Bitcoin Cash, ETC, Dash continue on downtrend as market fails to rally

The month of May hasn’t been very good for a lot of cryptocurrencies in the market, with almost all altcoins seeing their prices fall on 1 May. However, while some coins have recovered and started a bull run, others like Bitcoin Cash, Ethereum Classic, and Dash continue to follow a bearish trend that might persist for a few more days.

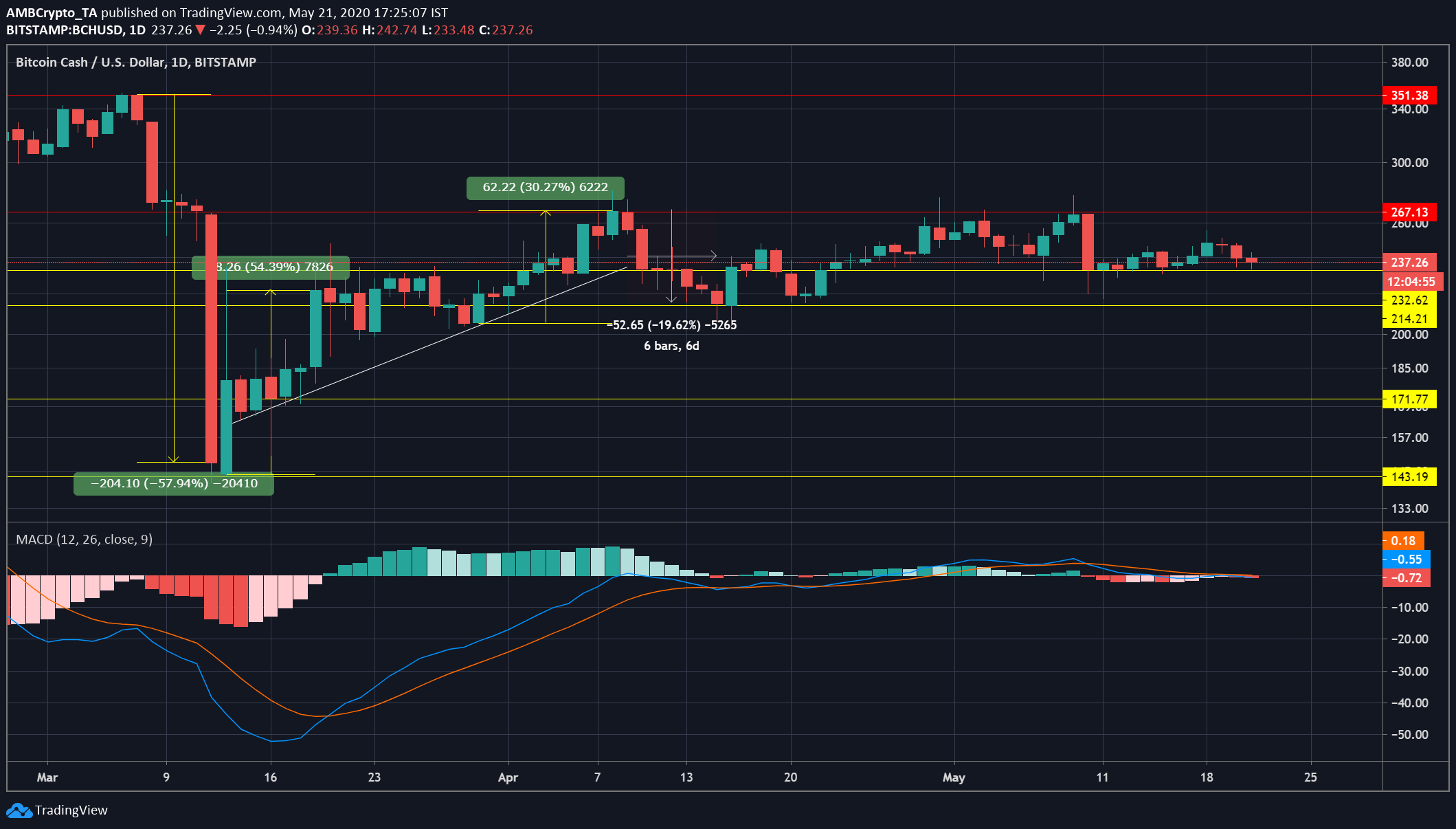

Bitcoin Cash [BCH]

Source: Bitcoin Cash/USD, TradingView

Bitcoin Cash, after noting a 57% fall following the March market crash, recovered pretty quickly. The fork coin soon found support at $214.21. After 20 April, the coin was maintaining a stable price level for a while, with not many price fluctuations. However, with the start of May, the coin started to go on a downward trend, one that continued till 11 May.

Although the coin rose up again on 18 May, it seemed to have entered the bearish territory again, at the time of writing. The coin might continue going south in the coming days, something confirmed by the MACD indicator’s bearish crossover.

If this was the case on the price-front, on the developmental side, the BCH network recently completed another upgrade, adding a couple of new features to the blockchain like opcode support, a chain limit extension, and the improved counting of signature operations using the new “Sigchecks” implementation.

Resistance: $267.13, $351.38

Support: $232.62, $214.21, $171.77, $143.19

Press time price: $237.26

Market Cap: $4.3 billion

24-hour Trading Volume: $2.8 billion

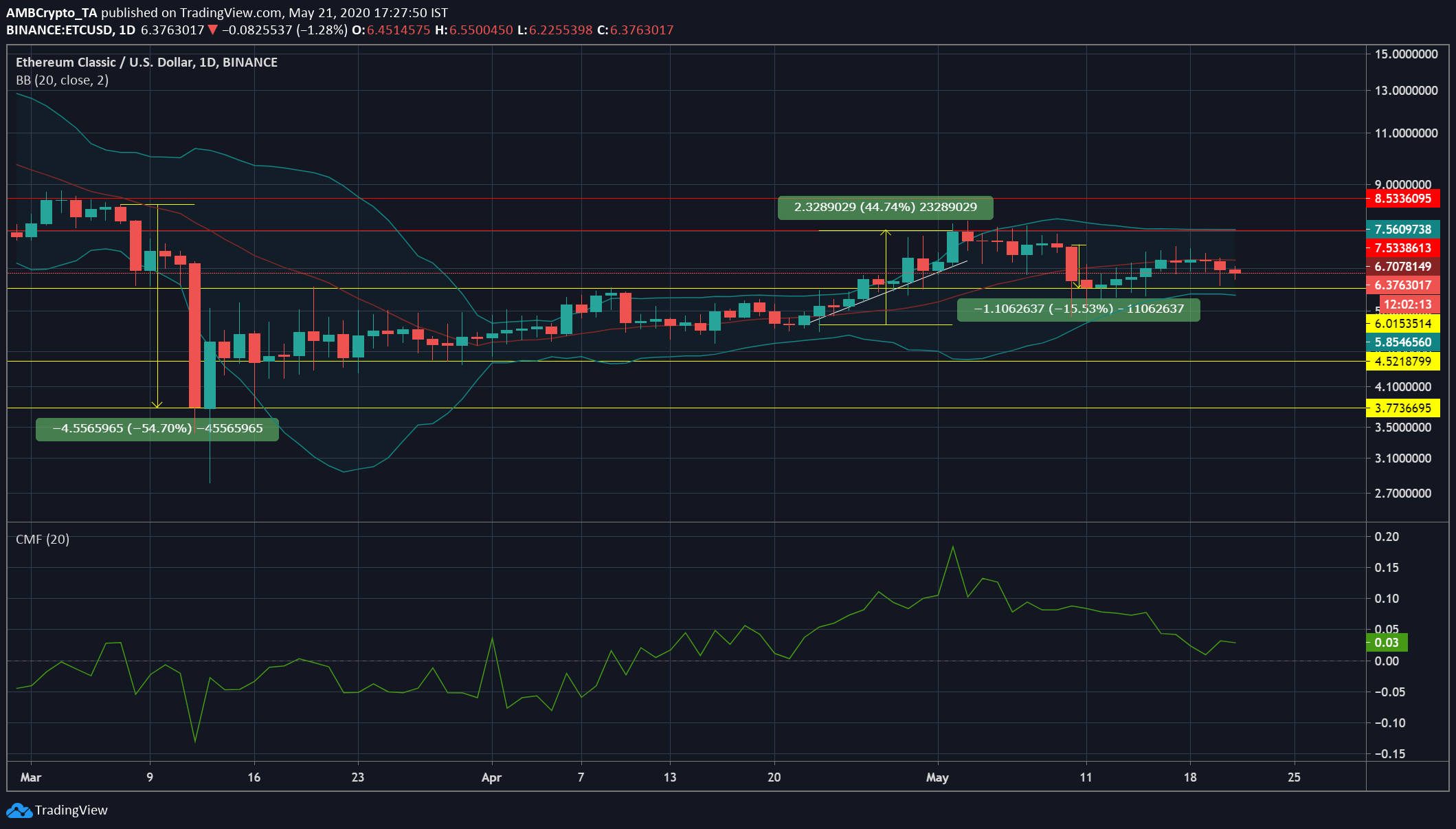

Ethereum Classic [ETC]

Source: ETC/USD, TradingView

Similarly, the 19th-ranked coin, after recording a drop of 54%, recovered soon after and found support at $4.52, a level that was maintained for over two weeks. The coin registered another rise in price worth 44% on 20 April, with the coin finding support at $6.01. However, just like all other alts, ETC dropped on 1 May and might continue to do so for a while, something confirmed by the Chaikin Money Flow resting below the zero line.

On the development side, Ethereum Classic Labs recently announced support for ChainSafe in the development of ChainBridge. One of the team members had said, “We believe there are many opportunities for cooperation and mutual development between Ethereum Classic and Ethereum and are optimistic that this will allow interoperability with all the other projects that adopt ChainBridge, both current and future.”

Resistance: $7.533, $8.533

Support: $6.01, $4.52, $3.77

Press time price: $6.37

Market Cap: $742 million

24-hour Trading Volume: $1.2 billion

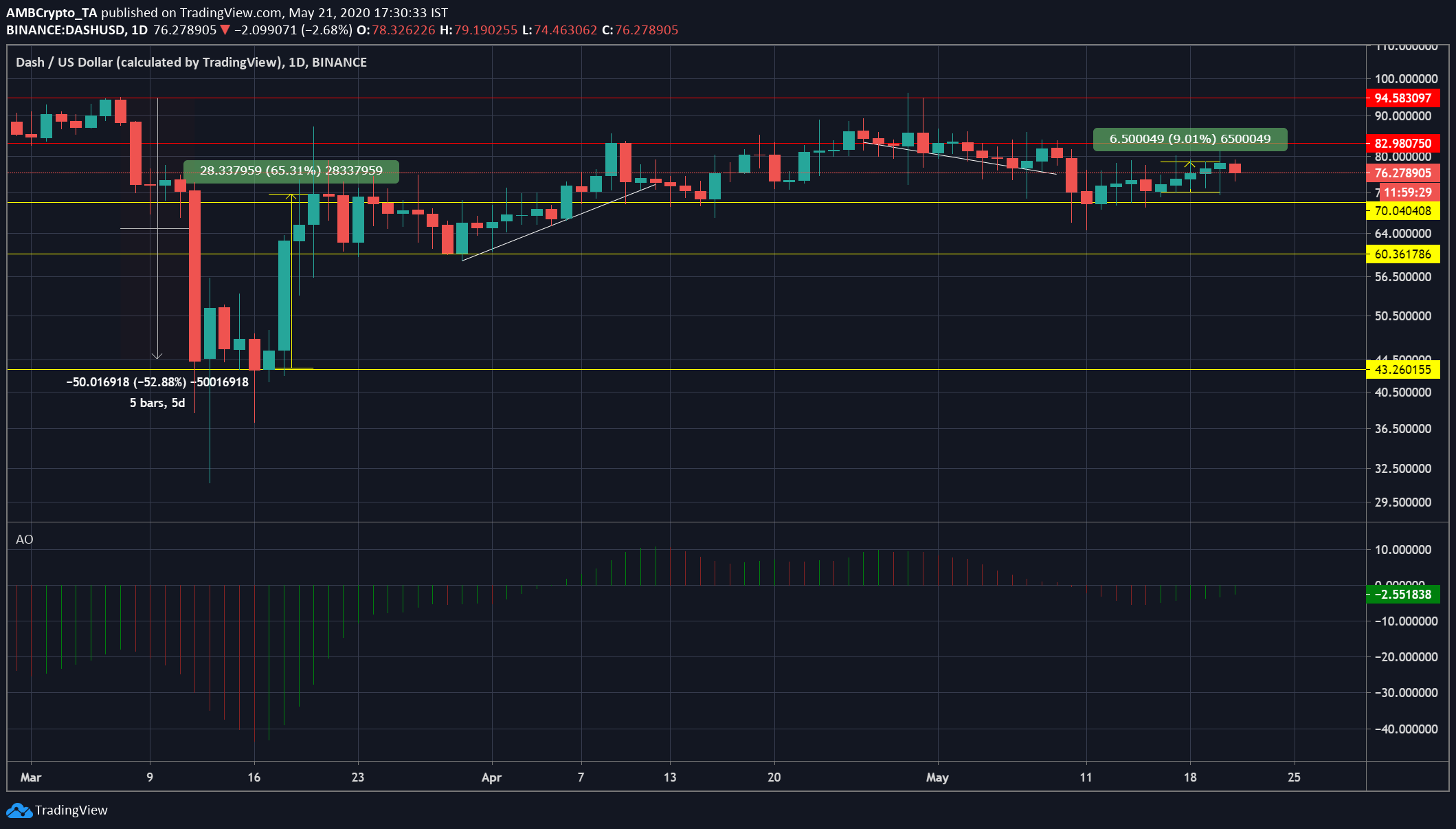

Dash

Source: Dash/USD, TradingView

Dash was among the market’s fastest recovering coins, following the March market crash. As seen in the attached chart, the coin went on a bull run with the start of April, while recording significant gains. However, the fag end of April wasn’t very good for the coin, with a persistent downtrend continuing till 11 May. On 16 May, the coin registered a rise of 9%, but the coin, at the time of writing, seemed to have started on a bearish run again.

The Awesome Oscillator indicator also hinted at a downward breakout in the next few days.

Dash, a crypto-coin with optional privacy features and a decentralized autonomous organization (DAO) for governance, has seen many recent developments and has performed quite well over the past month. The fact that Dash has moved up the CoinMarketCap ladder by one step is proof of this statement.

Resistance: $82.98, $94.58

Support: $70.04, $60.36

Press time price: $76.27

Market Cap: $718 million

24-hour Trading Volume: $585 million