Bitcoin Options notes an influx of interest and volume

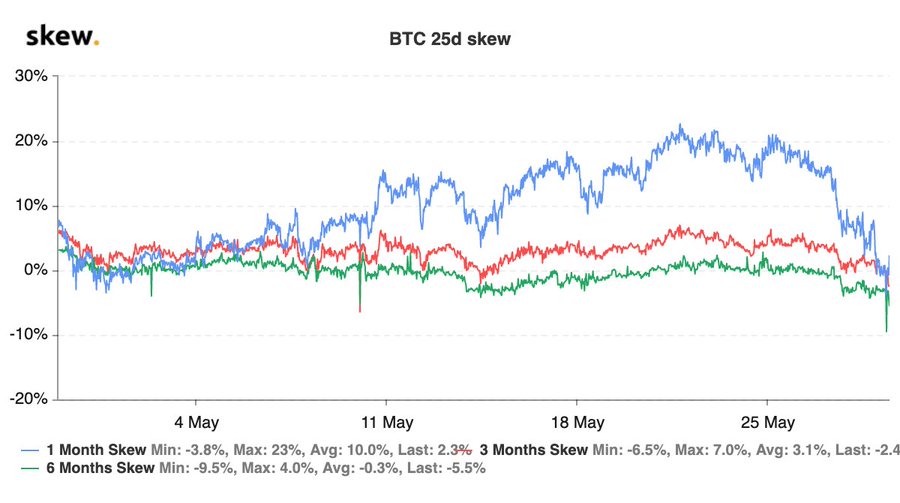

Bitcoin market had reported slow progress in May and as the month comes to an end, the options market may have influenced the direction of the tide. The BTC spot price has finally sprung above the $9k resistance and focusing at the Options market, the traders appeared to take this as a positive sign to open positions. According to data provider skew, as the Bitcoin price moves like a wave, the BTC 25-d skew fell flat.

Source: Skew

The skew had turned positive in March, for the first time since 2019. As the volatility from March retracted, the market gave rise to a positive volatility skew. It indicated the options contracts for BTC, with different strike prices, but which had the same expiration, will have different implied volatility. The sudden dip in the metric took place as the traders turned bullish as they probably went long on BTC, still keeping it positive in the short-term.

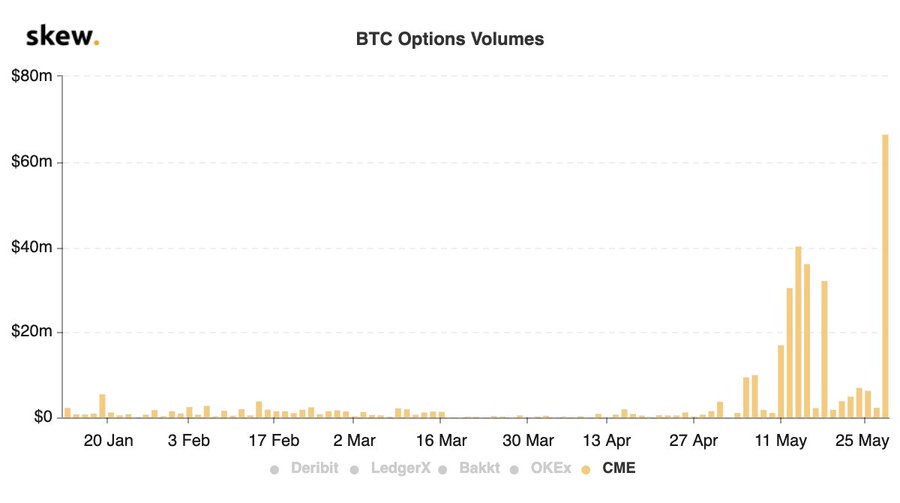

This demand for BTC options was high on the Chicago Mercantile Exchange [CME] on 28 May. The volume of contracts traded on the exchange reached a peak at $66 million, whereas other BTC options exchanges like OKEx and Ledger X noted a volume of $12 million and $826k, respectively. The number of open contracts on the platform also noted a sudden surge to establish a new high at $259 million, which was the second-highest compared to other exchanges, while Deribit took a lead.

Source: Skew

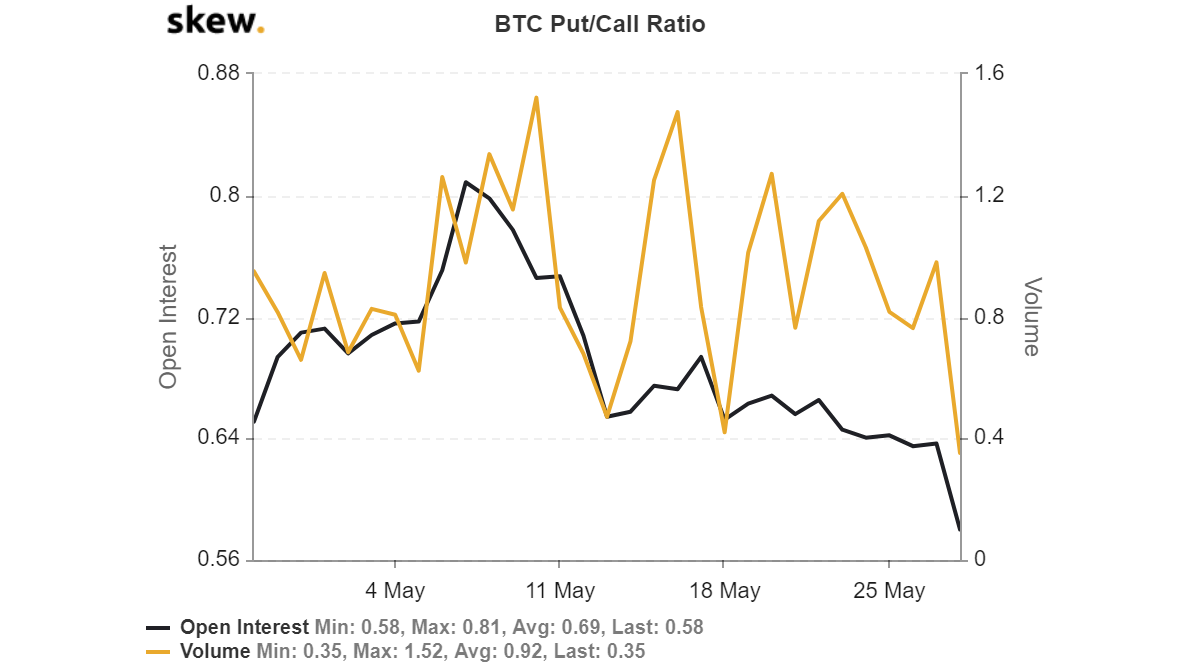

As the metrics took a sharp turn on 28 May, waving a green light for the bulls, the Put/Call ration, signaled the traders to buy the calls. According to data, the ratio dipped to 0.58, indicating the traders had already entered and more calls were being bought than puts, which has been considered a bullish sign.

Source: Skew

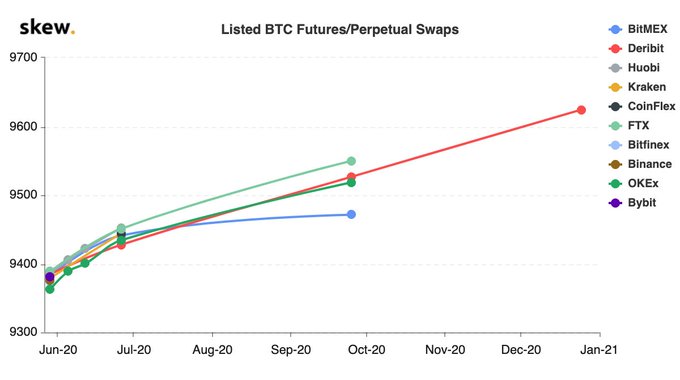

As the Options market was seeing an influx of interest, the futures market also noted a positive sentiment. The perpetual swaps were slopping upwards, indicating the market’s expectation in the rise of the largest digital asset.

Source: Skew