How Bitcoin’s active supply hit both an ATH and an ATL

Bitcoin, at the time of writing, was trading well above $19,000 on the charts. However, while that is a bullish observation, a closer look at Bitcoin’s fundamentals would reveal a contradiction of sorts.

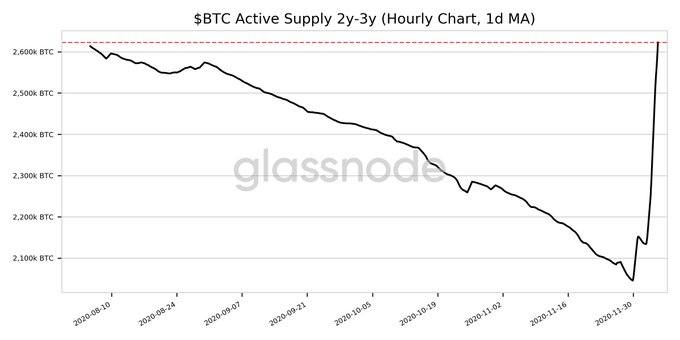

Curiously, the active supply of Bitcoin has hit both an ATH and an ATL. This contradictory position is possible entirely due to the difference in movements of the 1Y old supply and the 2Y-3Y old supply of Bitcoin. In fact, Bitcoin’s Active Supply 2y-3y (1d MA) climbed to a 4-month high of 2,622,543.824 BTC, based on data from Glassnode, while the previous 4-month high of 2,613,571.261 BTC was observed earlier in August.

BTC Active Supply 2y-3y || Source: Glassnode

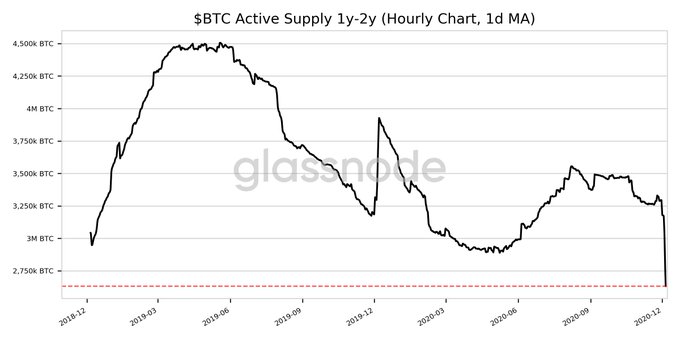

Interestingly, Bitcoin’s percentage supply last active 1+ years just reached a 5-month low of 61.188%. The previous 5-month low in Bitcoin’s percent supply of 61.189% was observed recently too.

BTC Active Supply 1y-2y || Source: Glassnode

Based on data from Glassnode, the percent supply active in 1Y has been dropping rapidly against increasing activity from the 2Y-3Y supply of Bitcoin. These contradictions are interesting as they build an overall bullish case for BTC in the short-term. Bitcoin’s price is determined by its active supply, and despite Bitcoin’s increasing supply held dormant in wallets since 2017 and 2018, the percent active supply on the 1Y charts is hitting new lows.

On-chain analysts have predicted that Bitcoin’s liquidity needs to drop before the price rallies again, however, the percent active supply is hitting newer lows and that takes care of the long-form narrative.

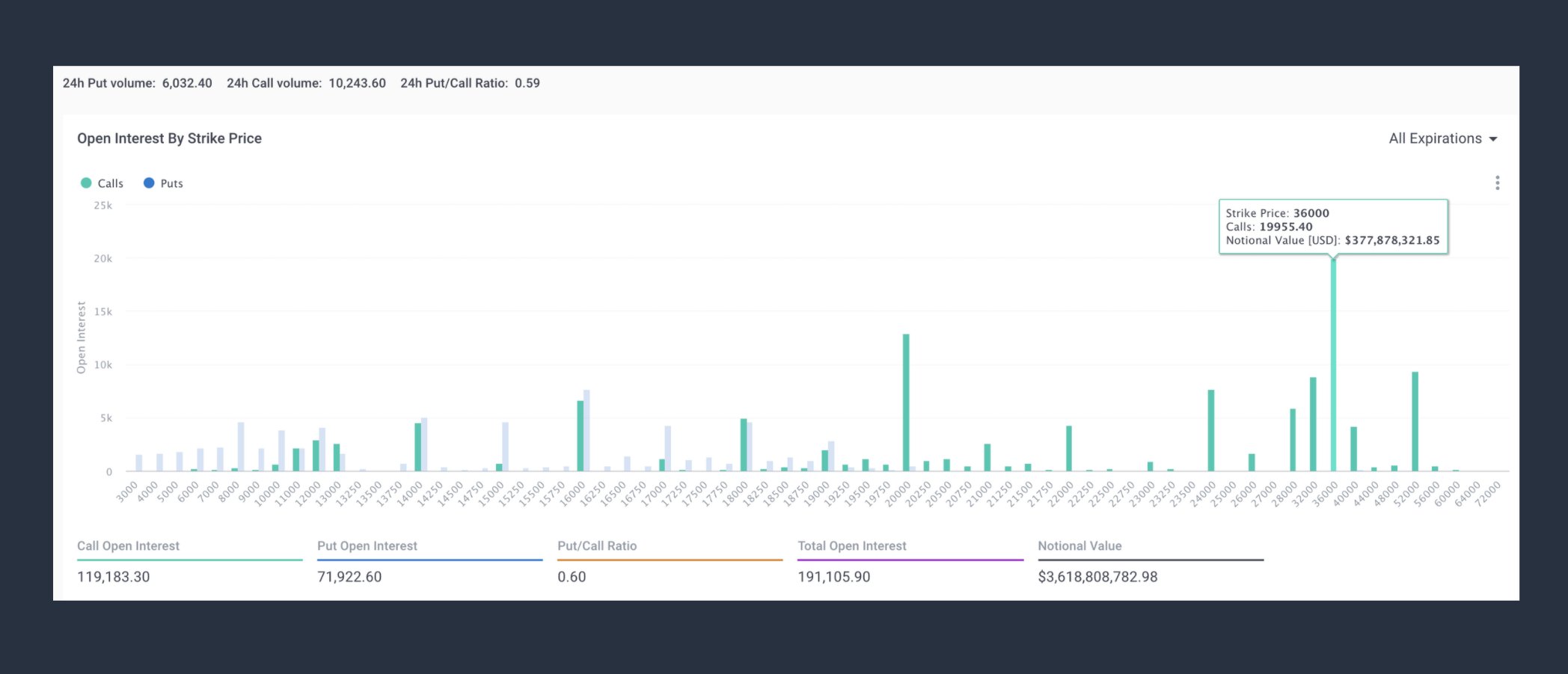

The shortage of the supply narrative that led Bitcoin’s price rally post the third halving is still valid. Additionally, the bullish sentiment is evidenced by Deribit’s BTC OI with a strike rate of $36,000. It was the leading strike, at the time of writing, with 19,995 contracts in OI. In fact, it had a notional value of $378 million and a majority of it was in January 2021 Options.

Source: Twitter

The Open Interest on most other derivative exchanges supports the evidence and the narrative of a sustained long-term price rally on the cards for Bitcoin.