Is Bitcoin in for a long-overdue correction this week?

Bitcoin’s recent purple patch seemed to face its first setback over the past 24-hours after Bitcoin dropped down to $17,610 from a high of $18,890 on 22 November. While the cryptocurrency’s price had recovered to climb above $18,000 at press time, the wheels, unbeknownst to everyone, might have been in motion over the previous week itself.

Trouble in ‘CME’ paradise?

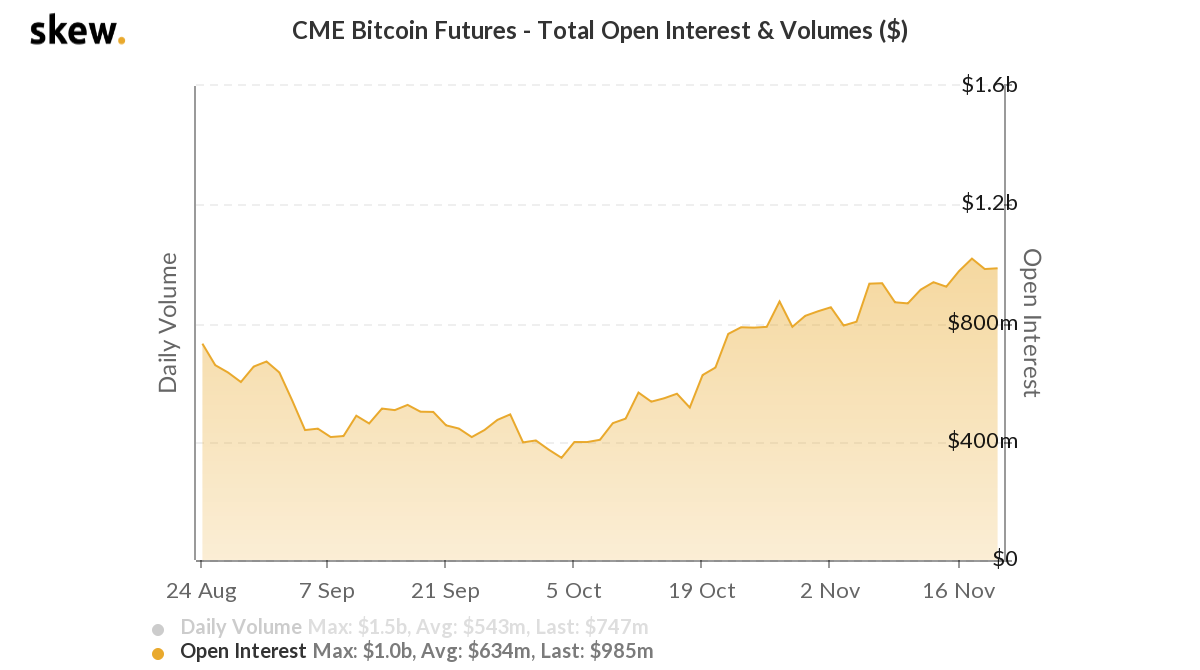

CME Bitcoin Futures noted a monumental period last week after its Open Interest registered an ATH of over $1 billion. There is a minor catch here though. While Bitcoin’s price gained by 15% after 17 November, CME’s OI failed to register a similar incline.

In such bullish conditions, the ideal scenario is for traders to build strategies around their long positions with CME cash-settled Futures. This was definitely not the case here, however, as indicated by the dropping OI towards the end of last week.

So, what was exactly happening?

Bitcoin HODLing over Futures?

It can be speculated that traders might be finding it more lucrative to take self-custody of Bitcoin at the moment, rather than indulging in cash-settled Bitcoin Futures. In fact, in a way, it makes sense from a long-term perspective. With cash-settled Futures, investors have to deal with the roll-over of Futures contracts from one month to another (Roll-over of Futures has been discussed here).

With roll-overs, traders have to keep paying a premium every time it is executed, with BTC hodling eliminating this particular function. Simply put, hodling would mean more profits, right?

Well, not exactly, since with cash-settled Futures, traders also get the option of leverage on their contracts, which also leads to higher profitability.

What can be expected this week?

According to last week’s Commitment of Traders report, changes are already starting to take place. Retail traders are beginning to cash out profits as over 750 long contracts have been executed from the top. However, there was adequate balance, with smart money exhibiting an initial long position of 800 contracts. Short contracts did not register any exits, with the traders possibly expecting the price to stumble more on the charts.

The upcoming week will be crucial for Bitcoin because, for the first time in 7 weeks, BTC is starting on the back foot. With the market long-overdue for a correction, it will be interesting to see whether the perma-bulls are able to sustain the bullish momentum or not.