Bitcoin and Gold stick together through thick and thin

Only in troubled times do you know who your real friends are.

Bitcoin and gold are often placed opposite each other by their most loyal supporters. Each side lambasting the other as a false ‘store of value.’ But the more you look, the more the two non-traditional assets have in common.

Limited supply, arduous production, dollar opposer, and at a time of economic crisis liquidity haven. As Covid-19 is plummeting markets to record-lows, causing a consumption crisis and creating stockpiles of essentials, investors are looking at Bitcoin and gold under the same lens, a means to make liquid their holdings.

In the past week, both Bitcoin and gold saw massive sell-offs. As is the norm, digital gold’s swing was far more severe than the yellow metal. On March 12, Bitcoin saw its worst single-day move in 7 years, falling by over 50 percent, to as low as $3,800, a month after it was trading in five-digits. Gold, the noted safe-haven asset, saw a similar trajectory, beginning its plummet on 9 March, losing over 9 percent of its value by the end of the week.

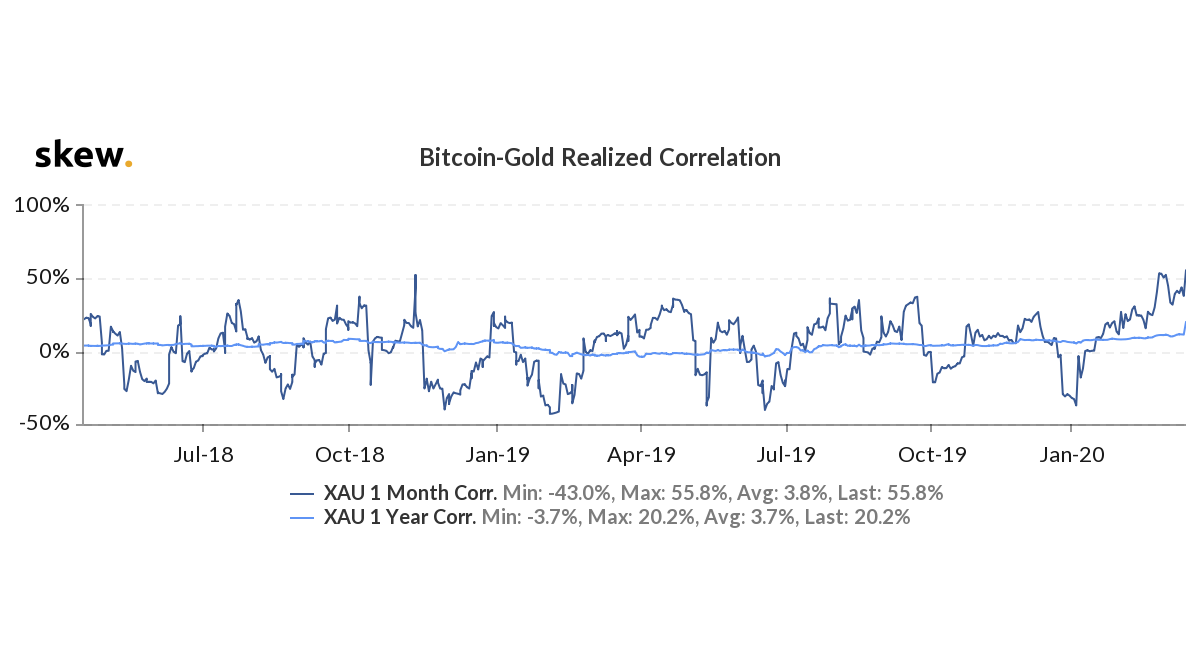

This like-for-like movement between the two touted store of value assets shot up their correlation. According to data from skew markets, the 1-month realized correlation between Bitcoin and gold reached an almost two-year high of 55.8 percent. Even on the larger time-frame, the trend held firm, with the 1-year realized correlation reaching a high of 20.2 percent.

Bitcoin-Gold Realized Correlation | Source: skew

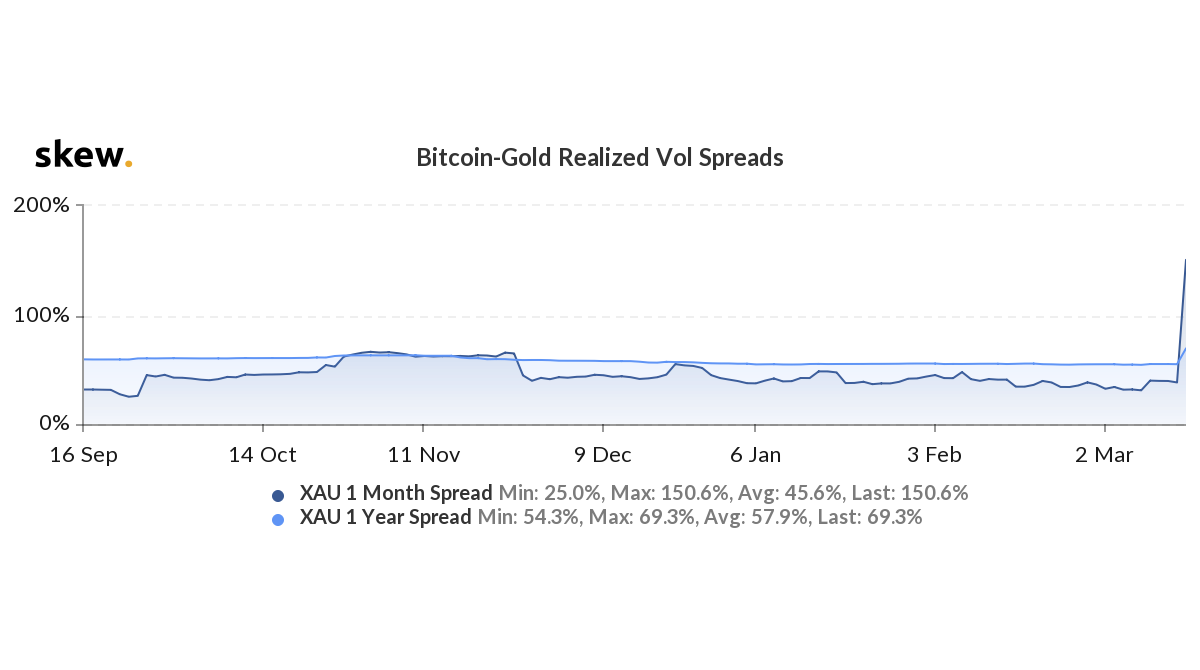

Unsurprisingly, the incredible movement of the two assets took not only the traders by storm but also the charts. The realized volatility of Bitcoin and gold, reacting to their price falls, increased by almost x5 on 12 March. The 1-month realized volatility between the two increased from 38.1 percent to 150.6 percent in less than a day, with its 1-year volatility spiking to 69.4 percent, over the 6-month average of 57.9 percent.

Bitcoin-Gold Realized Volatility | Source: skew

Much like the 2008 financial crisis, the 2020 Covid-19 crisis has shown the tendencies of investors to favor assets that have high liquidity, like fiat currency, and divulge assets that have highly liquid markets, like Bitcoin and gold. In a March 12 letter to investors, Anthony Pompliano, co-founder of Morgan Creek Digital state that at the time of the 2008-crisis “investors needed liquidity over anything else.”

Using the example of gold’s 30 percent fall in 2008-2009, Pompliano stated that modern-day SoVs i.e. gold and Bitcoin are seeing a similar liquidity crunch. This crunch is causing investors to sell-off the two assets for fiat, resulting in a price plummet,

“Bitcoin has a liquid market, so many people who are holding it will sell it for cash because they need liquidity. In fact, most of them have already sold the asset over the last week, which is why we have seen such a significant drop in Bitcoin’s price.”

In 2019, Bitcoin and gold saw capital inflow in countries going through economic and political turmoil. In 2020, as world markets are collapsing, Bitcoin and gold are seeing capital outflow. In times like these you can’t help but question: Bitcoin and gold, friends or foe?