Bitcoin Cash might consolidate above $200 after 32% dip

After spending the entirety of 2020 above $200, Bitcoin Cash’s valuation came crashing down today after the collective market recorded a major bearish pullback. With losses coming on all fronts for a majority of the tokens, BCH’s valuation fell to $178, at press time, with a market cap of $3.27 billion.

Over the week, Bitcoin Cash suffered the highest depreciation, with a pullback of close to 50 percent.

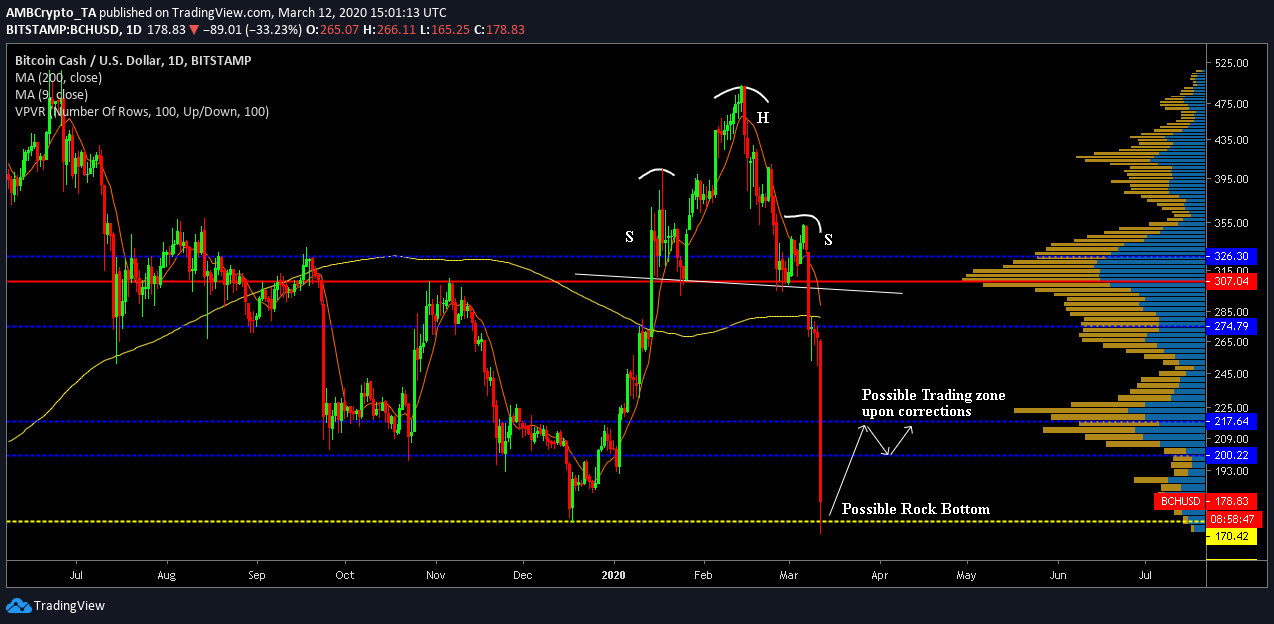

Bitcoin Cash 1-day chart

Source: BCH/USD on TradingView

On analyzing Bitcoin Cash’s 1-day chart, it can be pictured that the crypto-asset went past major support levels at $217.64 and $200 during the recent slump. With prices rallying towards the start of the year, prices were relatively high on 6 March as well, with BCH being valued at $352.

However, an inverted head and shoulder pattern was pictured on the charts, a pattern that may have played a critical role during the recent downturn. The pattern was breached on 7 March itself, but the major collapse occurred on 12 March. The initial breach of the pattern saw the token undergo mediation below the $300 range on the 7th, and the recent slump facilitated its drop under $200.

At press time, Bitcoin Cash had managed to remain above support levels at $170 and further depreciation should be avoided beyond this point.

The VPVR indicator suggested that the valuation might manage to consolidate above $200 after corrections take place, as the trading activity has been substantial between $200 and $217 over the past 9 months. However, the fact that the 200-Moving Average underwent a trend reversal during the course of the price fall is a major bearish sign.

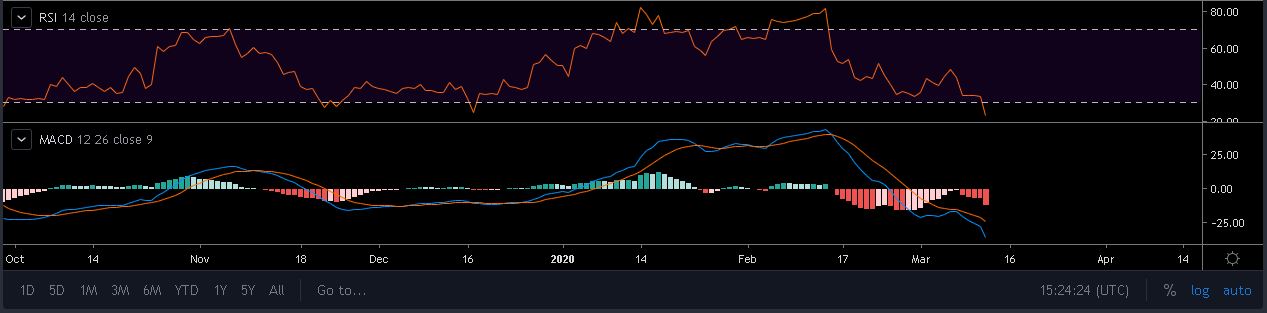

Source: BCH/USD at Trading View

Even though the RSI indicator remained bearish, over the past 9 months, BCH has dwelled in the oversold zone only twice, which suggested that the price could bounce right back after the recent dip under $200.

The MACD was significantly bearish as well, as the signal line continued to hover above the MACD line.

Conclusion

It is difficult to foresee BCH’s immediate response, but corrections should allow a quick return above $200. Consolidation under the mark for more than 48 hours may suggest a different scenario, hence, the next few days would be critical from Bitcoin Cash’s perspective.