Bitcoin trading at 25% premium in crisis-stricken Lebanon

Lebanon, the country spanning a mere 10,400 sq. km on the western border of Syria is on the brink of collapse. Riddled in a slew of financial crisis, the falling value of their currency the Lebanese pound [LBP], the resignation of their Prime Minister Saad Hariri, its citizens are looking elsewhere for respite.

According to a recent report by Reuters, Lebanon is staring at bond repayments worth $1.34 billion in interest and $842 in principal coming up at the end of March and April. The analysts queried on the matter suggested that a “rescheduling or a restructuring” could be worked out, which would only delay the inevitable.

On the foreign reserve front, the country’s coffers not only look dry, but negative. Despite holding a lot of US debt, the country’s central bank implemented a “reverse ponzi scheme” to increase the dollar reserve, which had a reverse effect by “reducing net foreign reserves,” according to Miner Update’s Andrew Kang.

In the midst of this crisis, in which the LBP is trading at a discount of over 30 percent on the black market, cash-strapped citizens are looking to Bitcoin. Kang’s tweet stated,

16) Some people convert acquired cash to BTC/USDT in order to move capital overseas – many of them using the crypto to buy property in the UAE.

There are increasingly more WhatsApp groups dedicated to this OTC activity

— Andrew Kang (@Rewkang) January 26, 2020

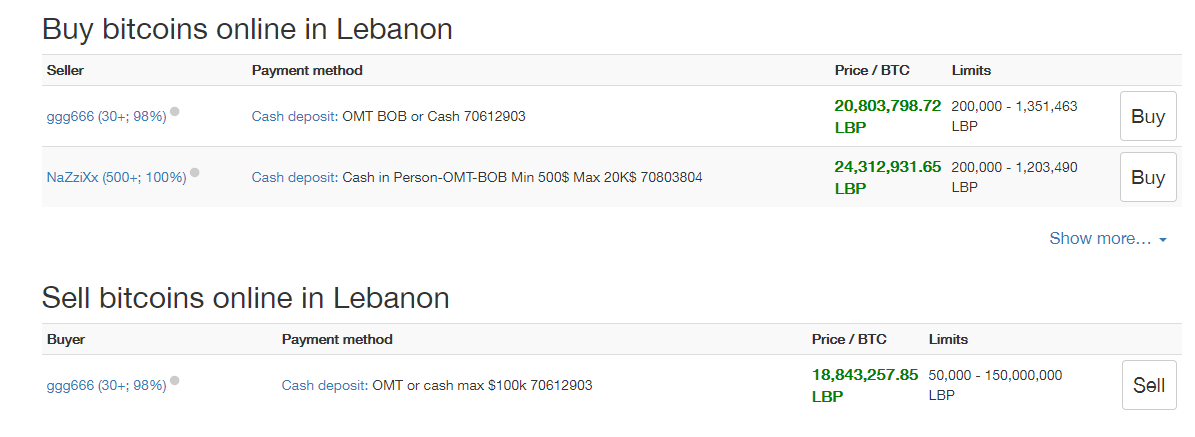

Peer-to-peer exchange LocalBitcoins recorded a premium on Bitcoin transactions from the Mediterranean country. At press time Bitcoin transactions, on the buy side, were valued at LBP 20.8 million or $13,700, a premium of over 30 percent against the global price of Bitcoin at $9,100. On the other hand, Bitcoin was selling at LBP 18.84 million, a premium of 26 percent.

Source: BTC/LBP via LocalBitcoins

A similar capital-flight was seen in Argentina back in August. Following an unexpected victory in the Presidential elections, the Latin American country’s premier stock market index, the S&P Merval 25 dropped by over 45 percent with the Argentinan peso [ARS] losing 25 percent of its value. Bitcoin saw yet another bump up in ARS exchange, trading at a premium of over 28 percent against its global rate.

Mati Greenspan, founder of Quantum Economics noted the rise, stating,

Bitcoin trading higher in Argentina than the rest of the market @LocalBitcoins

Lowest offer: 650k Pesos = $10,790 (8% higher than Bitstamp)

Highest offer: 770k Pesos is 28% above Bitstamp.

Bitcoin may be a risky asset for investors but for some, it is clearly a safe haven. pic.twitter.com/idLyTvAkMg

— Mati Greenspan [tweets are not trading advice] (@MatiGreenspan) August 15, 2019

The examples in both Argentina and Lebanon show Bitcoin’s claim as a “safe haven asset” which also proved itself on a macroeconomic scale earlier this month. When the United States killed Iranian commander Qasam Soleimani in a coordinated airstrike, Bitcoin shot up by over 4 percent in the hour. Days later, as Iran retaliated, Bitcoin saw another upswing, breaking the $8,000 mark for the first time since November.