Grayscale’s Bitcoin buying spree and what it means for the price

It is important to understand that post-halving is when the price of Bitcoin needs to be the most stable, ie., not drop, since a lot of miners are going offline. Hashrate and price are a function of each other. Hence, after the third halving, the price did not collapse and it could partly be due to Grayscale’s massive buying spree.

Supply-Demand

What happens after halving is the inefficient miners shut off their mining equipment and hence the hashrate drops. After the first two halvings, the price has seen a decline, however, considering Bitcoin’s price since halving [10-12%], the opposite is occurring. Grayscale, alone, has bought 18,910 BTC and the coins mined since then is 12,337 BTC, ie., Grayscale has effectively bought 153% of the total supply. The surplus BTC could be from these inefficient miners that are bearly breaking-even or are under loss.

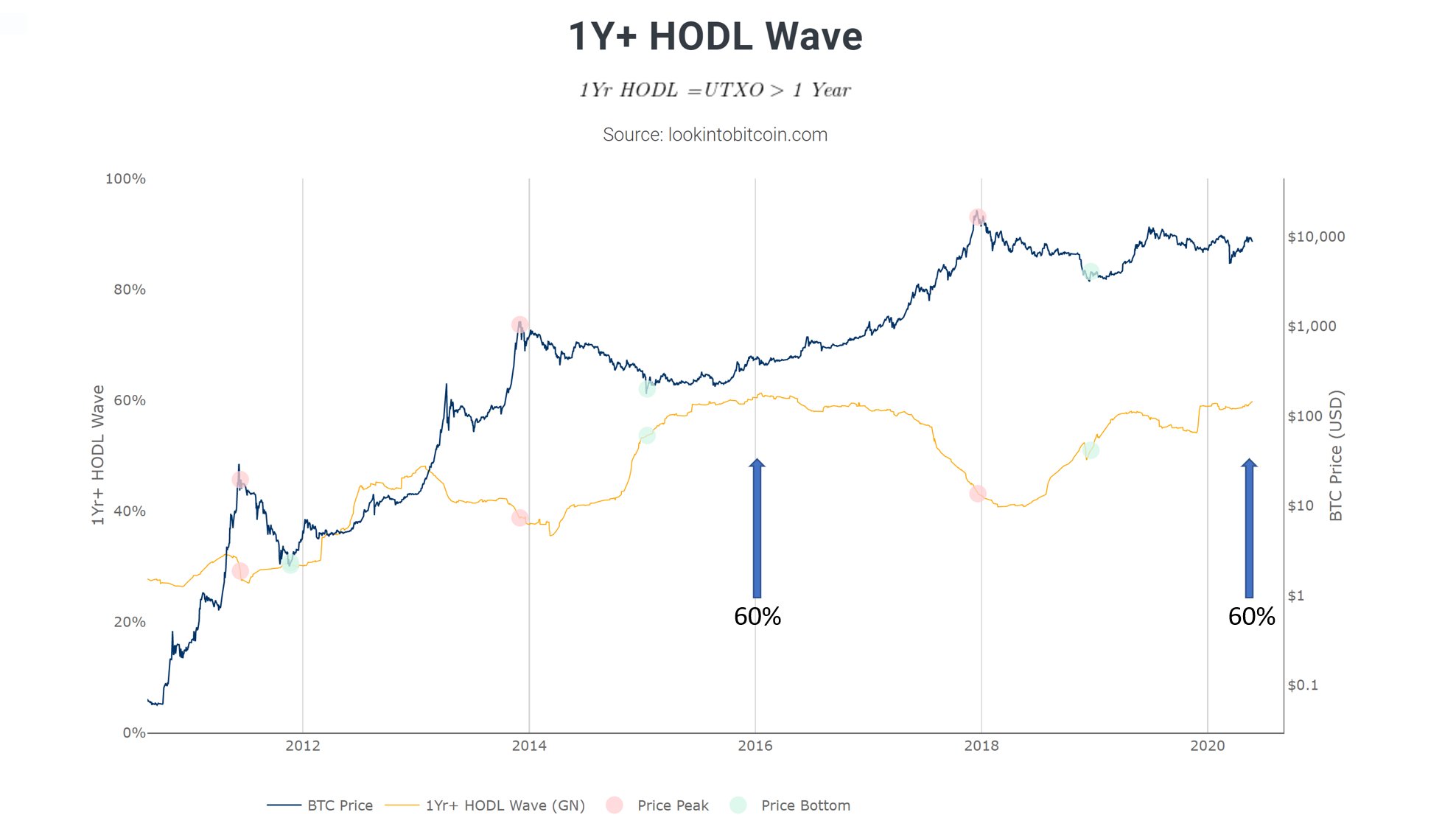

Apart from Grayscale, there is Square and other players that need to be factored into the supply-demand equation. This will reveal that the bid offers are more as compared to the ask side. Additionally, 60% of all bitcoin has not moved on the blockchain for at least 1 year and this indicates hodling. The last time this happened was in early 2016, at the start of the bull run that pushed Bitcoin to $20,000.

Source: Twitter

But looking at the above terms in the supply-demand equation, the demand side is much greater than the supply side, indicating an immediate bullish trend. However, it is not a linear equation and there are a lot of moving parts. Miners, till-date constitute a major portion of the selling pressure for Bitcoin. After halving, this has increased and will continue until the next few difficulty adjustments [a few weeks] or at least until miners’ reserves are emptied.

So, why hasn’t the price skyrocketed yet?

Technically, the price hasn’t collapsed even through the harshest drop in hashrate and miners turning off their farms. Furthermore, since Black Thursday miners experienced this shock and the speculators are net-long. Supporting this is, according to CMS Holdings, are 1. Skew expensiveness and flatness and 2. Funding rate, which has largely been negative, ie., shorts pay longs. This indicates that the net longs will eventually push the price higher for Bitcoin and especially when other players start accumulating BTC. Additionally, the retail market is also largely bullish with 13,000 BTC positions expecting the market to surge higher.

Opposing this bullish trend is CMS Holdings, who mentioned that “cash will win long term” and added,

“… there’s some risk being the most hedged corporate in a rally, you effectively become the poorest, you also have difficulty explosion risk as weaker hash comes in and you may, in fact, find yourself short the forward… There’s only so much future supply you can pull forward.”