Bitcoin’s 14K price triggers a series of these consequences

Bitcoin is currently trading around $14,500. The asset saw this particular price range back on January 8th, 2018, a whopping 1029 days back. Safe to say, these were unfamiliar trading provinces in the past three years.

With Bitcoin building its rally step-step across the past month, the recent entry above $14k is currently creating a derivatives market frenzy (an almost non-existent market in Jan 2018).

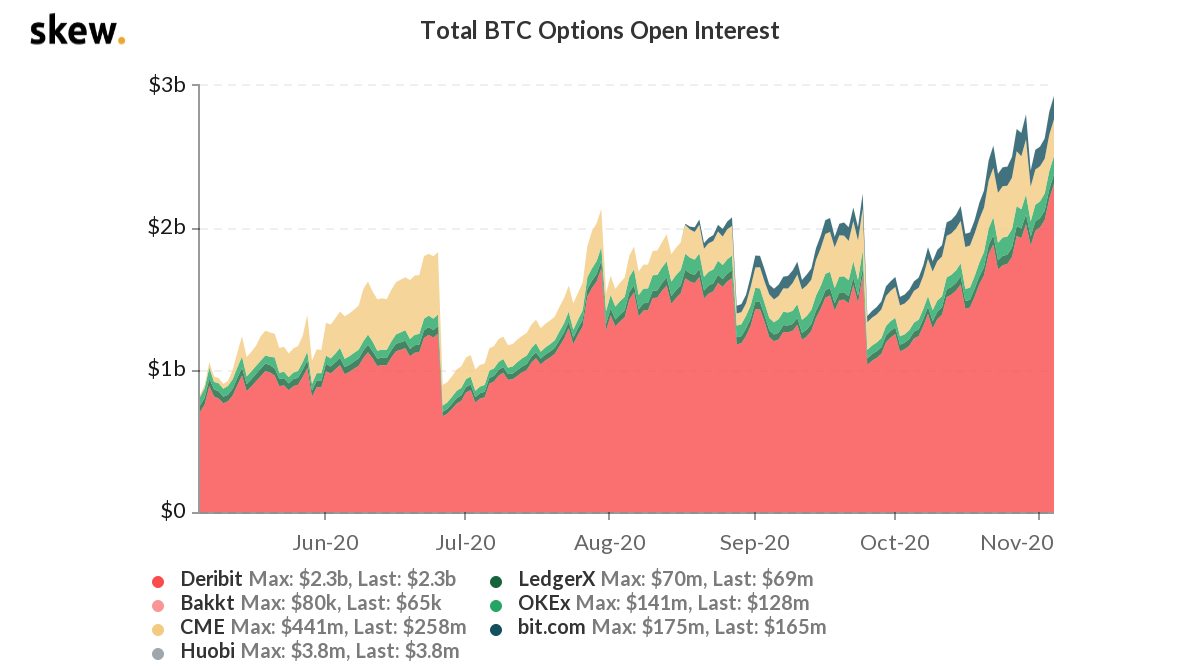

Source: Skew

As illustrated by Skew, the collective Open-Interest across major exchanges went through the roof and total BTC Options Open-Interest registered a new all-time high. Deribit indicated its highest BTC OI at $2.3 billion, alongside Huobi and LedgerX, registering respective highs at $3.8 and $69 million.

The surge in OI was coupled with the increase in calls with respect to puts. Skew indicated that BTC Put/Call Ratios was dragged down to 0.61 from 0.74 over the past few days.

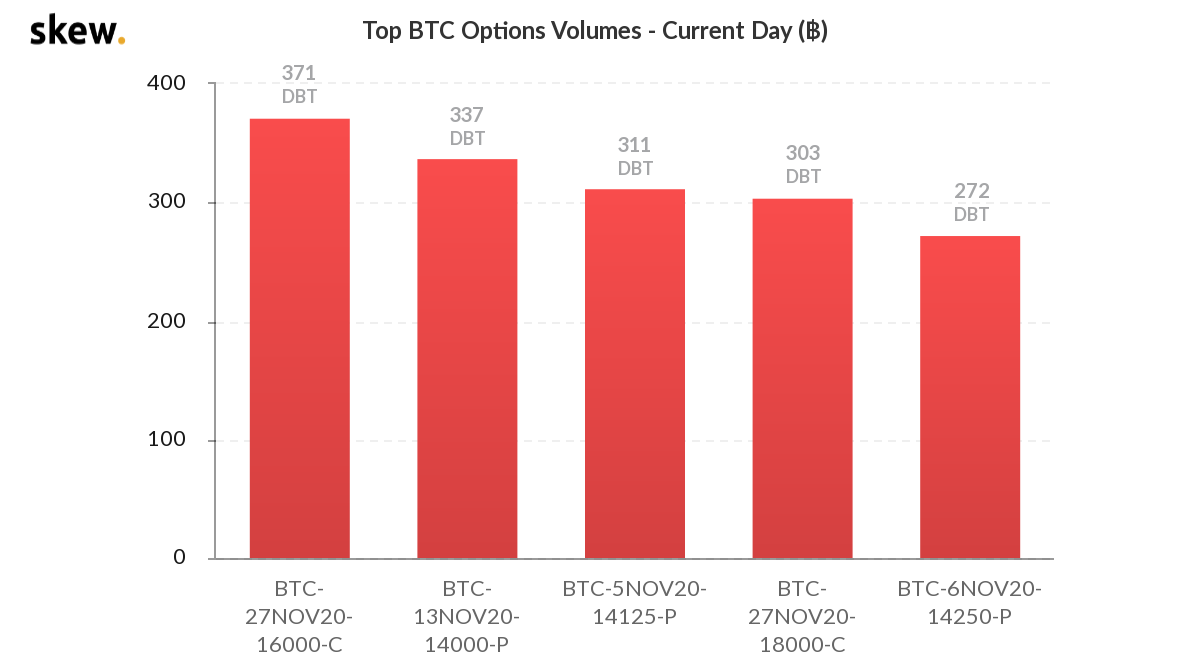

Source: Skew

Speaking about Calls and Puts, the optimism across the board was reflective of the contracts as well. Many traders were expecting BTC to ascend up to $16,000 and $18,000 by the end of November. However, it was thoroughly balanced with some group of traders opting for a drop down to $11,000 (stats not displayed in the above chart).

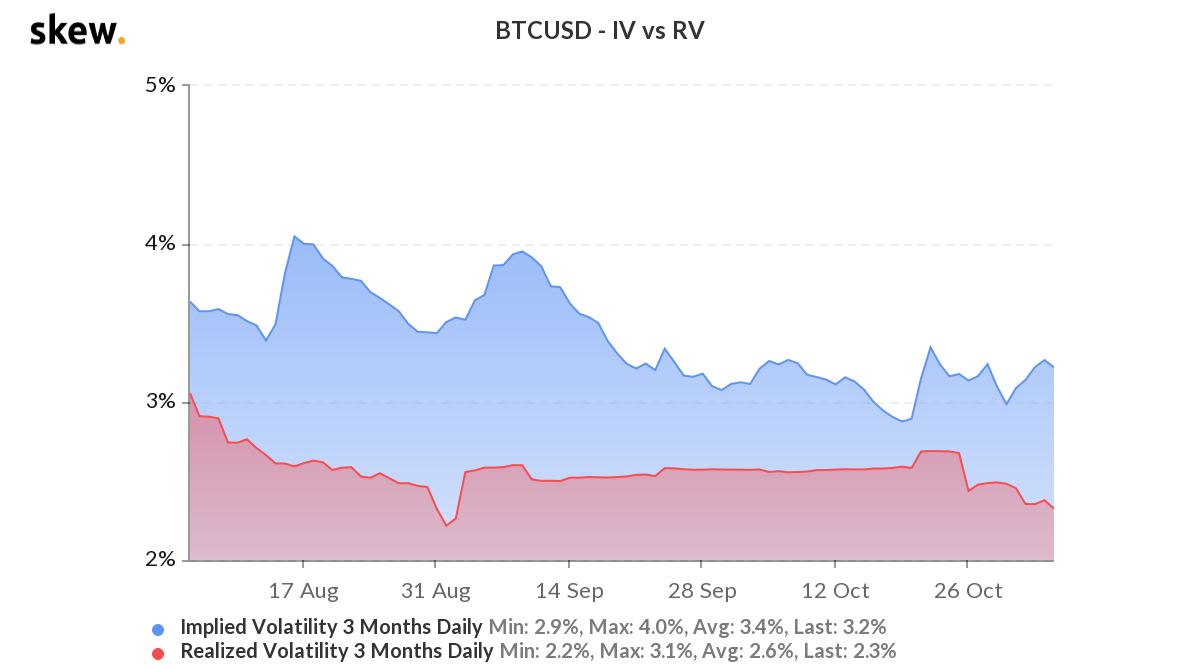

Source: Skew

Surprisingly, Bitcoin’s realized volatility dropped during the current trading session, signifying a less volatile market than expected. Low realized volatility may suggest that the options market was expecting more stability as Implied Volatility exhibited a minor decline as well.

Potential aftermath following market cool-down

Last week, we reported on the current dilemma of CME futures traders, on whether it is better to facilitate a roll-over or settlement on the BTC futures contract.

With respect to the current market, a roll-over would have been a better option. Now according to Ecoinometrics’ recent newsletter, the October contract expired with a record 43% of the calls, ending up in the money. This is before BTC crossed $14,000 so the potential investment from the institutional end may only increase in November.

Bitcoin Options traders have been positive through and throughout, and considering Bitcoin is able to consolidate above $14,000, the floodgates may open from CME’s clients as well.

On a larger scale, it is positive for Bitcoin as well, with the asset potentially entering another bullish-rally towards the end of 2020.