Bitcoin’s hash power still largely ‘seasonal’

Bitcoin miners have always been in the spotlight; right from its initial heydays to the ones leading up to its recent halving. For the network, the miners are a very crucial part of the puzzle. For miners, both big and small, the reduction in block rewards has made it a bit more challenging to maintain their mining operations. After the halving, while Bitcoin managed to keep the hash rate stable, the transaction fees spiked as a reaction to the 50 percent drop in revenue for miners.

On the latest episode of the On the Brink podcast, Apolline Blandin, cryptocurrency research lead at the Cambridge Center for Alternative Finance, discussed how energy and geographic distribution are very crucial variables to the Bitcoin network and its miner ecosystem. Blandin noted that in the case of Bitcoin, there has been noticeable migration in terms of hash power.

While China’s Sichuan province is known to host many Bitcoin mining pools, Blandin said that the region sees migrations based on seasons.

“The rainy season in Sichuan is from May to the end of October. In September and October on the map, then you see that situation is about 37%. But then as the rainy season ends, a lot of miners are relocating their operations to other regions like inner Mongolia”

The primary reason why miners have settled down in regions like the above is due to the province’s dependence on hydro-power. During the monsoons, excess energy is generated and Bitcoin miners are able to capitalize on the low-cost energy to sustain their operational costs.

According to Blandin, China’s energy security policies have given birth to such a scenario.

“During the rainy season that produce a lot of oversupply in excess of energy. A couple of weeks ago we saw, a city in Sichuan who was actually calling for miners to come and install some of the facilities there to tap into this excess energy.”

With the block reward now being 6.25BTC, such variables have a magnified role for mining pools and can initiate shutdowns.

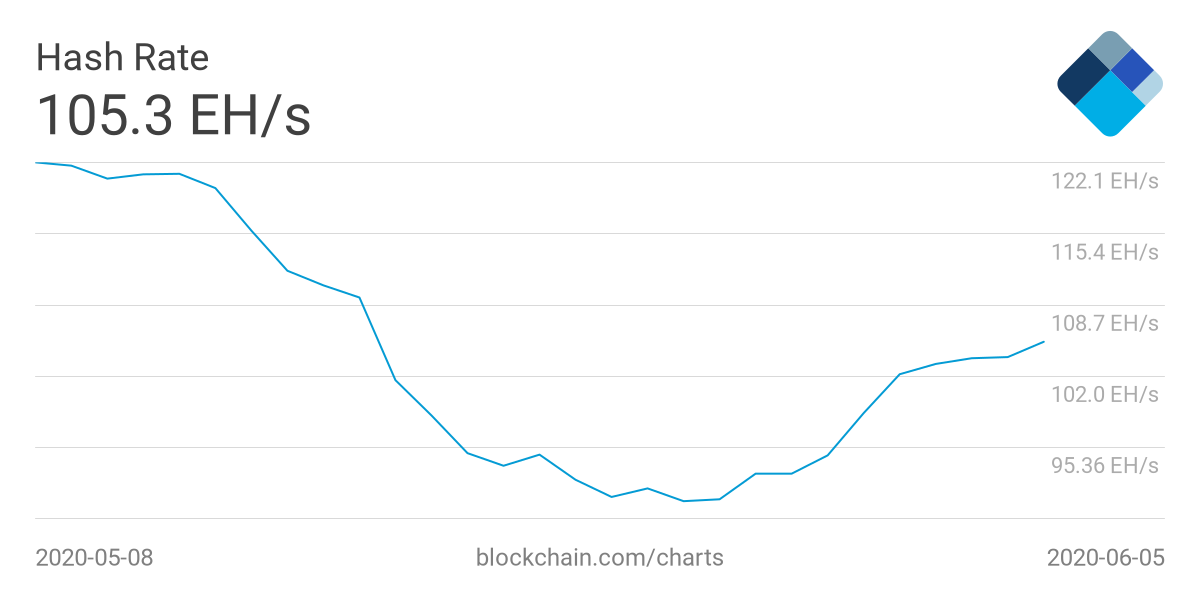

Source: Blockchain.com

According to network data, after the third block reward halving, the Bitcoin network did see a drop in hash rate. While the network has bounced back, it goes to show how such variables such as the block reward can influence an otherwise delicate system i.e its mining ecosystem.

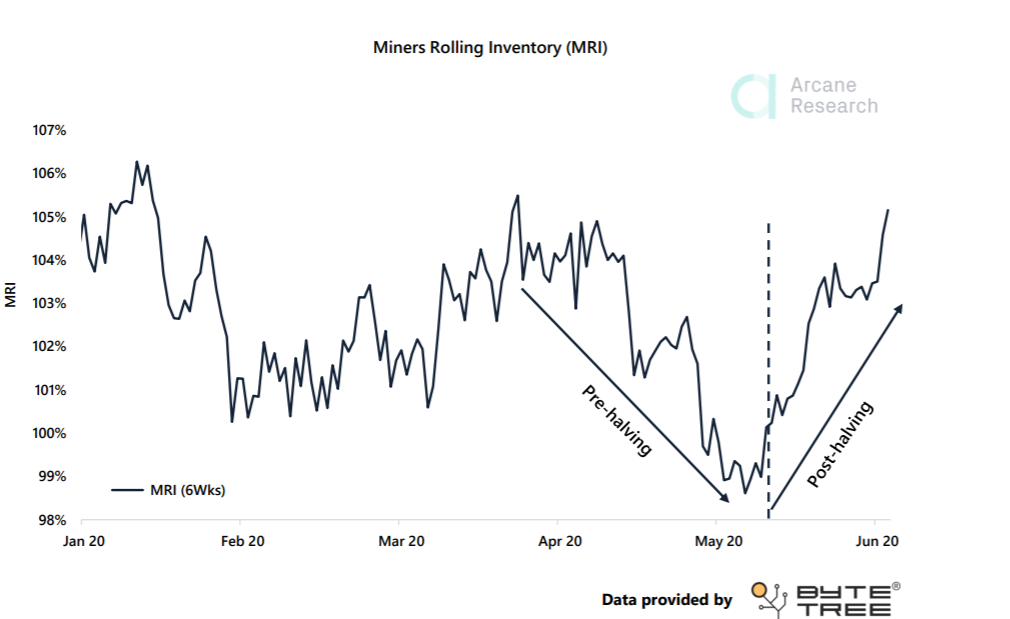

Source: Arcane Research

In fact, the latest Arcane report cited data from Bytetree showing that miners are now selling their BTC inventories to maintain profitability owing to the slashed block reward. Referring to the MRI indicator, the report noted,

“An MRI above 100% means that miners are moving more than they are mining. The only way to do this by also moving inventory built up previously.”

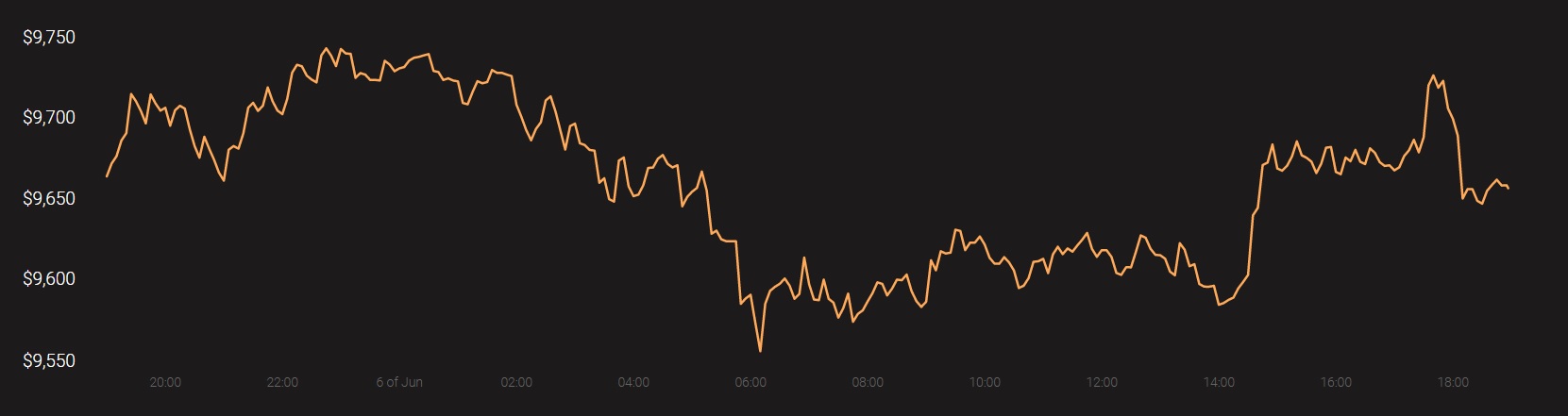

At the time of writing, Bitcoin was priced at $9,659 with a 24-hour trading volume of $21.4 billion.

Source: Coinstats