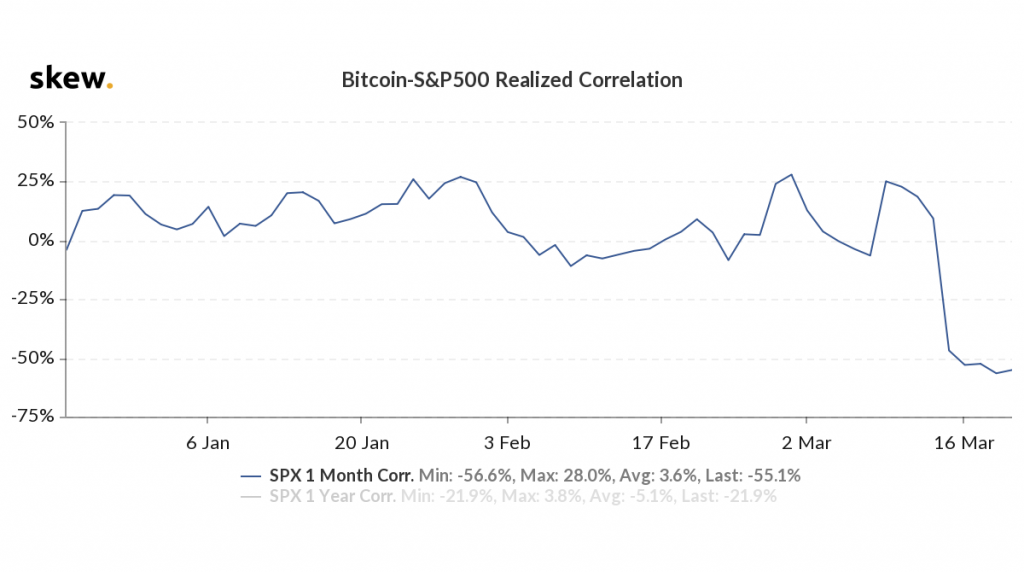

The King coin as of March 20, recorded a low with S&P500. The 1-Month realized correlation for BTC-S&P500 which was at 25.52% on March 9, dropped to -46.9% on March 13. It is currently at a correlation of -55.1%.

Source: Bitcoin-S&P500 Realized Correlation, skew

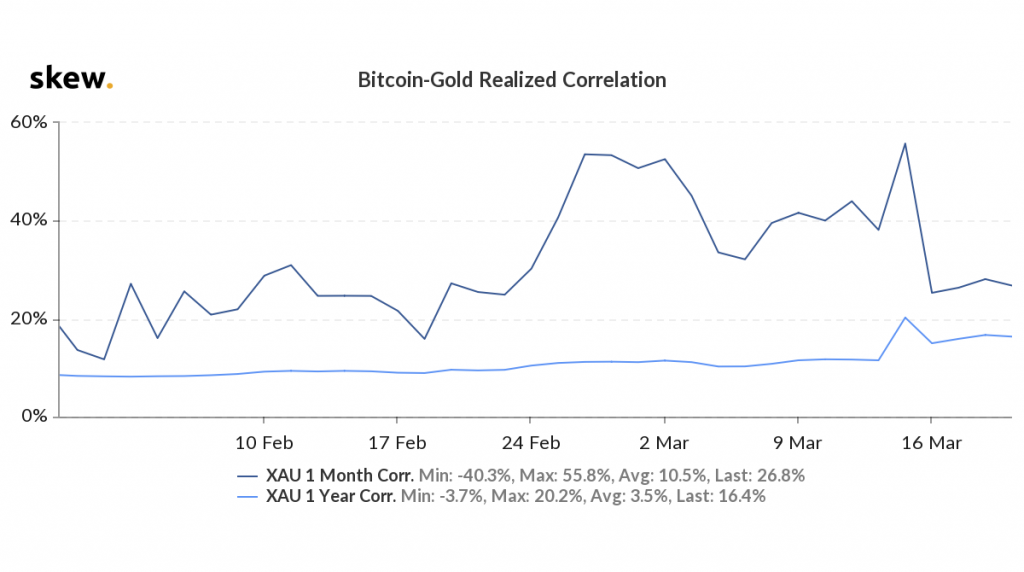

Similarly, the coin was highly correlated with Gold just days ago, dropped from 55.8% on March 13 to 26.8%, at press time. This drop in the correlation of Bitcoin with other traditional assets is a good sign for Bitcoin’s ‘uncorrelated asset’ claim.

Source: Bitcoin-Gold Replaced Correlation, skew

Tongtong Gong, COO, and Co-founder of crypto analytics firm Amberdata, in a recent podcast, opined that Bitcoin and the entire crypto space would see significant growth five years down the line.

She stated,

“From the financial history or from a finance perspective, it’s not really a linear, predictable, linear fashion, right? It’s a war. So I think the next five years is critical in the development of digital asset as the regulations become more clear.”

Interestingly, Bitcoin experienced a rise in price by 29.7% in 25 hours; this is the first time the price rose after the ‘Black Thursday’.

Source: BTC/USD, TradingView

Commenting on this rise, Naeem Aslam, chief market analyst at AvaTrade noted that this upward movement of Bitcoin was a “huge buy signal”. He stated,

“Given the fact that the price has crossed the $6,000 mark – an important level of resistance – the upward momentum is likely to pick up the pace, and if the price crosses the 200-day moving average on a daily time frame, it would be a huge buy signal.”