Bitcoin halving and pandemic pressure builds on the CME

As the cryptocurrency market stands on the precipice of only the third Bitcoin halving, the pressure is building. It’s not just the spot market and the miners who are reveling in the imminent halving bulls, but also the derivatives market, on the west of the Atlantic.

In the United States, the Chicago Mercantile Exchange [CME], the biggest derivatives exchange in the country, under the watchful eyes of the Commodity Futures and Trade Commission [CFTC] is seeing an onrush into Bitcoin. In the past few weeks as Bitcoin managed to overturn its March plummet, and turn positive on year to date [YTD] returns, the trading on the CME’s coffers, not just in the short-term, but also in the long-term has skyrocketed.

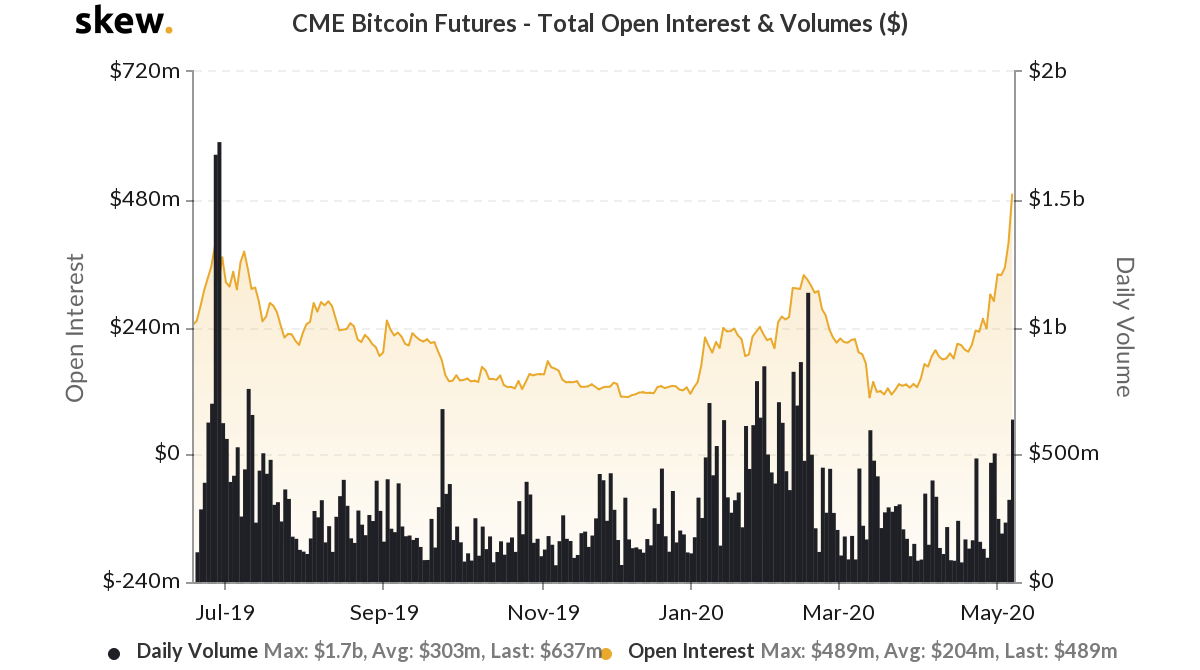

Last week, as Bitcoin surged by close to 13 percent in a single day, CME saw a combined $971 million traded on April 29 and 30. To put that in perspective, the CME has seen single-day volumes of over $1 billion on three occasions only – June 26 and 27, 2019 and February 18, 2020. This move, unlike the previous two moves, is seeing the same, if not more buying pressure looking at the outstanding positions on the exchange.

CME Bitcoin Futures volume and OI | Source: skew

The open interest [OI] on the CME has surged creating a new all-time high [ATH] earlier this week on May 5 when the number of active positions was valued at around $400 million. With over 13,400 being traded on May 7 as Bitcoin surged above $9,500, the highest single-day contractual volume in over a month, the volume was recorded at $637 million with the OI reaching $489 million.

As mentioned earlier three volume moves stand out – two in June 2019 and one in February 2020. The important thing to note here is both these moves happened when Bitcoin was trading over $10,000. In fact, the June volume rush of over $2 billion in two consecutive days happened when Bitcoin reached its 2019 peak of $13,800. Considering the price at the time of the volume moves and the corresponding open interest, the current sub-$10,000 price with an incredibly high OI bears introspection.

It seems institutional investors, the main category of BTC Futures traders, are more bullish on Bitcoin at this moment than when the cryptocurrency was trading above $10,000 in February or when it was trading at $13,800 in June of last year. A few reasons could be responsible for this premium attached to Bitcoin. The first is the imminent halving, which will cause a deflationary pressure to push prices up, as most people in the community expect, and as historic trends support. The second is the risk-on nature of the cryptocurrency, which has seen its price rise, as other competing macroeconomic assets like equities and commodities have either dropped or held firm.

Whichever way you look, institutional investors on the CME are more bullish on Bitcoin than ever before, because of an unlikely duo – the halving and the pandemic.