47% of existing Bitcoin contracts set to expire this Friday: What will change?

Bitcoin markets have welcomed volatility in the market. The week began with a sharp fall in BTC value from $10,980 to $10,286. This devaluation of Bitcoin followed a solid recovery effort observed in the market that took place during the previous week.

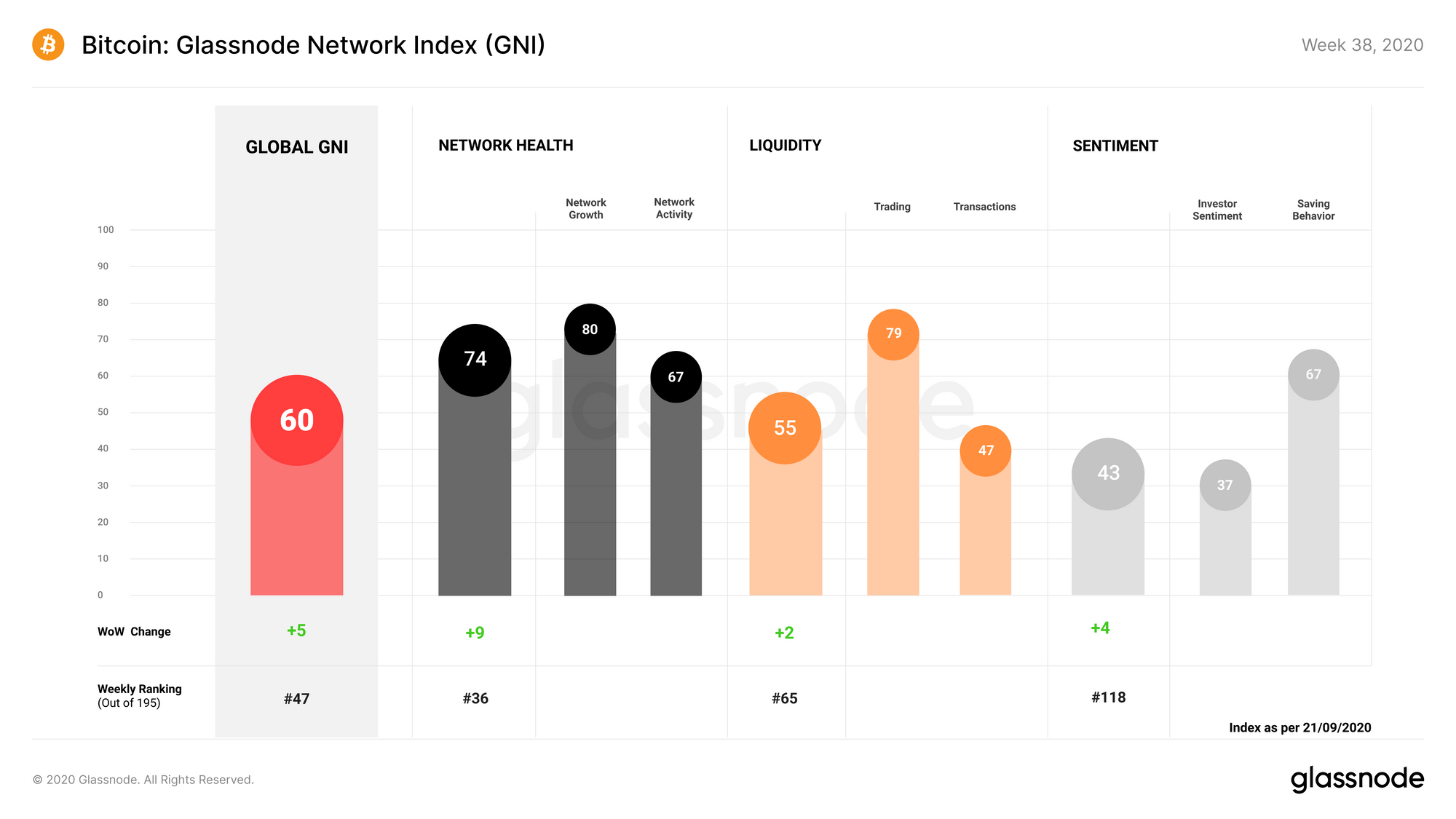

As Bitcoin finally broke out of consolidation on 14 September its value was being carried higher and was at $11,183 on 19 September. This was the first time in the month, the value of the largest asset had reached that high, however, it could stand the resistance at this level and eventually collapsed. At the same time as the market recovered, the on-chain fundamentals were gaining positive momentum as the three subindices of BTC, Network health, Liquidity, and Sentiment were all climbing higher, as suggested by Glassnode’s data.

Source: Glassnode

The overall Network index was strong again and this was the result of an increase in not only the on-chain BTC transactions but also the stablecoin supply and accumulation. The Network health witnessed a 16% rise as more BTC addresses were created, while both, trading and transaction liquidity also surged.

As the BTC price climbed upwards, investor sentiment and saving behavior categories also noted a rise. The rising price motivated hodlers to acquire more BTC which contributed to the saving behavior observed in the market before. However, the fall on Monday may have hurt the traders, apart from the ones who expected an impact from the expiration of the Dow Jones futures on Monday morning.

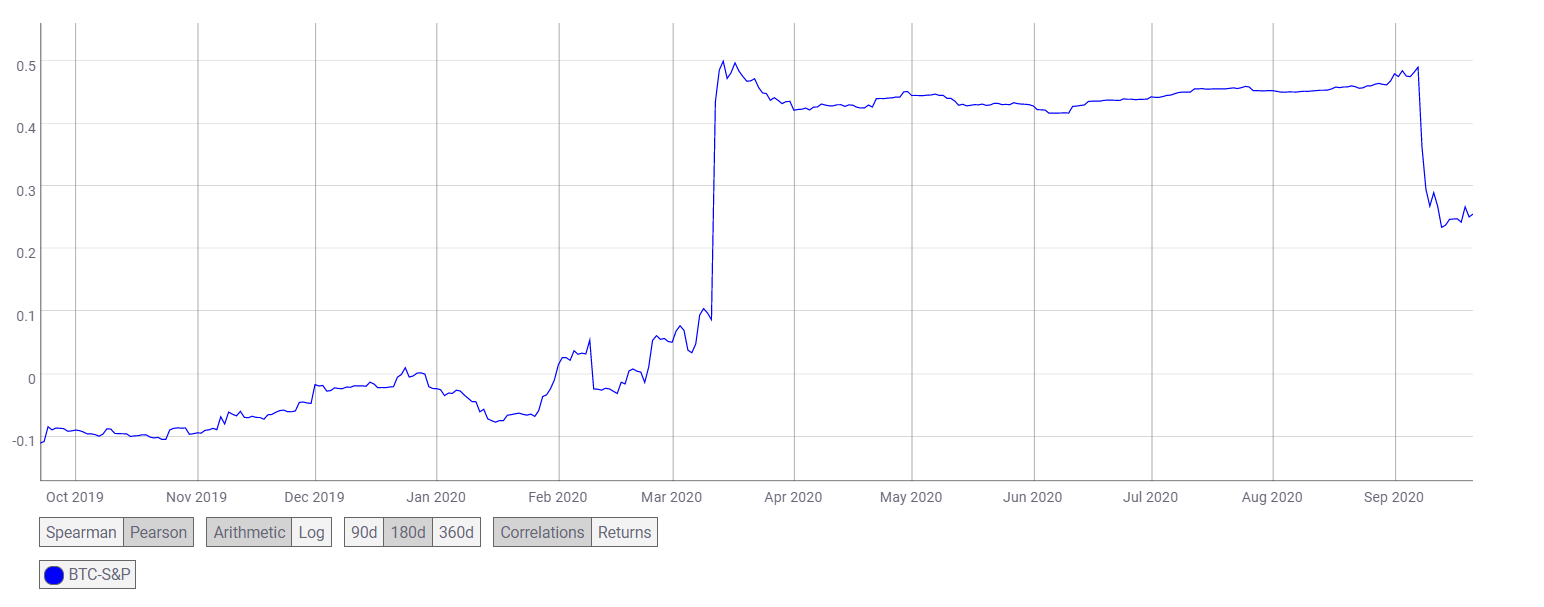

The correlation between the digital gold and stock market has remained strong since the Black Thursday event in March, although this was hit recently between 7 September and 9 September when BTC’s price was pulled under $10k but bounced back almost immediately, along with the stock market that also witnessed a similar trend.

Source: CoinMetrics

With 47% of existing BTC contracts set to expire this Friday, traders may want to keep a close watch on the trends in the stock market trend as well. Although, the options market currently suggests that the upcoming expiry could turn to be a non-event, as per the contrarian view. The supply has dropped to its lowest point in a month, with minimal traders liquidating positions. With institutional interest reporting high trading volume, Bitcoin may not be as vulnerable as thought prior to the previous set of contracts reaching expiration. The trading volume has been consistently high since 31 August, and if this volume is maintained till Friday, the expiration could turn to be a damp squib. However, even if there is a drop in the price of BTC post expiry, the recovery may be faster than expected given the active hodling behavior in the market.