Bitcoin hits $41K: BCH, ORDI not left behind

- ORDI and BCH were part of the few cryptocurrencies that jumped by double digits in the last 24 hours.

- BCH’s uptrend may become weak, but ORDI has the potential to keep going.

Cryptocurrencies including Bitcoin Cash [BCH] and Ordi [ORDI] were two of the biggest gainers in a move that saw Bitcoin [BTC] reach a new high this year. At press time, ORDI had a 24-hour 30% increase, while BCH jumped by more than 10%.

The move may not be surprising to some who have monitored Bitcoin’s correlation with these assets. For Bitcoin Cash, the 2017 Bitcoin hard fork seems to be working in its favor.

For context, a hard fork refers to an update implemented to a blockchain which can cause the split into two cryptocurrencies.

Tied up in the movement

BCH was Bitcoin’s hard fork, but still functions as a decentralized peer-to-peer network like the top blockchain. As a result, when BTC pumps, BCH followed most times. This was evident in the series of articles AMBCrypto published earlier this year.

In ORDI’s case, its status as the highest BRC-20 token has favored its strong correlation with Bitcoin. BRC-20 is an experimental token standard that enables the minting of fungible tokens on the Bitcoin blockchain.

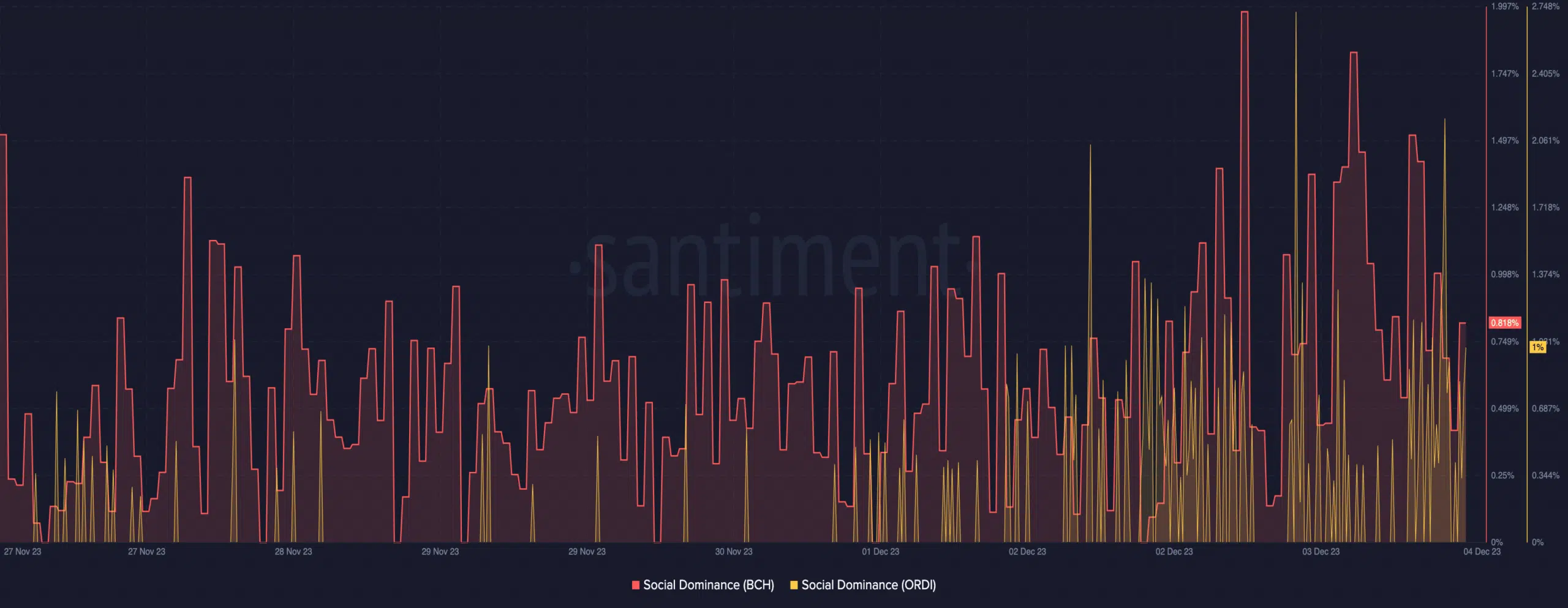

It is also important to mention that ORDI’s rise to $42.25 means it had reached a new All-Time High (ATH). In terms of social dominance, Santiment data analyzed by AMBCrypto showed that ORDI and BCH have been rising.

At the time of writing, Bitcoin Cash’s social dominance was 0.81% while ORDI had tapped the prestigious 1% dominance. The rise in the metric suggests that the assets are getting more attention from the media and market participants.

Careful, not all that glitters is gold

So, it is likely that traders are trying to capitalize on the price movement while monitoring the potential tops and bottoms. An assessment of the Funding Rate showed that the metric was all green.

While ORDI’s Funding Rate was 0.015%, BCH stood at 0.01%. Funding rates are fees paid between shorts and longs to keep their contract open. If the Funding Rate is negative, it implies that traders are bearish and expecting the price to fall.

However, the funding rates for BCH and ORDI were positive at press time, confirming the bullish bias traders have regarding individual price action.

Furthermore, traders should not get too excited about BCH’s price action. This is because of the trend shown by the Open Interest. Open Interest shows the total number of outstanding futures contracts left at the end of a trading period.

Realistic or not, here’s ORDI’s market cap in BCH’s terms

At press time, the Open Interest around Bitcoin Cash was down to $213.74 million. When placed by the price action, the decline in the Open Interest means that BCH’s upward direction could become weak.

Hence, there is a likelihood that the uptick will come to a stop soon.