Bitcoin driven by institutions will not help price

Since Bitcoin began entering mainstream finance there was always anticipation around ‘when will the institutions arrive?’ Motivation was merely price-centered, and the logic for the same went something like this, when institutional investors arrive, they will bring in bags of cash waiting to be dumped into the Bitcoin market. This massive dump in the cryptocurrency would inevitably increase the price of the market, causing the price of a single Bitcoin to surge.

This theory while prospective is largely aspirational and very, if not entirely optimistic. The reality is more grounded, especially for a cryptocurrency like Bitcoin. Being a retail-driven, micro-level decentralized currency, most of Bitcoin’s price movements have come from retail-investors, with institutions piling on once the average Joe signaled his interest, not before.

In 2017 when Bitcoin saw its first publicized bull-run, several factors were at play. On the institutional side Bitcoin Futures contracts were launched by the CBOE and the CME, and prior to the same traditional investors saw the first glimpse of Bitcoin on the television screens, and within the news media. Speaking to AMBCrypto, Ryan Scribner, the creator of Investingsimple.com said that Bitcoin built a lot of FOMO in the average guy in 2017. He stated that the Thanksgiving and Christmas dinner conversations about Bitcoin caused a word-of-mouth rally resulting in a price move. The airing of the Big Bang Theory episode titled “The Bitcoin Entanglement” on 30 November also added fuel to the fire.

Deep-pocketed institutional investors despite rushing into Bitcoin, especially now as the cryptocurrency has held its value while every other major asset is falling, are only in it for the hype. The latest report from crypto-analysis firm Ecoinometrics suggested that most companies coming into crypto are merely launching “blockchain projects” which, they labeled, as not much more than “marketing.”

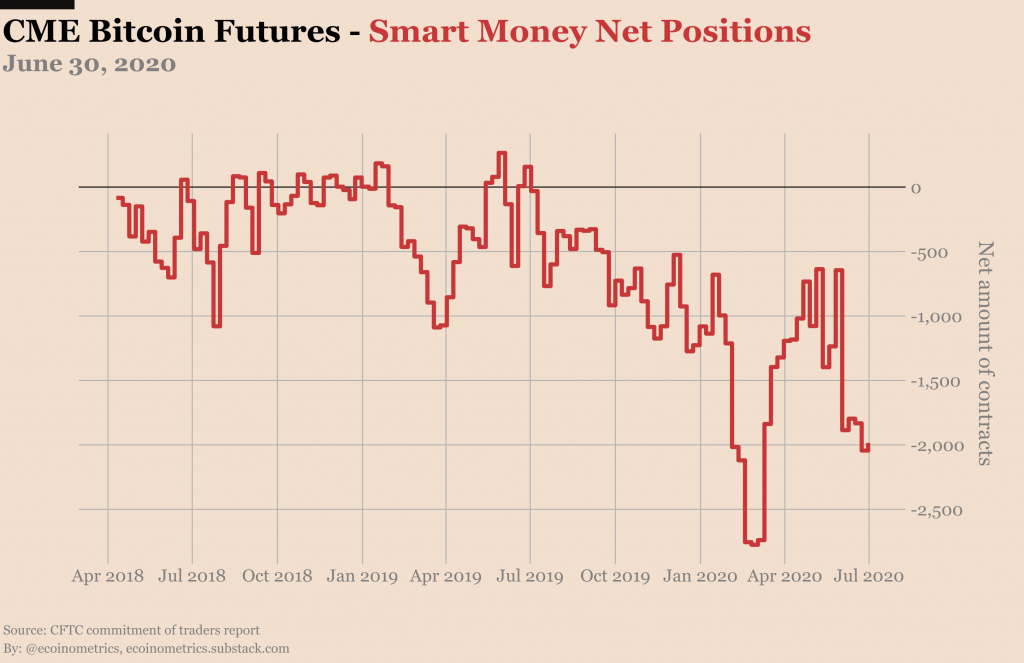

Bitcoin CME institutional investors net positions | Source: Ecoinometrics

The report also mentioned the motivations of retail investors – returns, or more precisely “risk-adjusted returns.” Institutional investors are not, and were never, interested in Bitcoin as a currency or a long-term investment, but a high-risk high-return financial asset with massive volatility. In fact, institutional investors are “not short Bitcoin,” expecting the cryptocurrency is more likely to fall than rise.

Furthermore, institutional investors operate not just in a highly volatile market, but also highly leveraged. Exchanges like BitMEX and Binance offer triple-digit leverage on Bitcoin derivatives trades, which are lapped up by deep-pocketed investors. Several big-moves in the cryptocurrency space are initialized by small retail investor moves, but because of the leveraged trading bots, the price quickly precipitates as evidenced by the infamous Black Thursday price crash.