Bitcoin likely to face an uphill battle, price may drop 10 percent

For the most part, the king coin has managed to recover its losses. However, the current price point Bitcoin finds itself in, may not have been expected by many at the start of the year owing to the upcoming block reward halving that is to take place in less than 60 days.

At press time, Bitcoin was trading at $6650 with a market capitalization of $121 billion and a 24-hour trading volume of $46 billion.

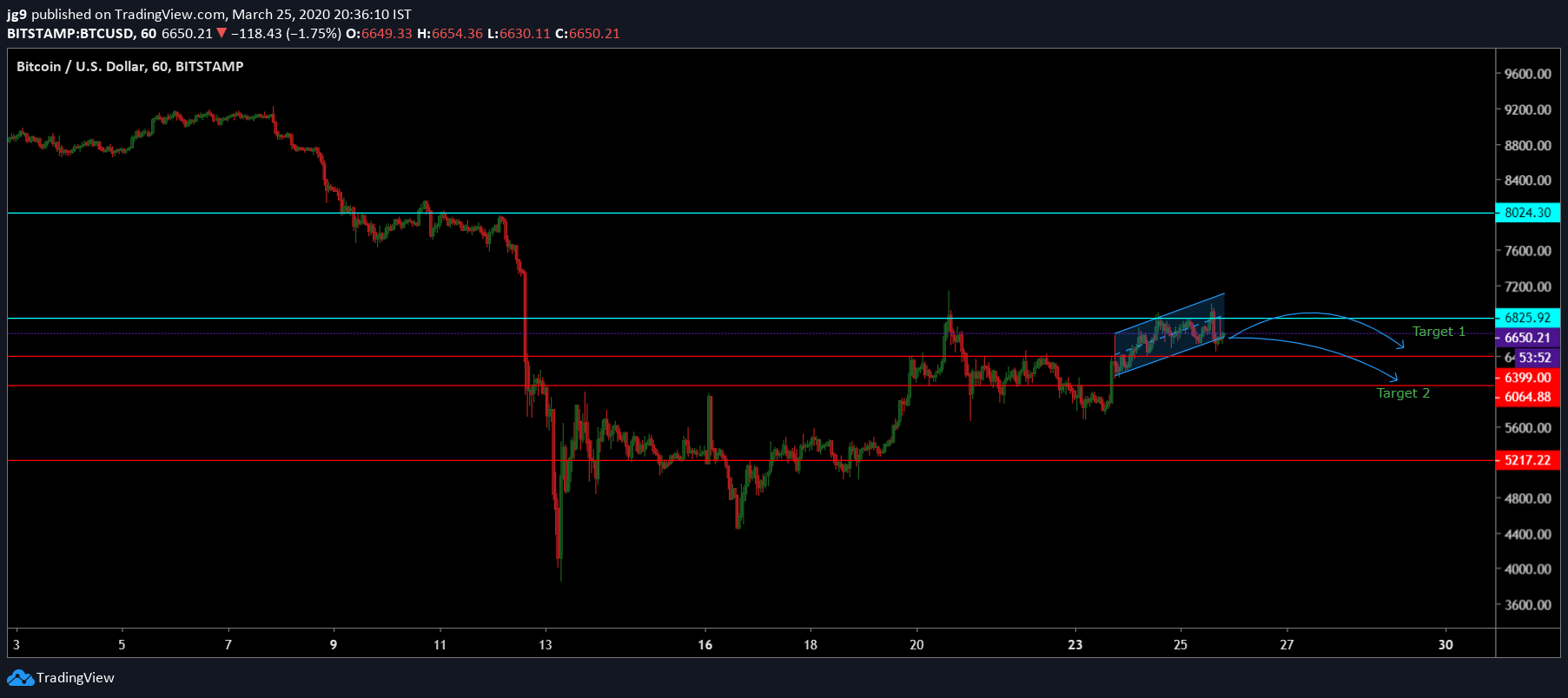

1-hour chart

Source: BTC/USD, TradingView

As per the 1-hour chart, Bitcoin’s price movement has settled into an ascending channel in the past few days. For an ascending channel, the break out is likely to be downward in the coming days.

For Bitcoin, there are a few strong supports that are likely to be tested in the coming week. The first point of support is $6399, the next important support is $6064. In the unlikely scenario that the price of BTC would fall even further, then the support at $5217 is likely to be tested.

If the price of Bitcoin were to increase substantially, there are two points of resistance for Bitcoin as of now. The first resistance is at $6825 and the second is at $8024.

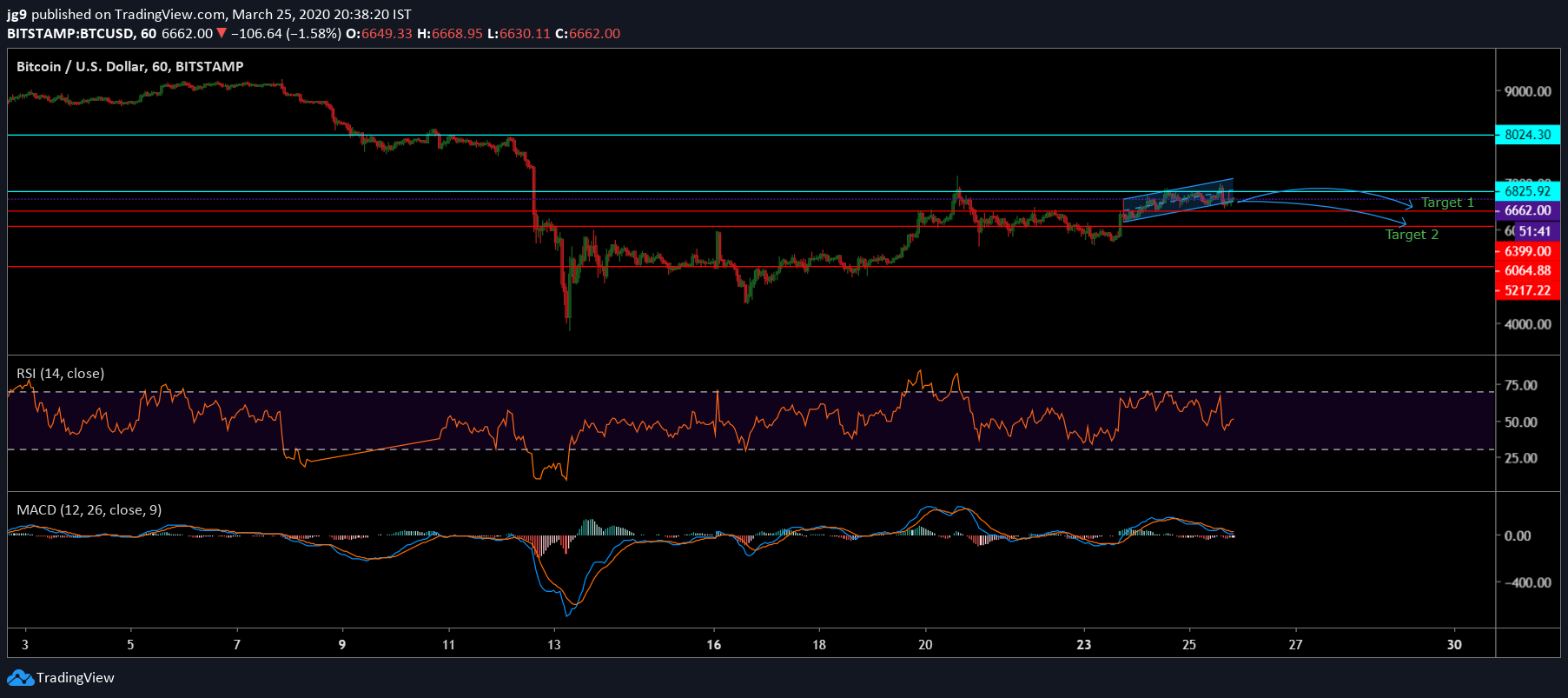

Source: BTC/USD, TradingView

In the 1-hour chart, indicators such as MACD and RSI do not point to bullish sentiment in the near future. MACD indicator at the moment showed that the signal line continues to move above MACD line which is a trait for bearish sentiment. RSI indicator, on the other hand, continues to stay just below the halfway mark at 48 at the moment. However, the indicator is pointing toward the overbought zone which may end up in an increase in BTC price. However, given the overall scenario, it is more plausible that the RSI indicator is just showing bearish divergence at the moment.

1-day chart

Source: BTC/USD, TradingView

At press time, even the daily chart for Bitcoin showed that the coin has been in an ascending channel and is likely to see a price drop in a week’s time.

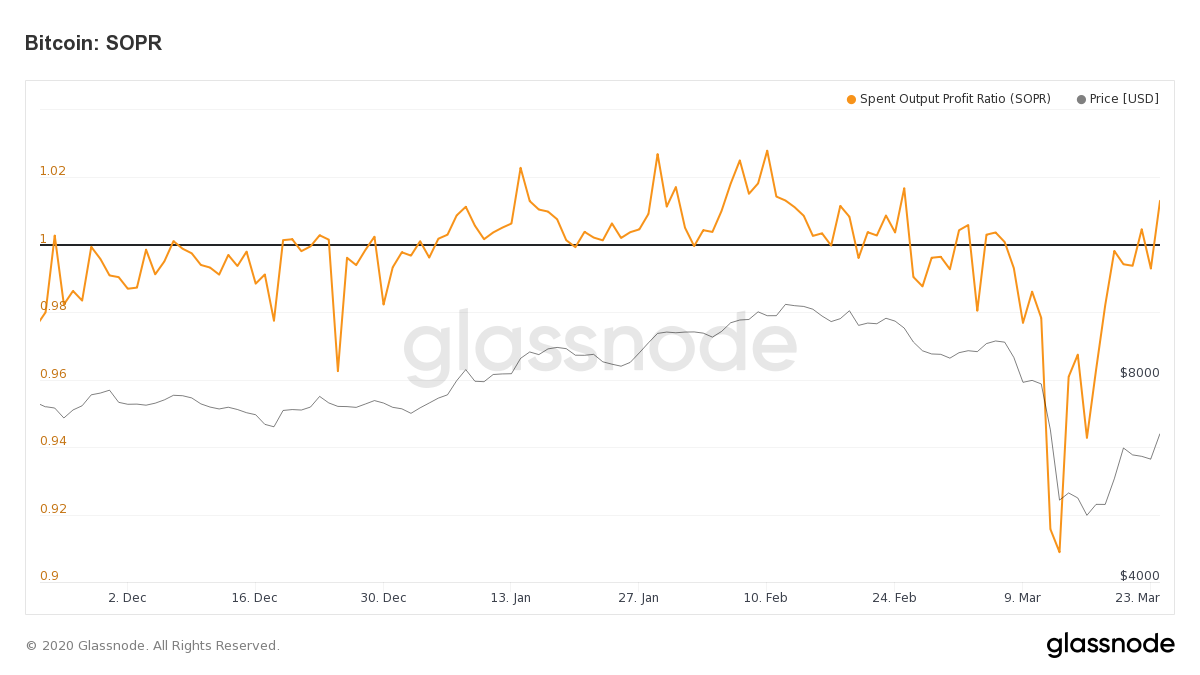

Source: Bitcoin: SOPR, Glassnode

Interestingly as per data regarding The Spent Output Profit Ratio (SOPR) from Glassnode, the current ratio for Bitcoin is just over 1. SOPR measures the profitability of Bitcoin transactions. When the ratio falls below 1, it indicates that the coin is being sold at a loss.

During the March 12 BTC crash, SOPR ratio plummetted substantially. The fact that the ratio is currently over 1 means that BTC is not necessarily being sold at a loss. However, in the bear market, there is a possibility that the ratio corrects itself.

Conclusion

As per the indicators and Bitcoin’s price movement, a downward breakout is expected. In the coming week, there is a slight possibility that BTC will see a close to 10 percent drop in its price. As of now target 1 stood at $6399 and Target 2 stood at $6064. In case the coin is able to sustain its upward momentum, we may also see Bitcoin’s price go past $6825