Bitcoin’s institutional investors taking a step-back as OI exhibits a nose-dive

Bitcoin and the collective digital asset bid farewell to a rally as the crypto market industry registered a 22 percent drop, which took the king coin’s market cap from $302 billion to $236 billion in the last 14 days of February.

Although March had commenced at press time, the repercussions of Bitcoin’s depreciation had carried over to the institutional side of trading as well.

Source: Skew

According to the above skew chart, CME Bitcoin Futures’ total open interest and volume dipped significantly over the past two weeks of February as OI dropped from $338 million on 14th February to $210 million on 28th February. Although daily volumes hit a monthly high of $1.1 billion on 18th, a yearly low of $118 million was observed on 21st. On 28th, the daily volume was around $204 million.

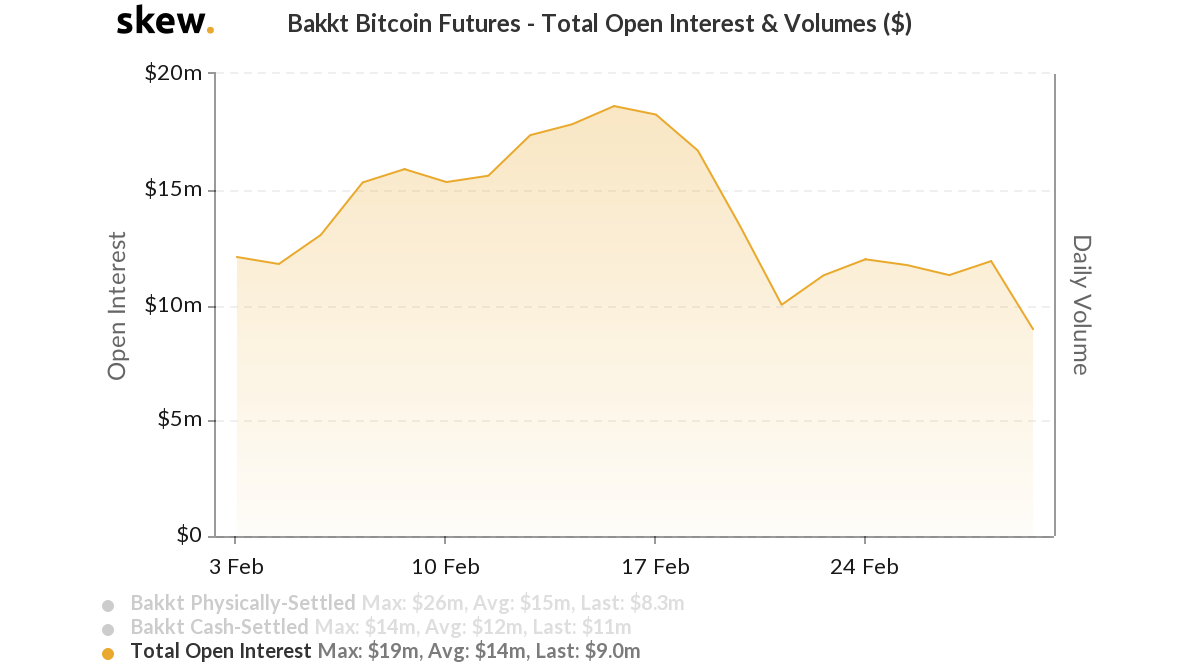

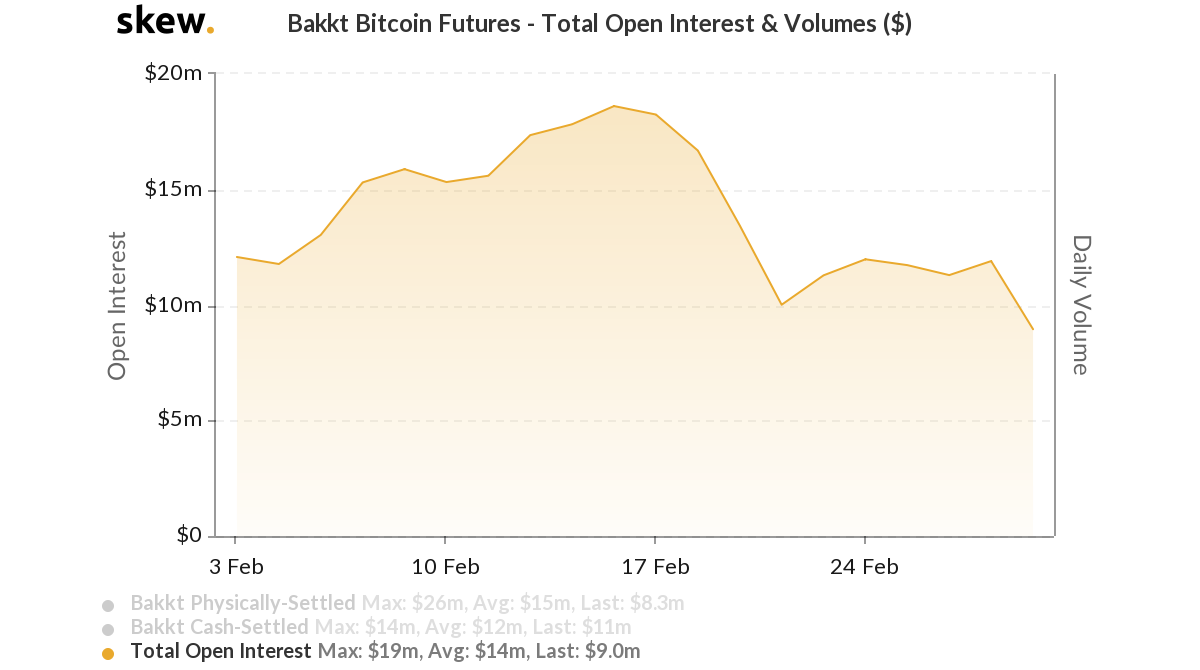

Source: Skew

Bakkt’s Bitcoin futures faced a similar fate as the aggregated open interest dropped down to $9 million on the 28th. The monthly high OI was 19th million on the 14th.

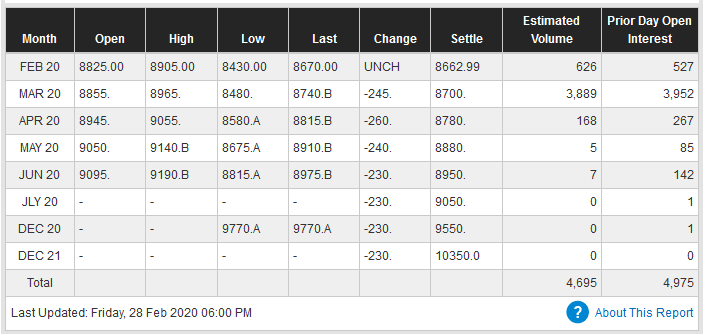

Source: CME group

A reasonable explanation can be inferred from the above chart.

Over the last week of February, over 626 BTC futures contracts were settled at $8662 which may have triggered a drop in Open Interest as well. Previously, it was reported that close to 37 percent of all outstanding positions on the exchange had been shut as Bitcoin’s valuation had failed to swing upwards during the tail end of the Month.

The declining open-interest also affected the premium rates on CME futures as traders were slowly becoming less bullish for the months ahead. Premiums of CME were up by a mere 0.6 percent over the previous week.

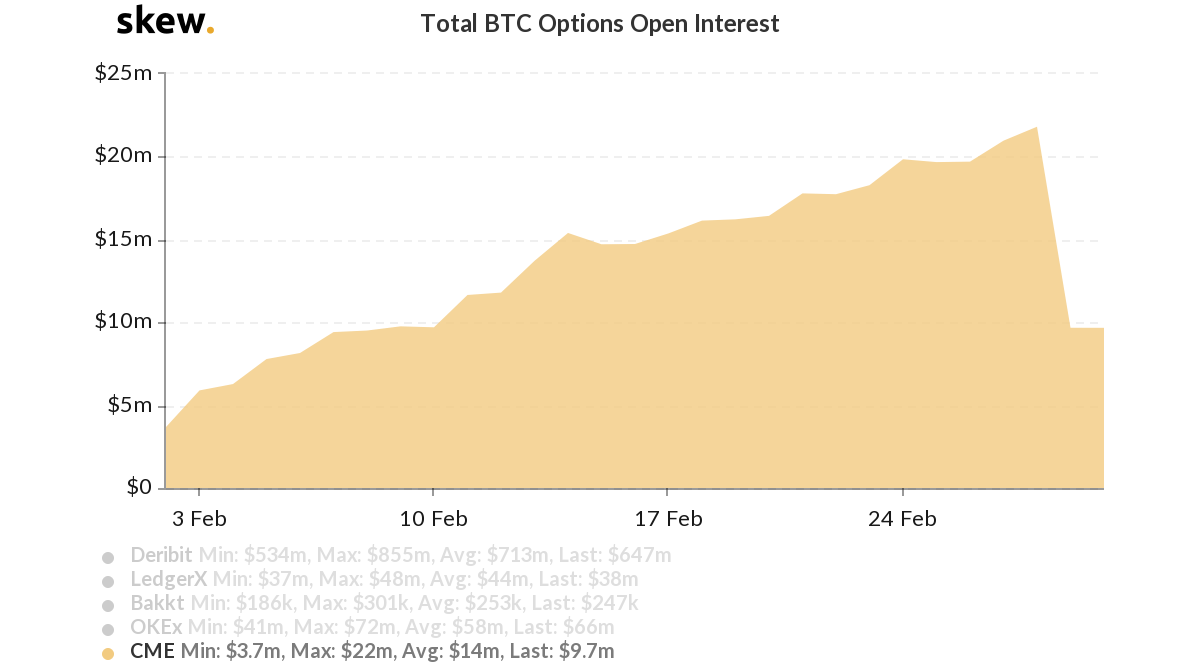

Source: Skew

Other than futures, CME’s Bitcoin options registered an evident slump on 29th February, as Open-interest dropped to 9.7 million after exhibiting a high of $22 million just a day prior.

Assuming Bitcoin undergoes under bullish rally, a higher involvement from the institutional and retail side can be expected but for the time being, investors remain cautious in the market.