Bitcoin retests 2019 highs; next up, $10,000 or $9,465?

Bitcoin’s sideways movement finally ended when its price bottomed ($9,080) by the end of 4 February 2020. The price rallied after this bottom, pushing past the band of resistance and retesting the October 2019 highs of $9,700. At press time, this resistance had been tested twice and has not been breached yet.

The Dichotomy

Source: BTC/USD on TradingView

Scenario 1

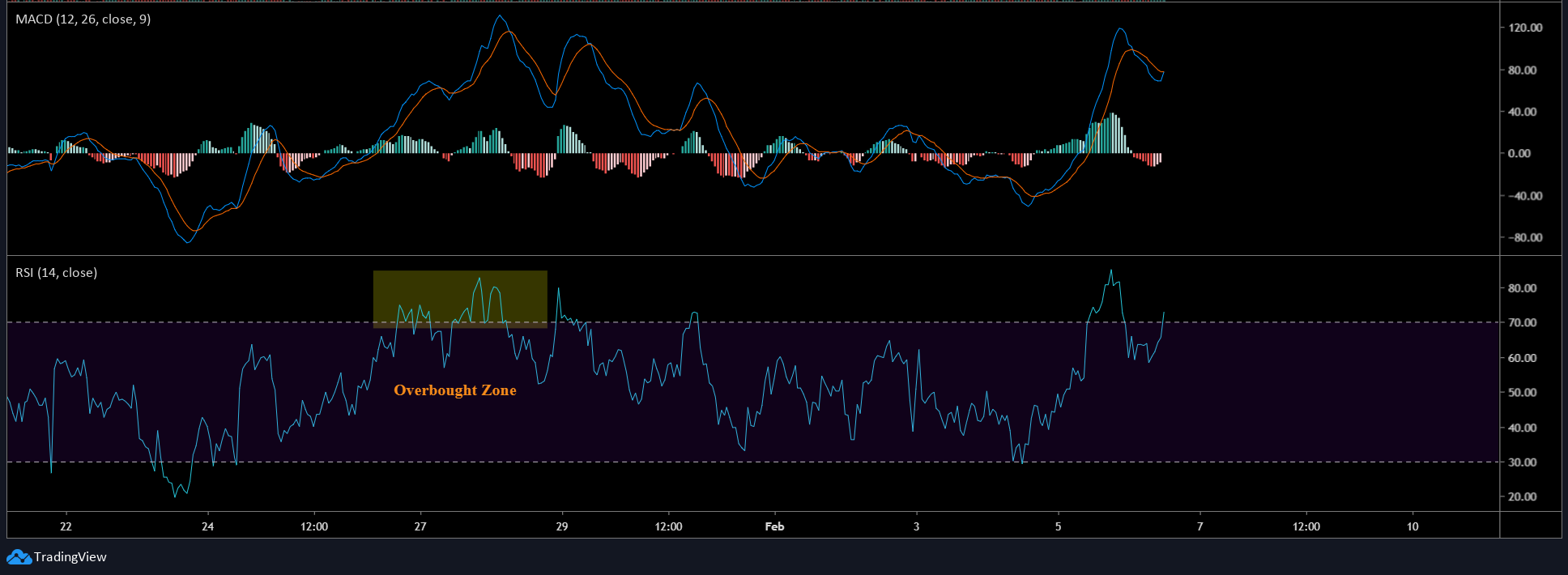

Since Bitcoin is facing resistance, there are two obvious ways how this scenario will play out – a breach or a rejection. The breach of the resistance will take a lot of bulls acting in unison. However, the problem here is that the RSI has already hit the overbought zone. Breaching the $9,600 level would mean that bulls need to push through the overbought zone and stay there, very similar to what transpired between January 26 – 27, 2020. The MACD indicator highlighted that the momentum is going for another bullish crossover, furthering the above-mentioned scenario.

Source: BTC/USD on TradingView

If there is a breach, this would put BTC on a rally to $9,800 and $9,900 (Target 1), where it will face minor resistance. Following this would push BTC to a very important psychological level – $10,000, a level where it would face more resistance, much like it did when breaching the $9,000 level.

Scenario 2

If the price fails to breach the $9,600 level and the RSI starts to drop, this would indicate a failure of bulls. The eventual onslaught of bears would push the price of BTC down by 2%, causing a retest of $9,465 (Target 2). This is where the bulls will once again come into action.

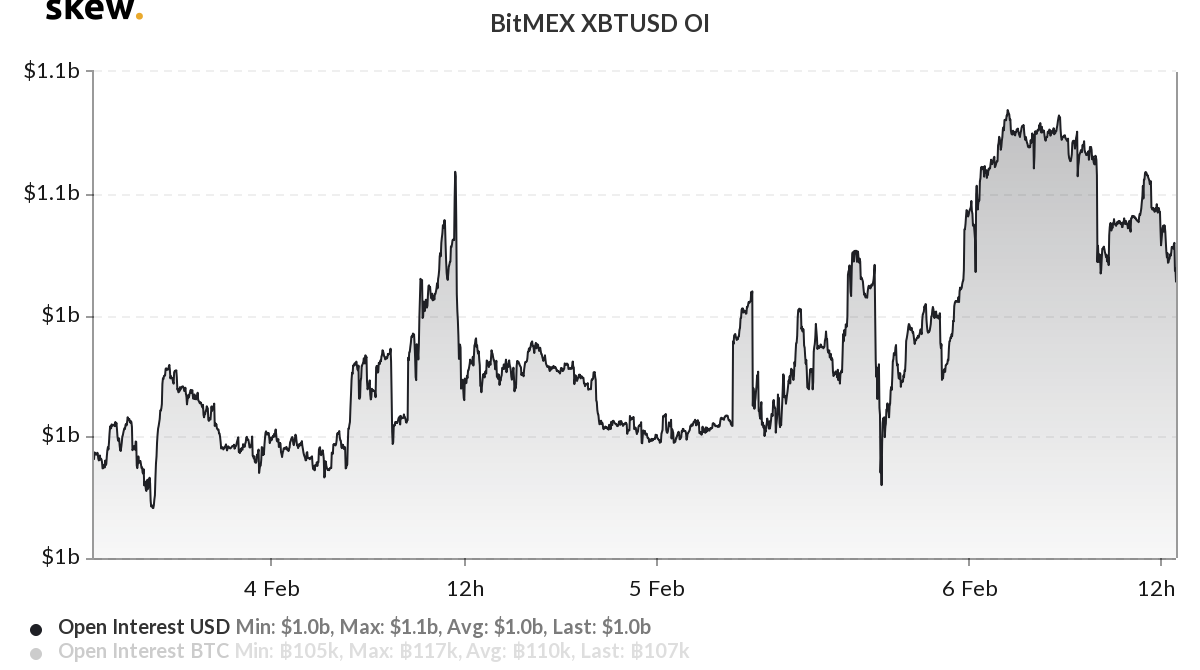

Source: Skew

For scenario 2 to manifest, the Open Interest (OI) must drop from $1 billion. Failure to do this would establish $1 billion as the new normal. As mentioned in previous articles, there was a rejection trend after the OI would hit $1 billion. However, this seems to be changing.

XBTUSD open interest over 1 yard. Time for some fireworks. pic.twitter.com/2CTc9v3AR8

— Arthur Hayes (@CryptoHayes) February 2, 2020

As seen above, the OI was slumping but was just above the $1 billion mark.

Conclusion

At press time, Bitcoin seemed to be pumping and had already reached $9,800, where it was facing resistance. If the bulls continue to push through, $10,000 by the end of today seems more than possible. However, the above scenario seems less likely; a drop from $9,800 would definitely take it to target 2 ($9,465) in the next 24 hours and this would mean a reset of the OI, RSI, and even MACD.