Bitcoin short-term Price Analysis: 22 October

It is turning out to be an extremely bullish week for Bitcoin, with the crypto-asset recording 6 consecutive days of green candles. From $11,250 to breaching $13,000 for the first time in 2020, Bitcoin’s short-term trend is riling up the markets. While altcoins were extremely bearish until 20th October, over the past 48 hours, the collective industry has rallied behind Bitcoin.

However, with turbulency at full-throttle, a price dump isn’t out of the question just yet.

Bitcoin 4-hour chart

Source: BTC/USD on Trading View

While patterns are often nullified during such periods of volatility, the market structure taking shape on Bitcoin’s charts, at press time, was approaching a breakout point. As illustrated by the 4-hour chart, a parabolic ascending curve was reaching its pinnacle after the price oscillated within the pattern for over a month.

The chart highlighted the successful minor rallies attained from Base 1, Base 2, and Base 3 of the parabolic curve, with the crypto-asset having reached a possible sell-out range. Bitcoin topped off at $13,230 a few hours back and at press time, was recovering from a minor drop. While the selling point can be anywhere between $13,250-$13,500, corrections till $12,450 is the expected outcome. $12,450 was the previous high of 2020, and any bounceback from this range will be ideal.

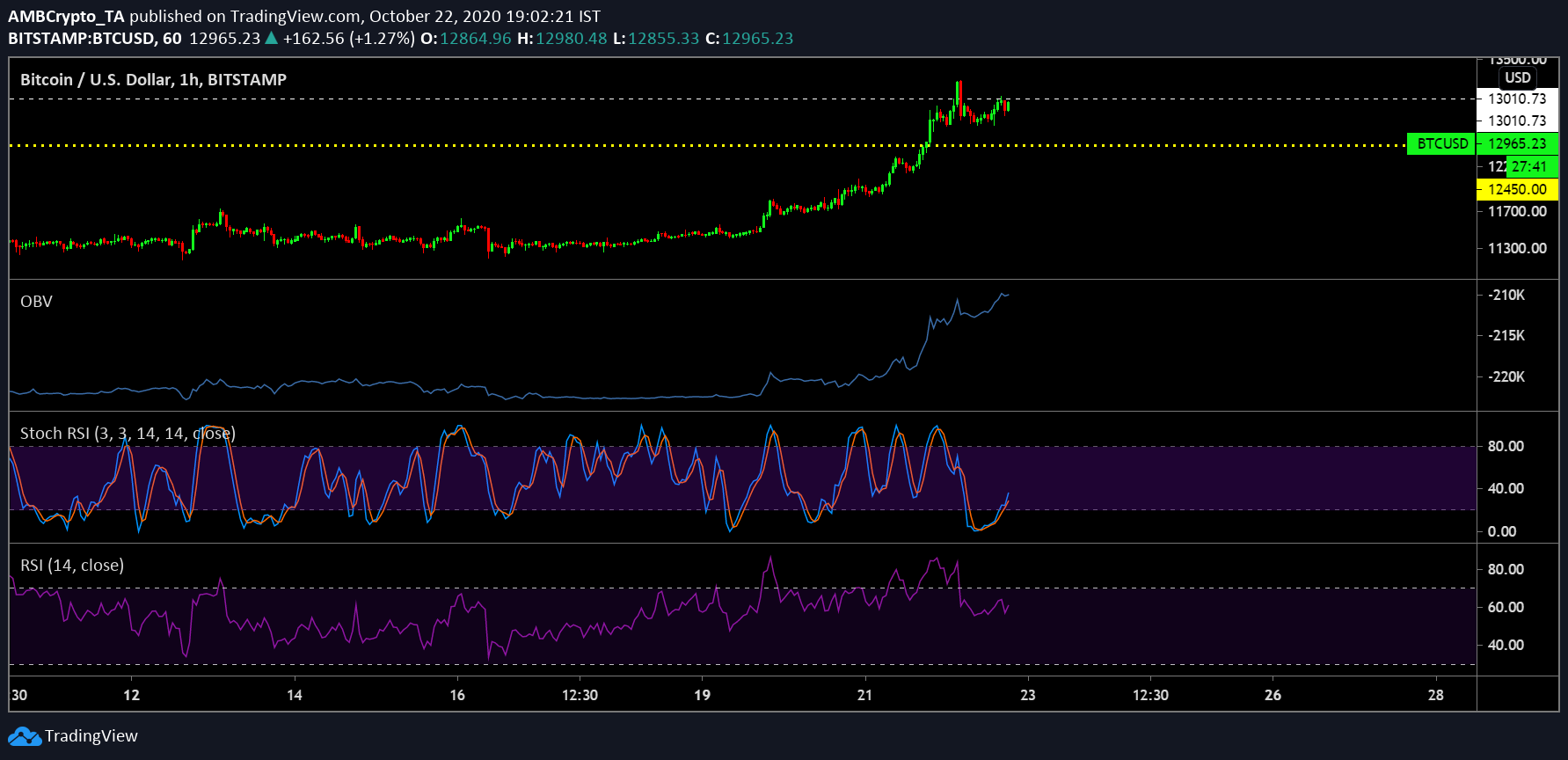

Bitcoin 1-hour chart

Source: BTC/USD on TradingView

While patterns might give you a definite idea, other factors can always indicate a different scenario. Right now, market indicators are anything but cohesive.

The On-balance volume suggested that sellers/buyers can soon become extremely active and FOMO might kick in for BTC retail.

The Stochastic RSI suggested that another top was approaching, with the blue marker completing a bullish crossover with the signal line.

Finally, the Relative Strength Index was suggestive of a consolidating period. While the buying pressure controlled the proceedings at the time of writing, the narrative can definitely be flipped to give shape to more selling momentum.

Choppy markets ensure future price movement, but the market will definitely turn a little bearish over the next few days.