A few snippets to begin your day: India may ban Bitcoin, QuadrigaCX, and more

Paxful deserts Venzuela

Venezuela has often been the highlight whenever the conversation has been about what Bitcoin can do. However, that may soon change. Peer-to-peer Bitcoin exchange Paxful, in a statement to its users, informed that it will no longer support trades that involve the Bank of Venezuela owing to the sanctions imposed by the U.S government against the country.

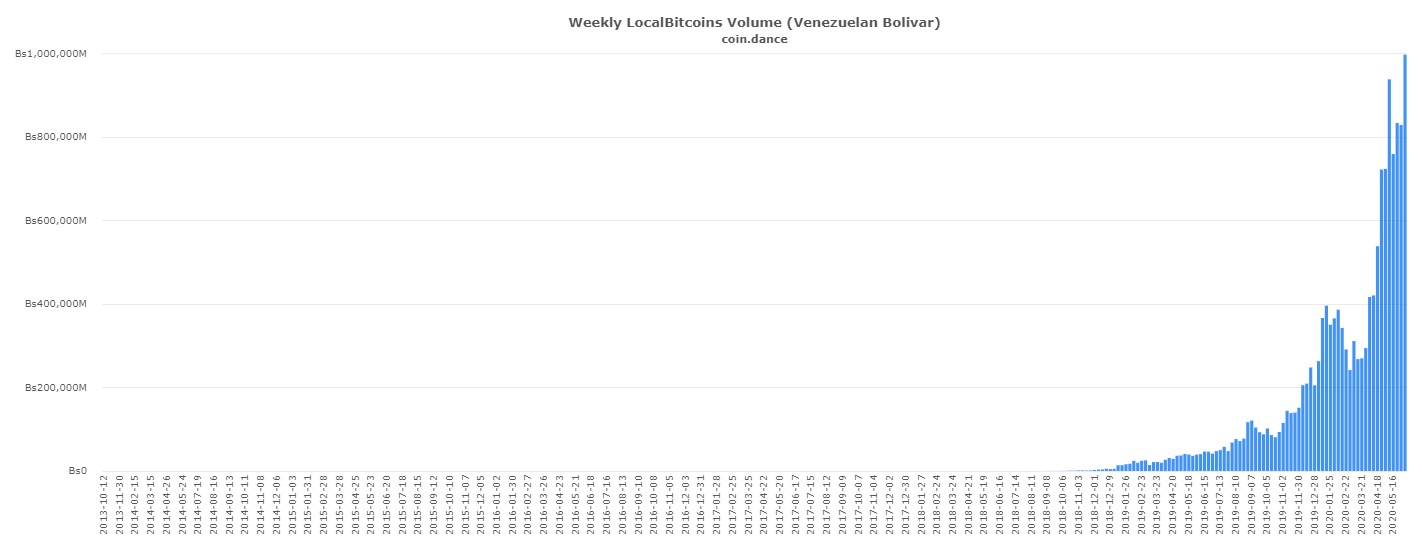

On the other hand, no such restrictions have been put in place by LocalBitcoins with regard to The Bank of Venezuela, despite the sanctions, something that is interesting since the majority of the trading volume is from LocalBitcoins.

Source: Coin.dance

While the ban by Paxful may not disrupt the Bitcoin trading ecosystem in the country entirely, if other platforms decide to follow suit, Bitcoin traders are likely to find themselves in a precarious position.

India flirts with Bitcoin ban…. again

Earlier in the year, the Supreme Court of India had lifted a de-facto ban on trading Bitcoin and other digital assets. While the step by the country’s highest court was greeted by much fanfare, a legislative ban may be in the works. According to a recent report, Indian legislators are working on bringing a law to ban the use of cryptocurrencies in the country.

A legal framework that bans crypto is likely to have a greater effect than a circular by the Reserve Bank of India and the same is being discussed between different ministries of the ruling government. According to the draft law, any direct or indirect use of cryptocurrency could be punishable with a fine or imprisonment ranging from one to ten years

Grayscale finds Three Arrows

The Grayscale Bitcoin Trust has played a crucial role in facilitating participation by institutional investors. Interestingly, according to documents filed with the U.S Securities and Exchange Commission, Singapore-based Bitcoin fund, Three Arrows Capital, has purchased around 6 percent of the outstanding shares in Grayscale’s Bitcoin Investment Trust.

Three Arrows Capitol’s 6 percent position is currently worth 20,000 BTC and is just the tip of the iceberg, in comparison to the 360,000 BTC worth over $3.6 billion it holds in custody for its clients.

QuadrigaCX a “Ponzi scheme”

Canada’s Ontario Securities Commission, in a recent report, termed the now-defunct exchange QuadrigaCX a “Ponzi scheme.” The report highlighted that QuadrigaCX’s CEO Gerald Cotten faked around $115 million in volume on the platform, which amounted to 75-100 percent of the exchange’s volume in 2014. Terming the enterprise a scam, the report read,

“The downfall of crypto asset trading platform QuadrigaCX (Quadriga) resulted from a fraud committed by Quadriga’s co-founder and CEO Gerald Cotten (Cotten).”

However, the report did highlight that fraudulent and criminal practices that were found to be true in the case of QuadrigaCX are limited to the exchange and don’t reflect on the crypto-market in general.