Bitcoin: ‘Profitability’ has no role to play in the concentration of mining

Bitcoin mining is expensive as it is but the upcoming BTC halving seems to be a huge challenge for the miners. As estimated by the crypto-focused research firm TradeBlock, the average cost to mine a single bitcoin (BTC) could jump to $12,525. As a result, the miners might have to run extra computations, which results in extra use of electricity, in turn resulting in increased electricity charges.

This has raised concerns among the community around the profitability of bitcoin mining. ‘Are big mining firms more profitable when compared to the small mining firms?’. ‘Will this lead to the concentration of mining?’. Bitcoin advocate Andreas Antonopoulos is of the opinion that profitability cannot lead to the concentration of mining.

In a recent video, Antonopoulos also noted that profitability, in the long term, does not just depend on the economies of scale. During the halving, the least efficient miners shut down the machines fearing the high electricity charges which leads to the difficulty reduction. As a result, the miners who were in the unprofitable zone earlier are able to get back on track and make profits. Antonopolous, thus asserted that profitability does not necessarily depend on small and big mining firms and addressed the ‘concentration of mining’ concern.

He added,

“The factors that lead to the concentration of mining have a lot more to do with the geographic availability of basic chips and the geographic availability of cheap electricity and comfortable regulatory domains.”

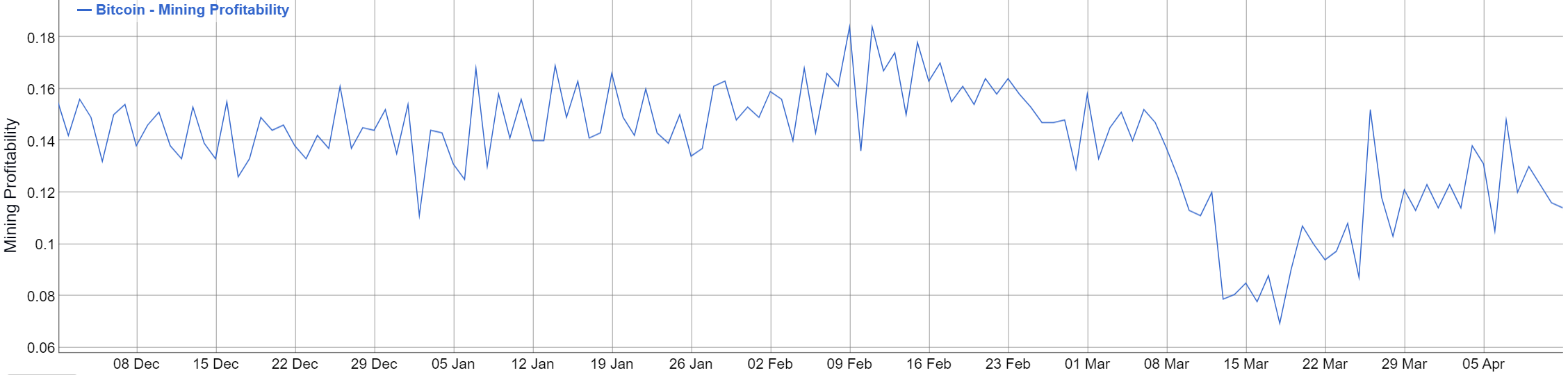

Source: Bitcoin Mining Profitability historical chart, bitinfocharts

As seen in the above chart, BTC mining profitability saw a drop by 41% post the big crash on March 12 and on March 18, the profitability dropped further down to its lowest point in many years reaching o.o69 T/HASH. However, it has recorded an increase since then and as of April 12, the profitability was at 0.114T/HASH.