Huobi’s decision to launch options trading… a strategic move?

Cryptocurrency exchange Huobi Global revealed its plans to launch Bitcoin Options. The announcement comes at a time when Bitcoin has been coiling-up and in an extended bear market, awaiting a bull run.

Huobi Global’s entry into Bitcoin Options isn’t a surprise considering its dominance in the Futures market. At press time Huobi’s 24-hour Bitcoin Futures volume was the highest [$1.89 billion]. BitMEX, the derivatives pioneer stood fourth while Binance came in third.

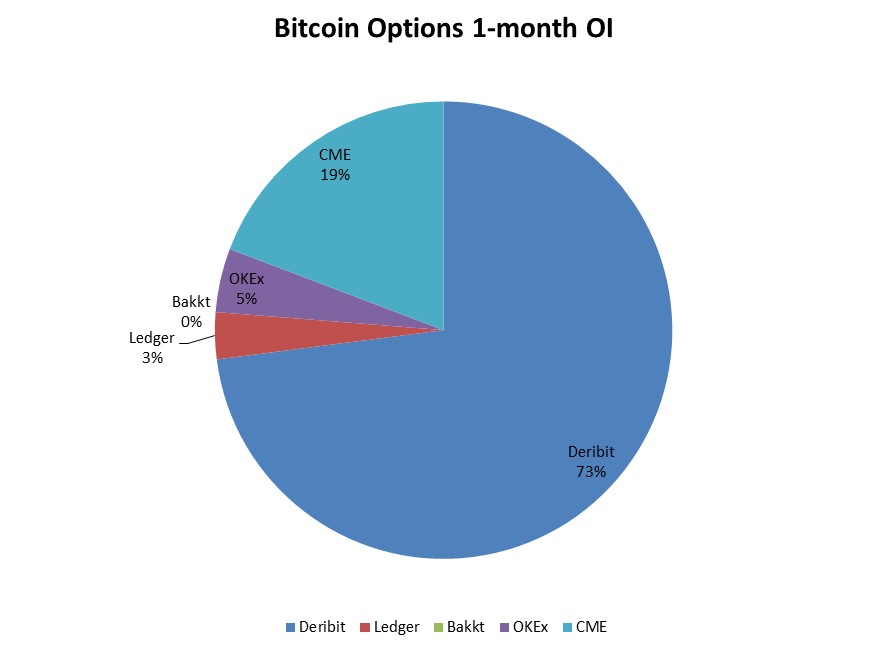

At press time, the options market was led by Deribit and CME. Deribit exchange’s OI was 73% while that of CME’s was 19%.

Source: Skew

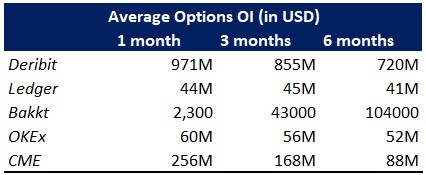

Furthermore, the table below shows how Deribit owns and has been owning a large share of the Bitcoin Options market, despite the presence of regulated players like CME and Bakkt’s.

Source: Skew

Six months ago, Deribit had the highest Bitcoin options OI of $720 million while CME had $88 million. The growth of options OI for Bakkt and other players was slow in comparison.

While Binance has the biggest volume when it comes to spot trading, its futures volume has, on some days, managed to surpass that of Huobi’s. However, on average, Huobi’s volume has consistently taken the lead. With this decision of entering the options market, Huobi has a chance to compete in a saturated market with strong players like Deribit and CME.

Last month, Deribit’s newsletter, which shared with AMBCrypto, noted that it had registered a new record of $1.46 billion BTC Options Open Interest before the expiry, with a notional value of $746 million undergoing expiry on 26 June. According to the crypto-analytics platform, Skew, Derinit’s OI has consistently increased over past 6 months.

In comparison, CME’s options’ saw a slow but steady growth since its launch, but then it all changed. From May 5, a week prior to Bitcoin’s block halving, a new ATH was seen at $9.4 million worth of Bitcoin Options traded. Since then, the ATH has been broken 6 times, with the highest single-day volume reaching $66 million on May 28th.

Bitcoin Options

Ciara Sun, VP of Huobi Global Markets stated,

“Our entry into the derivatives market has been incredibly successful. Huobi Futures has been sitting at the top of many metrics regarding trading volume, and has rocketed to the top in Perpetual Swaps in just a few months.”

Additionally, Huobi will offer their options in the European style with a minimum position of 0.001 BTC, which will allow users with low initial capital [of $10] to invest and trade BTC options contracts.