Bitcoin CME premiums suggest mismatch in terms of Open Interest

Bitcoin is slowly trying to turn around its bearish losses suffered at the end of February with a monthly surge of over 8 percent in March.

The market sentiment suggests that a reversal and a little bit of a reshuffle was observed between exchanges offering Bitcoin Futures contracts.

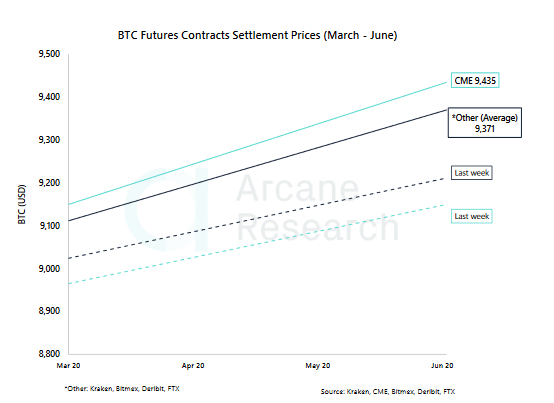

According to Arcane Research, after two weeks of decreasing premiums on institutional and retail exchanges, the rates started picking up pace once again. At the moment, however, the CME continued to hold the upper hand.

Source: Arcane Research

As previously reported, during the bullish rally of February, retail exchanges registered a higher average in terms of premium rates, with respect to the CME. Indicating an influx of retail investors, the CME lagged behind for two weeks following which the premiums started dropping on all platforms.

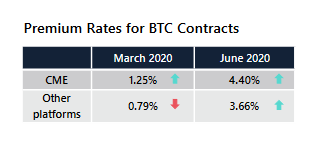

However, over the past week, the CME has managed to fight back and move back in the front, with a higher premium of 4.40 percent for BTC contracts in June. Other retail exchanges pictured a rate of 3.66 percent.

Source: Arcane Research

The CME continued to incur positive premiums for March 2020 contracts as well, with a hike of 1.25 percent, whereas other retail exchanges faltered with a 0.79 percent decrement from last week.

Open Interest-Premium Rates discord?

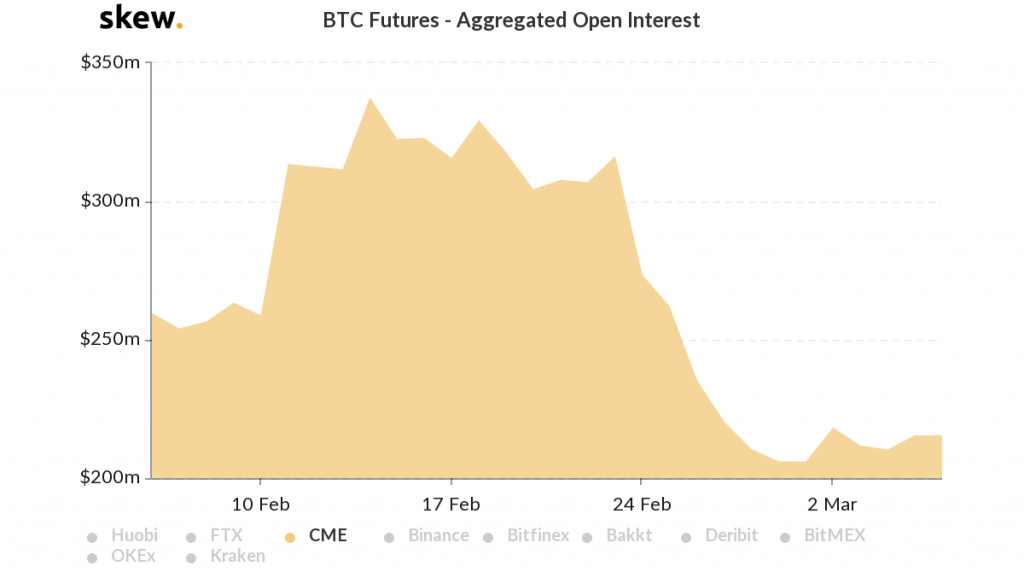

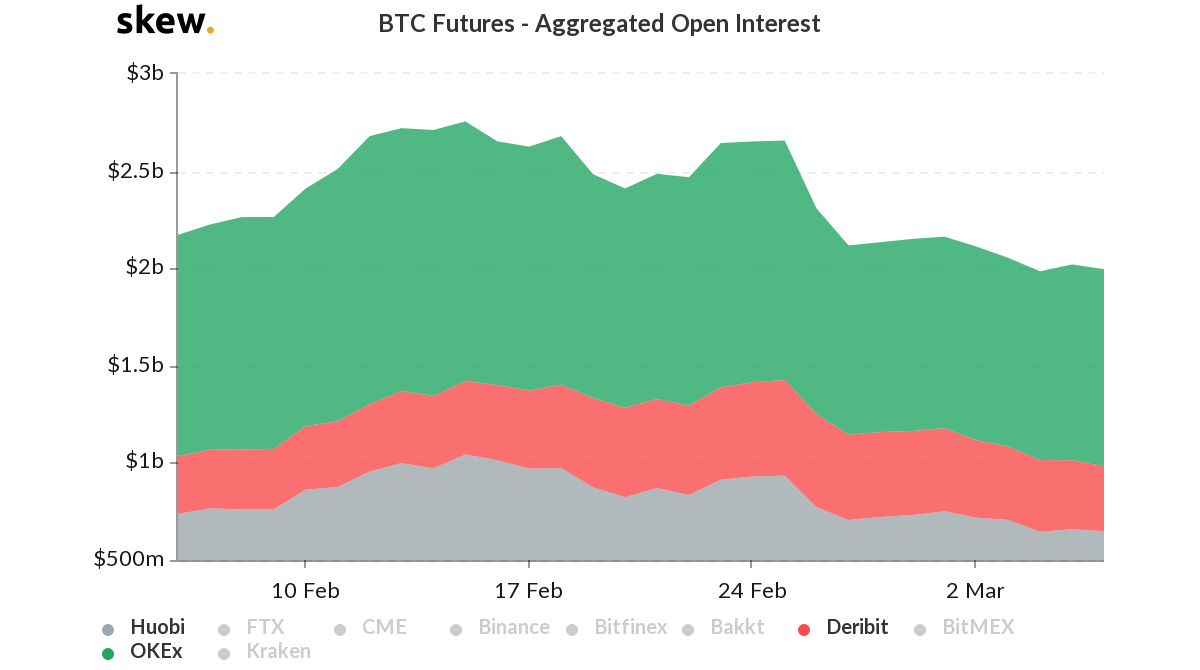

However, despite moving ahead of retail exchanges in terms of premium rates, the aggregated Open Interest of CME painted a different picture.

Source: Skew

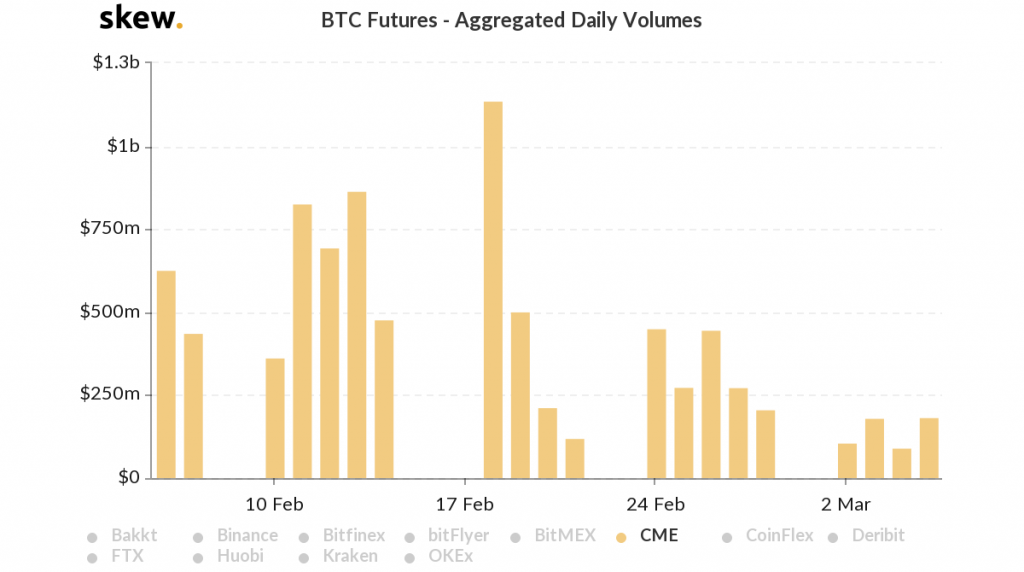

Source: Skew

As observed on the charts, the aggregated OI for Bitcoin Futures of CME is still around the lowly levels of $200 million, 6 days into March, after registering consistent OI of over $300 million for the majority of February. The daily trading volume has also been lackluster with levels under $250 million, common over the month of March.

In comparison, Open Interest on retail exchanges such as Deribit, Huobi, and OKEx, suffered a similar fate as well, but its depreciated OI panned out in terms of decreasing premium rates as mentioned above.

Source: Skew

Such contrasting statistics suggest that there is still a cloud of uncertainty about the sentiment for Bitcoin’s March 2020 contracts and whether investors are bullish or bearish in the long-term.

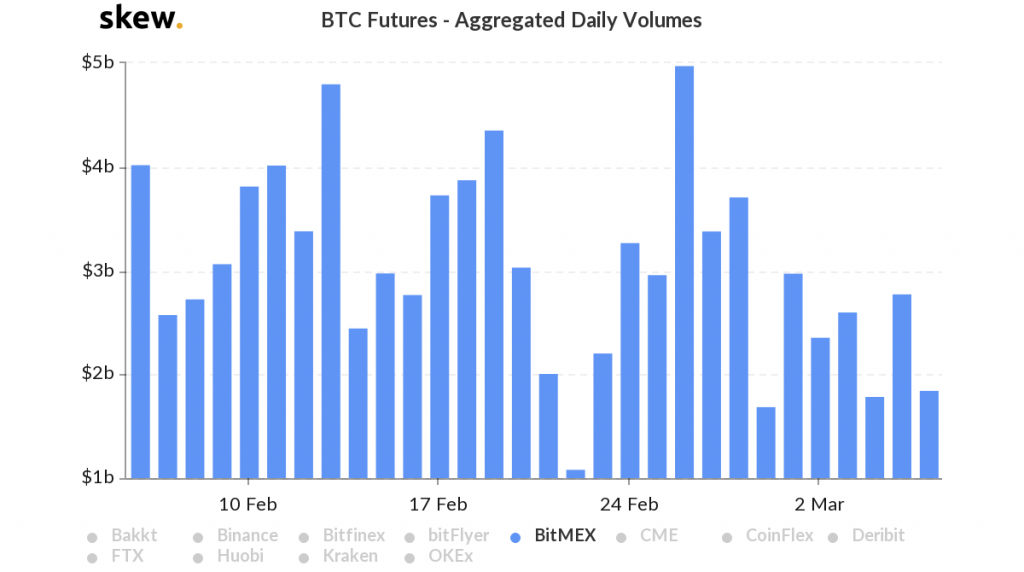

Surprisingly, Bitcoin Futures contracts on BitMEX did not picture a dramatic drop on its charts, even after the Financial Conduct Authority accused the exchange of operating in the United Kingdom without proper authorization.

Source: Skew

BitMEX’s aggregated daily volumes were low with regards to last month, but it sustained activity above the $1.5 billion mark. The scenario may change over the next few weeks, but for the time being, BitMEX remains in the clear.