FATF Travel Rule’s June Review: What to expect for Bitcoin, privacy-coins?

The Financial Action Task Force [FATF] came out with the ‘Travel Rule’ back in June 2019, following which many cryptocurrency exchanges started delisting privacy coins. With not long to go for the review, one can’t help but wonder about the plight of privacy coins if and when more countries start implementing the rule.

Down the memory lane

The global money-laundering watchdog announced the Travel Rule in June 2019, a rule that required cryptocurrency exchanges to collect and transfer customer information; the information being the originator’s name, account number, location, as well as the beneficiary’s name and account number.

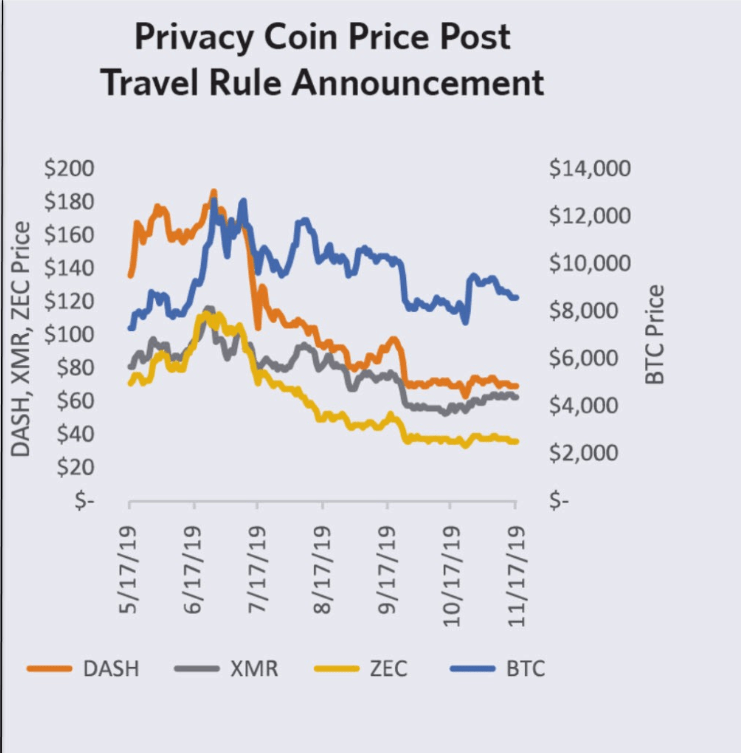

As seen in the attached chart, many of the market’s privacy coins saw a massive drop in price just weeks after the FATF came out with the rule. In fact, the movement by alts such as Dash, Monero, and ZEC in the weeks after was contrary to their movement in May.

Here, it should also be noted that Bitcoin’s value fell as well; however, not as much as other privacy coins. The very price drop was the immediate reason that precipitated many cryptocurrency exchanges to delist privacy coins. South Korea’s OKEx was among the first ones to delist Monero, Dash, Zcash, Horizen, and Super Bitcoin, all at once, as they were unable to implement the FATF guidelines.

However, it does not stop there. Not everyone is happy with the FATF Travel Rule.

A community divided

If looked at it, the Travel Rule sort of created a divide within the crypto-system. While some in the community saw this rule as a long-standing requirement, many others were/are dead against it, calling it ‘a wrong move’ as it challenges the very concept of cryptocurrencies –‘anonymity.’

On the other hand, this very decentralized nature has bothered central banks and governments from day one. So technically, national governments must be more than willing to abide by the travel rule.

However, for better or worse, the FATF’s guidance has pushed countries to think about cryptocurrency regulations, the United States, for example. Crypto-exchanges and users in the U.S have been urging clear-cut crypto-regulations for a very long time. Surprisingly, the U.S was also among the first countries to implement the FATF Travel Rule, with the country already one of the few to have some sort of regulatory framework in place.

Apart from the U.S, Singapore, South Korea, Japan, and Switzerland have all implemented the FATF travel rule. However, it is important to take into consideration the crypto-environment in these countries, while talking about regulations.

Switzerland was one of the first countries to have shown a positive attitude toward Bitcoin. Since the 2016 assessment by the FATF, Switzerland has taken numerous steps to tackle money laundering and terrorist financing. So, the country implementing the FATF travel rule is not very surprising.

The same goes for South Korea as well. The country recently legalized crypto-trading in the country; hence, South Korea abiding by the FATF guidance to regulate the space is quite self-explanatory.

Not a ‘must and should’ rule to abide by the FATF guidance

Although the guidance released in June last year notes that the countries that do not abide by the rule would be blacklisted, many including crypto-attorney Jake Chervinsky opine that this might not be the case in reality. Chervinsky said,

“Member countries can adopt all, some, or none of FATF’s recommendations. There are basically no repercussions for not adopting (or for violating) FATF recommendations.”

Interestingly, there’s another important sector that might see significant changes following the implementation of the FATF guidance – Darknet markets.

Could privacy coins finally take the lead on the dark web?

At the moment, Bitcoin, although not a privacy-focused coin, is the top coin in demand when it comes to the dark web. So, while Bitcoin still dominates the darknet market, could users end up being more inclined to use privacy coins on the darknet, especially if exchanges’ implementation of the travel rule and adherence to other regulations make it difficult for users to use Bitcoin?

As Bitcoin is not a privacy-focused coin, exchanges might not delist it (Let’s face it – Who in their right mind would even attempt to delist Bitcoin?). So, exchanges might have to end up giving out transaction records. Now, this makes it difficult for the coin to be used on the dark web. Privacy coins might receive a lot of traction due to this. However, now that more and more exchanges are delisting privacy coins, what might be the future of cryptocurrency usage in darknet markets? Guess we’ll have to wait and see how things will turn out in the end.

That being said, some people in the industry believe that the privacy coins might not be in so much risk.

Reuben Yap, Chief Operations Officer at Zcoin, opined that privacy coins would face the same trials as any other cryptocurrency and that privacy coins weren’t in for any added risks, in comparison with other crypto-coins. He stated,

“Whether a coin has privacy features or not, this does not affect its compliance with the Travel Rule since a VASP can always give information of its transactions with other VASPs since it already has the customer’s identity and KYC.”

Will the review happen in June 2020?

Crypto-regulations expert Siân Jones does not seem to think positively about that. During a panel discussion on FATF’s crypto-guidelines recently, Jones opined that the implementation could take years. In her words,

“The deadline, as it’s sometimes being put across, is a bit of a myth at one level. It is a requirement that came into play all the way back in 2019 […] But there will undoubtedly be some rising problems as countries implement a wider range of FATF requirements as well as they are applying the travel rule to VASPs.”

Putting things into perspective, the implementation of the FATF Travel Rule does pose risks to the future of privacy coins. However, now that there are questions being raised on the review happening next month, which, by the way, may just be pushed with the onset of COVID-19, it is safe to say that privacy coins and its developers can take a moment, sit back, and relax for the time being.