Bitcoin Cash may struggle to keep uptrend alive as price likely to test support

Bitcoin Cash [BCH] underwent its block reward halving a few weeks ago, with BCH noting a lot of market momentum towards the latter part of April. The uptrend was continuing at press time, but for how long will the 5th largest cryptocurrency sustain this momentum? That seemed to be the pertinent question, at the time of writing.

At press time, BCH was trading at $255 and had a market capitalization of $4.7 billion. Over the past 24 hours, Bitcoin Cash has registered a 0.7 percent fall in its price, having registered a trading volume of $2.9 billion.

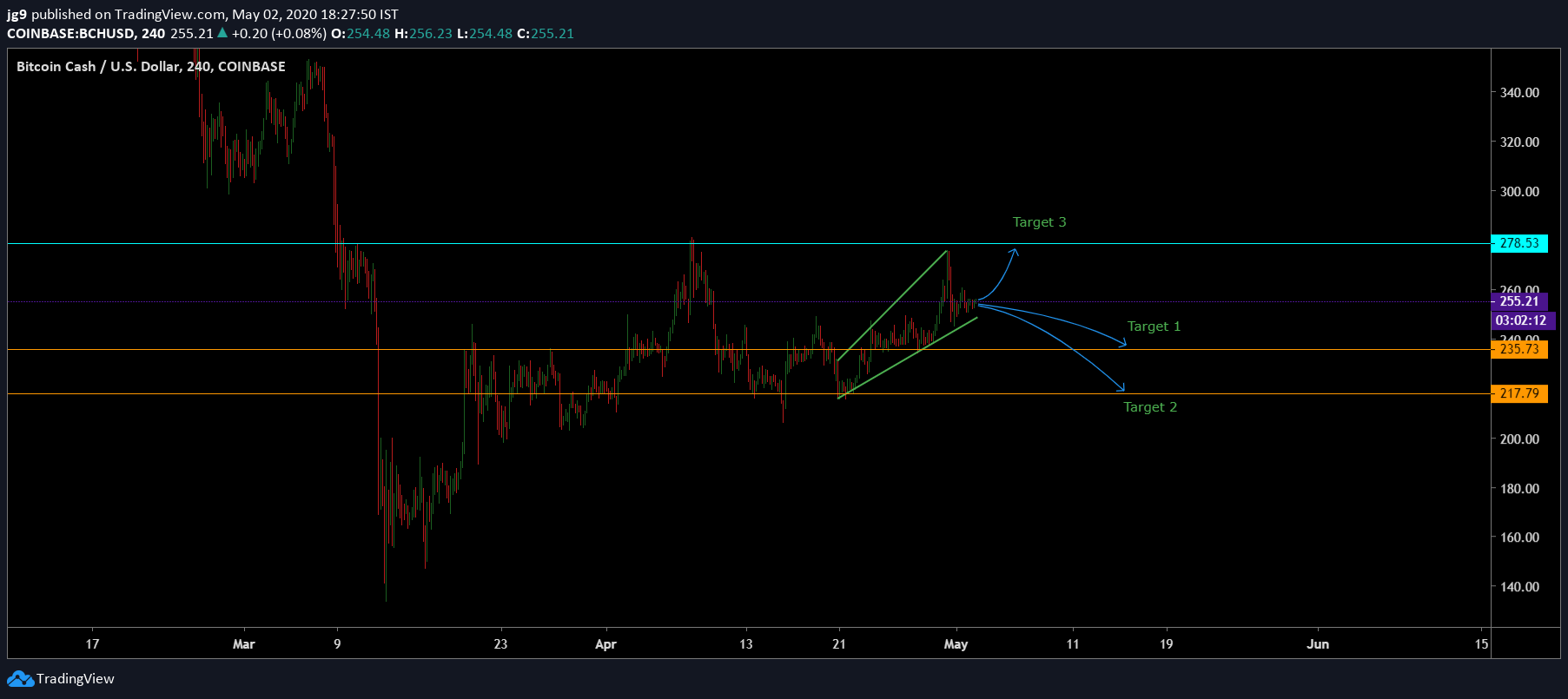

4-hour chart

Source: BCH/USD, TradingView

According to the 4-hour chart, Bitcoin Cash’s price has been in an ascending broadening wedge formation for the past two weeks. In such a scenario, there is the possibility of Bitcoin Cash’s price seeing a fall in the coming days, as per the expected breakout of the formation.

At the time of writing, for Bitcoin Cash, there are two crucial supports that have been tested in the past – $235 and $217. When the price does break out of the formation, it is likely to head towards Target 1 over the next few weeks. However, if the uptrend were to continue for longer, the price might reach the resistance at $278 in the next few days.

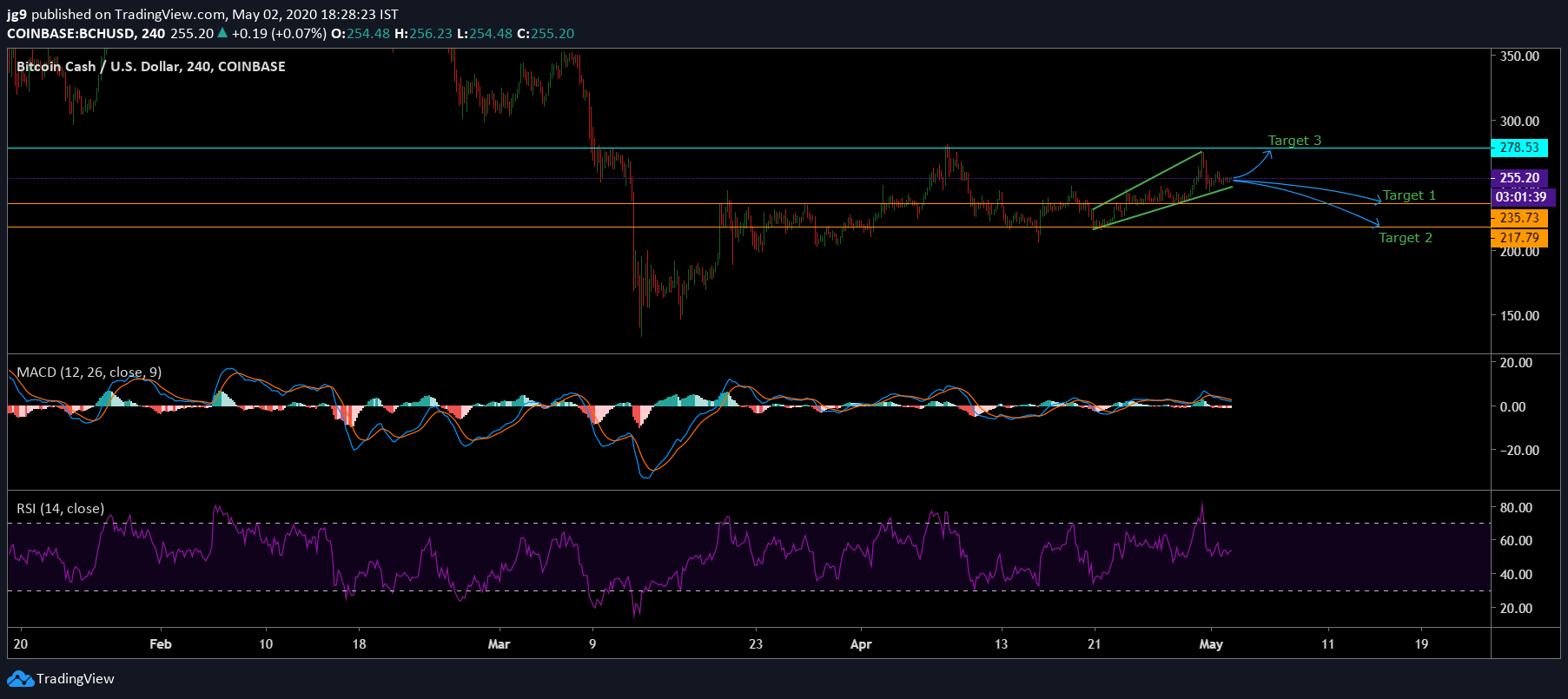

Source: BCH/USD, TradingView

On the 4-hour chart, the MACD indicator had just undergone a bearish crossover as the signal line had just moved above the MACD line. The RSI indicator was around the neutral zone and was showing a bit of divergence.

Source: CoinMetrics

Interestingly, for Bitcoin Cash, its correlation with the king coin, Bitcoin, continued to gain momentum and has been on a steady upward trajectory. Over the past two months, the correlation increased from 0.76 to 0.87.

Conclusion

Bitcoin Cash’s price is likely to see a dip once the breakout happens and is likely to head towards Target 1 at $235 in the next few weeks. Even if the coin’s price heads towards Target 3 in the short-term, there is the possibility that Bitcoin cash is likely to see its price fall as predicted by the pattern breakout.

This may result in BCH losing close to 7 percent of its value in the near-term. However, the unlikely scenario remains wherein Bitcoin Cash may move towards Target 3 at $278 mark and breach the resistance and if the bearish pressure were to take over significantly, BCH may soon find itself going past the first support and heading towards Target 2.