Bitcoin Options indicate price primed for reversal

Only in the cryptocurrency market can bullish and bearish be limited to days, rather than months.

After a massive fall on March 12, Bitcoin’s worst in 7 years, the coin sunk to a 10-month low. At a time of severe bearish activity, in all asset-classes, optimism is running dry everywhere except the derivatives market.

Option contracts, in traditional markets, have long been used as an effective gauge of an asset’s price going forward, and the Bitcoin world no less. But can it efficiently posit the price in an asset as volatile as cryptocurrencies?

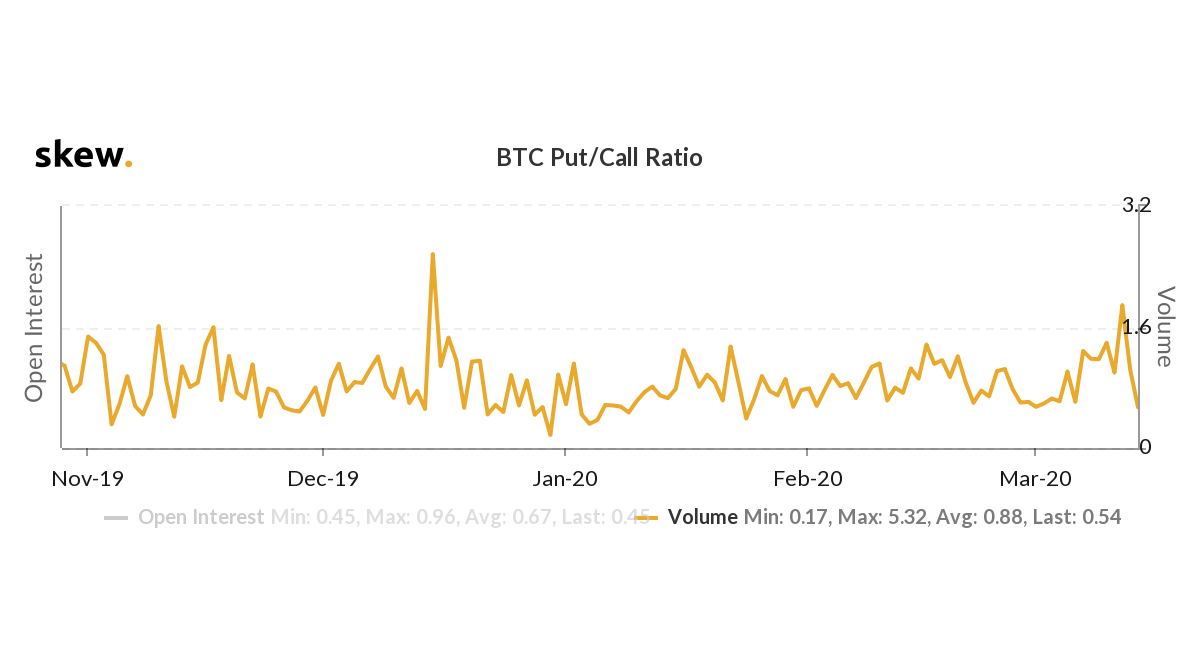

The balancing, rather than bullish sentiment is slowly returning to the market, with the price moving sideways for the past few days. According to data from skew markets, Put/Call ratio, after reaching a three-month high, has seen a stark reversal.

Bitcoin Put/Call ratio volume | Source: skew

Options contract provide an additional layer of risk for traders, as it allows an “opt-out” feature. Put option holders have the right to sell while call option holders have a right to buy. Hence a Put/Call ratio portrays market sentiment, depending on options trading.

A put-call ratio of 1.89, as was observed following the March 12 plummet, indicated that option contracts with sell-rights significantly outnumbered those with a buy-rights. However, this has seen a notable drop with the price balancing out over $5,000.

Between March 12 and March 14, the Put/Call ratio dropped by 71 percent to 0.54. In traditional markets, a Put/Call ratio of below 0.7 approaching 0.5 is a bullish indicator as more buy-rights are being bought compared to sell-rights. The Put/Call ratio for Bitcoin Options is smack in the middle of that range suggesting that traders are poised for a price reversal.

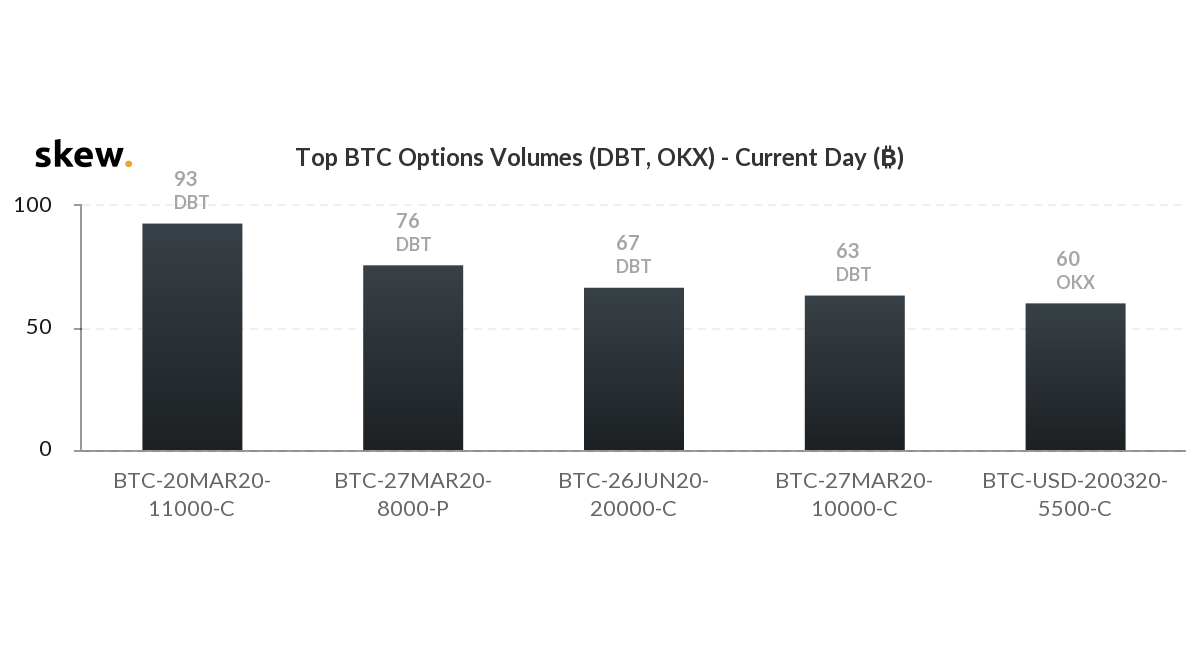

The traded options for the current day i.e. March 15, also suggest the same. Volume on Deribit and OKEx, the two biggest BTC Options exchanges suggest that most contracts are trading with a call option at a strike price over the current trading price.

Call options contracts with the shortest expiry of 20 March are trading with a strike price of $11,000, while those that are expiring later in the year are trading with both put and calls of $8,000 and $10,000, respectively.

Bitcoin Options volume on Deribit and OKEx | Source: skew