Bitcoin long-term Price Analysis: 27 July

Disclaimer: The findings of the following analysis may or may not materialize within a week as the variables involved and in consideration are too precarious for the year 2020

Bitcoin is treading deep waters again. In fact, the world’s largest digital asset has traded in this range only thrice over the past 7 months. Hence, based on its previous rallies, BTC’s long-term narrative might incline towards another bearish result. However, different factors are coming into play for the present rally. Therefore, it is possible that the crypto-asset may diverge from its past performance.

Bitcoin was valued at $10,340 at the time of writing with a market cap nearing the $200-billion mark at $190 billion.

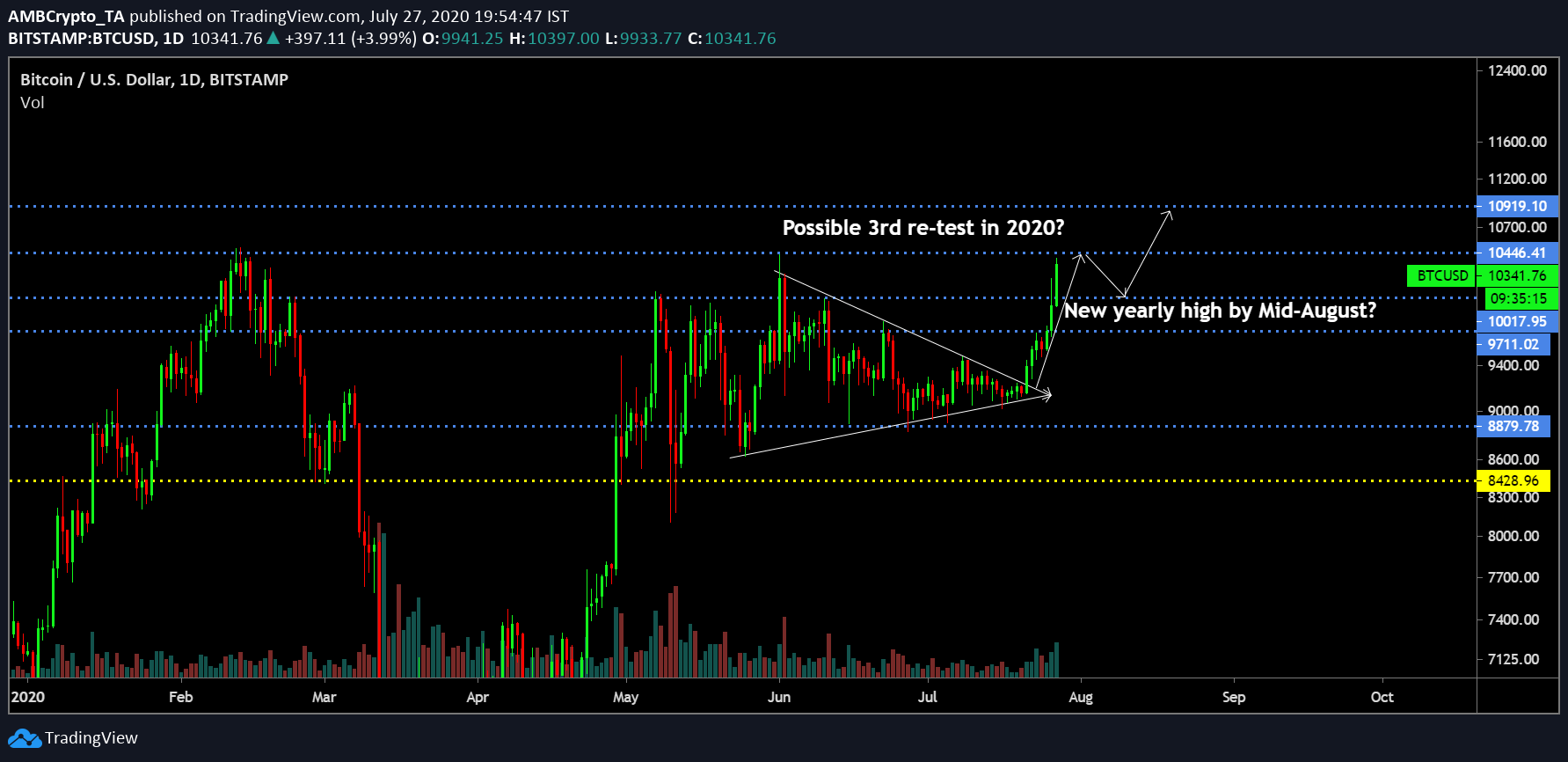

Bitcoin 1-day chart

Source: BTC/USD on TradingView

A straightforward analysis of the 1-day chart for Bitcoin pictured a breakout from a symmetrical triangle pattern. In typical fashion, the bullish breakout breached two key resistance at $9701 and $10,017, and Bitcoin’s price was continuing to move in the right direction, at press time. On further analysis, it can be observed that Bitcoin had reached the press time trading range for only the third time in 2020.

On both the previous occasions, the price had registered an immediate pullback, dropping down below $8879 on each occasion.

Considering an ideal correction period, Bitcoin may drop down to $10,000 over the next few days before embarking on a new yearly high towards $10,900-$11,000. It is not set in stone, but the possibility is very high.

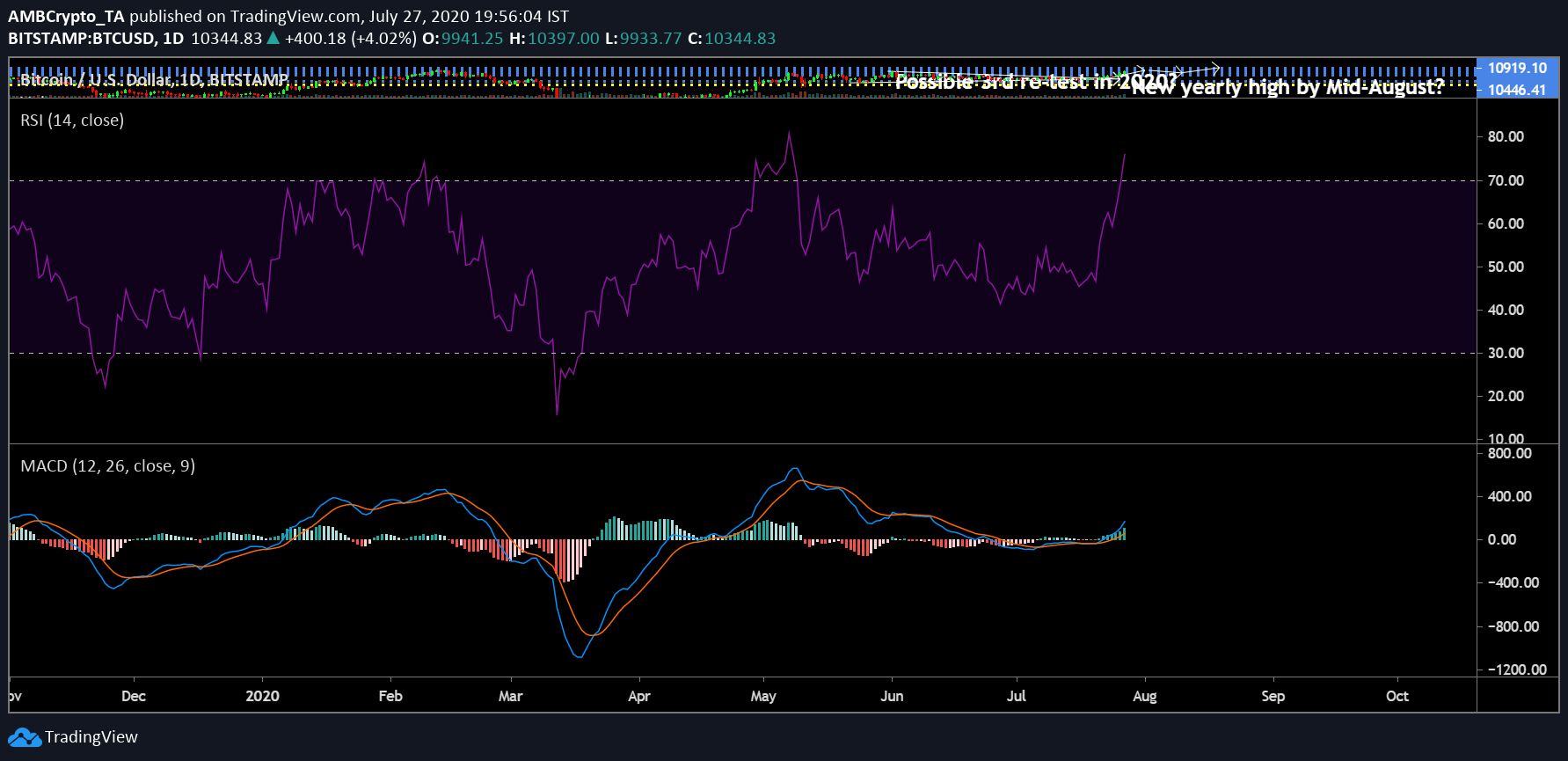

Bitcoin’s market indicators mirrored the market as well.

Source: Trading View

The Relative Strength Index or RSI for BTC was in the overbought zone for the third time this year, a finding which indirectly suggested that a potential pullback could be on the cards. The MACD remained bullish as the blue line continued to hover above the red line.

Will Bitcoin finally record a new high in 2020?

Source: BTC/USD on Trading View

Frankly, the press time price position of BTC is riddled with uncertainty. Users may idolize the attached chart and remain hopeful for a new high. As observed, on the previous three occasions Bitcoin reached $10,000, the price witnessed an immediate red candle, indicative of a pullback. At the time of writing, Bitcoin was on its way to record consecutive green candles for the first time in 2020 after reaching $10,000.

Hence, it is definitely possible the world’s largest digital asset can build more momentum from here onwards, but the RSI casts a shadow of a doubt. As noted earlier, Bitcoin is already in the overbought section, a development that means retracement may be on the cards.

The key for Bitcoin would be to consolidate above $10,000 this time if it wants to keep its hopes up of breaching $10,000. In fact, signs are largely positive, but they will be clearer over the next few days.

Conclusion

Bitcoin could consolidate between $10,000 and $10,450 over the next few days and possibly register a new yearly high after the 2nd week of August.