Bitcoin: Derivatives market shows promise, here’s why

The journey of Bitcoin in 2020 has been pretty nail-biting. With the global events hitting the crypto market, many investors saw Bitcoin’s recovery and decided to include it as a part of their investment portfolio. BTC has been reporting a 86% returns to investors year-to-date, while this surge in volatility also returned many traders back to the derivatives market.

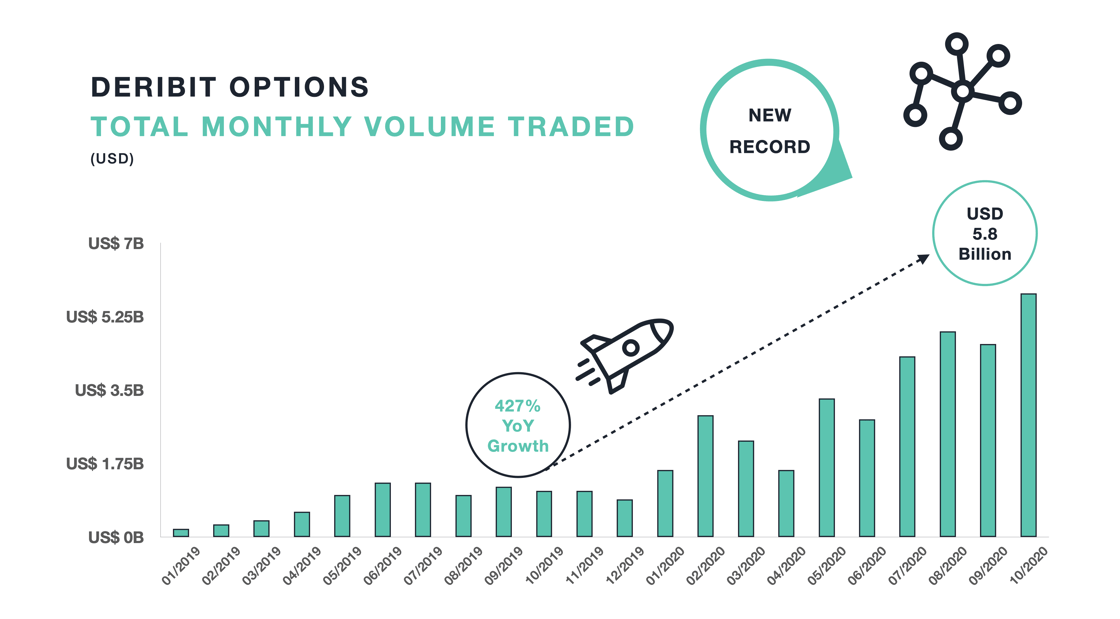

Deribit, one of the prominent Bitcoin options trading platforms in the field provided insights for BTC options trading in the month of October. According to the data shared by the exchange, the rise in BTC volatility had aligned with a growing interest in the digital asset. The exchange hit a new monthly notional record with $5.8 billion, while the daily BTC options turnover record day was noted with 47,000 BTC contracts.

As October helped BTC’s price, the realized volatility increased from 35% to 61%, which boosted the options market. The overall options market has reflected a YoY growth of 427%, with 89% of the volume coming from the BTC options market.

Source: Deribit

This growth was the result of the appreciating price of Bitcoin that reached levels last seen in January 2018. Most bullish traders on Deribit have shown tremendous confidence in the value of the asset going forward, as the exchange noted 40k strike added to the January, March, and June 2021 expiries.

After the large Options expiry on 30 October, the interest has noted a great dip. Skew’s Put/Call ratio has noting to drop from 0.74 to 0.61, at press time. This noted that the market makers were interested in buying more call options than puts. Adding fuel to this interest was another approaching expiry on 6 November, which also noted an almost 33k BTC options contract set to expire. With Election results around the corner, Bitcoin options traders have been prepared with their trades to set off.

Currently, the monthly BTC and S&P 500 correlation remained at 33%, which was moderate. But with interest heavily bestowed upon longer-dated call options, and November put options to hedge the potential risk, the election result may be the main and probably the last event of 2020, to impact BTC.