Will Bitcoin’s short-dated Options’ rise coax price into rising as well?

Among others, Bitcoin Options are a set of financial products popular with institutional investors. Bakkt, which launched with Bitcoin Futures, had expanded into the Options markets. At press time, the short-dated Options for Bitcoin were on the rise, a development that could indicate the price that might follow.

Bitcoin Options

Source: Skew

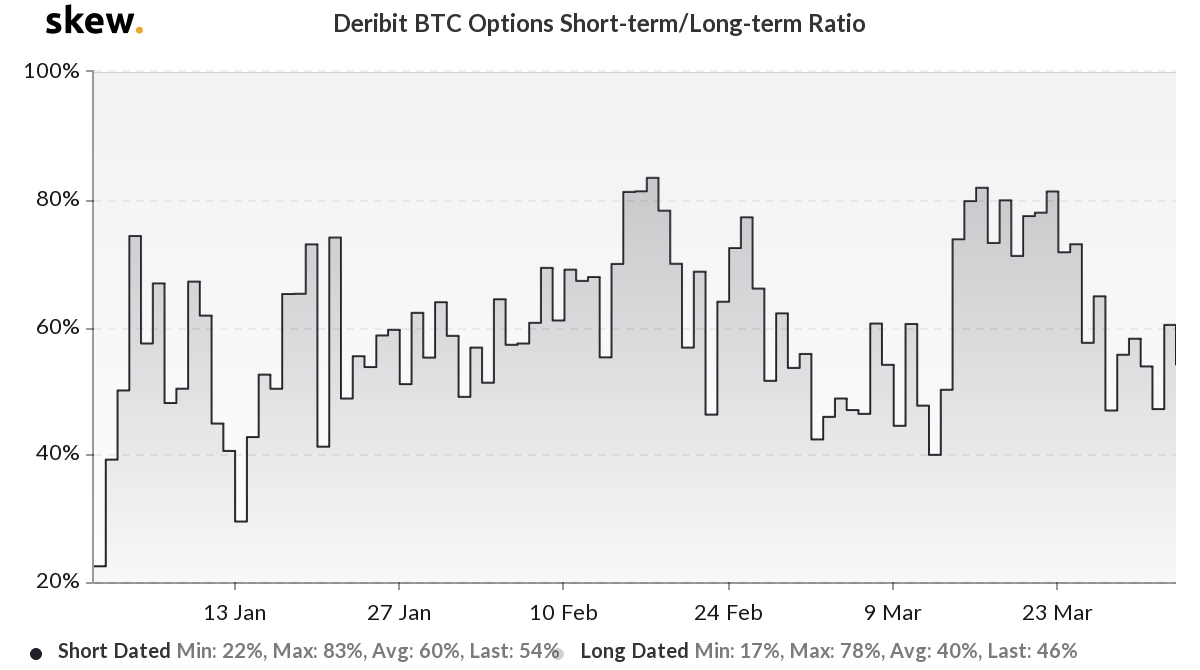

Deribit is a platform that has been gaining traction for providing institutional products for Bitcoin, like Futures, Options, etc. With respect to these products, Deribit is a leading exchange and short-dated Options on Deribits have recently been on the rise again.

As of 01 April, short-dated Options [SDOs] hit 60%, while the rest constituted of long-dated Options [LDOs]. The last time a rise in the SDO trend was seen was between January 2020 and February 2020. During this time, the price of Bitcoin went from $7,000 to $10,5000. After hitting a local top in February, the SDOs declined, causing the price to decline as well.

This correlation is due to the investors wanting to profit on the king coin’s short-term price movements; hence, they opt for short-dated Options instead of long-dated Options which have a higher risk-to-return ratio.

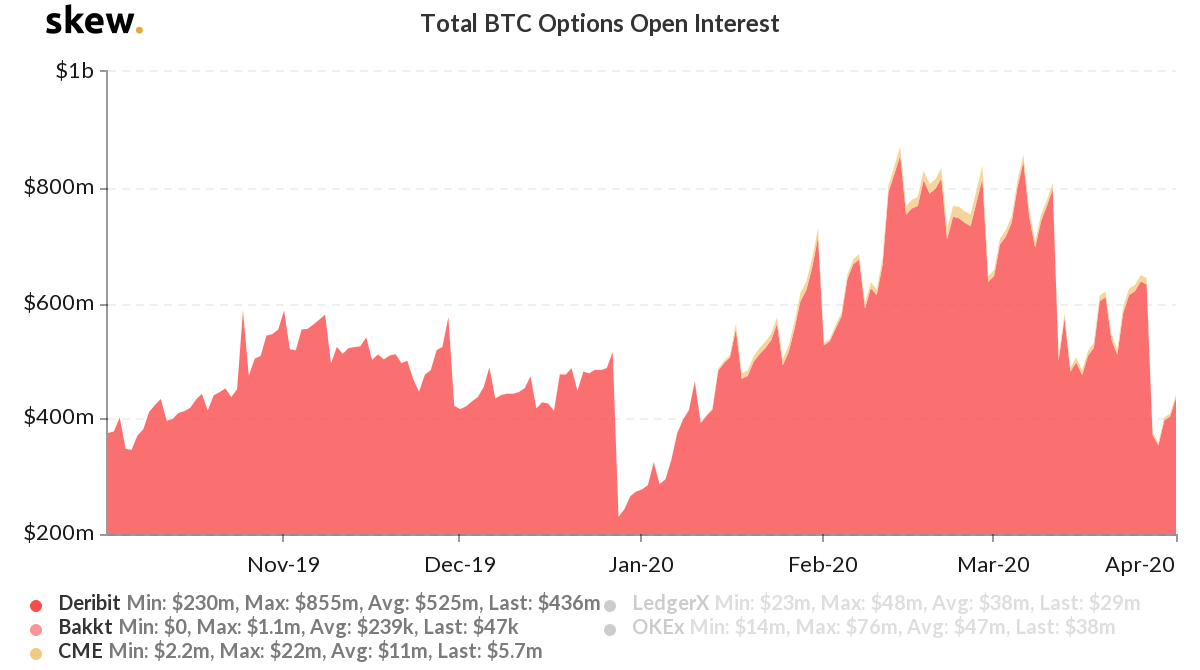

Further, this correlation can, for obvious reasons, be seen in the Open Interest on Deribit exchange. In fact, there was a huge surge in OI from January to February.

Source: Skew

However, at press time, the OI was starting to surge again, while the SDOs were also on the surge. This could indicate a surge in price as well in the near future. At press time, Bitcoin was trading at $6,666, with a 24-hour recorded change of 6.15%.

Source: BTCUSD, TradingView

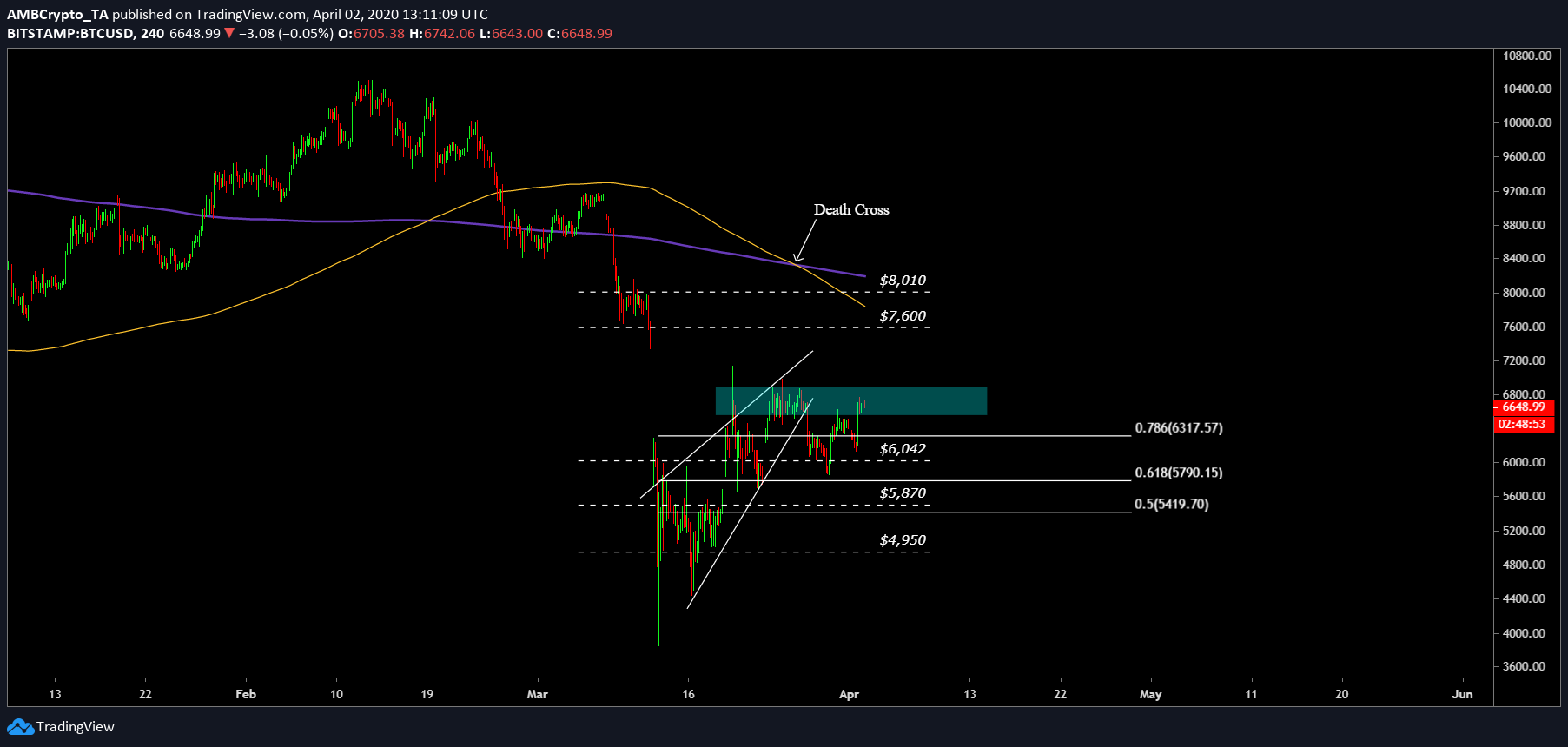

From the looks of the price action, we might see the formation of another rising wedge, similar to the one seen since the “Black Thursday” crash of Bitcoin. If the above scenario unfolds, then the price might shoot through the roof and blast through the resistance zone of $6,600 to $7,000.