Will Bitcoin become worthy investment thesis for ‘crypto-curious’ institutional investors?

Over the past few years, there has been increased interest regarding cryptocurrencies such as Bitcoin. What was earlier a disruptive form of currency endorsed by tech enthusiasts is now gaining traction in the corridors of institutional finance. Bitcoin’s status as a store of value asset increased global uncertainty, with a maturing cryptocurrency ecosystem also contributing to an increase in interest and adoption.

Anchorage CEO Nathan McCauley, on the latest edition of the Unqualified Opinions podcast, spoke about the growth of crypto’s significance with respect to institutional buyers and the current macroeconomic environment. He highlighted that cryptocurrencies on the whole progress as they encounter more use cases. He said,

“Crypto gets further by increasing store of value, increased medium of exchange, increased unit of account. Having tangible ways to use this across a broad range of different use cases just helps the whole ecosystem overall.”

Regarding crypto’s use cases, McCauley pointed out that given the present scenario, along with inflation, assets that are immune to such risks will become increasingly popular. He added,

“People need ways to keep up with inflation and it’s hard to do that outside of any kind of financial institution. So anything that makes it easier to serve those kind of goals is a net win there. In terms of Bitcoin versus USD or a fiat currency backed stable coins, I think it’s a very interesting question.”

He also claimed that in comparison to other asset classes, Bitcoin surviving the recent market crash further emboldened its ‘anti-fragile’ narrative. McCauley asserted that in the present scenario, there are a lot of people who are “crypto-curious,” but are limiting their choices to “traditional investment opportunities,” adding that in the coming years, it will increasingly be seen as an investment thesis.

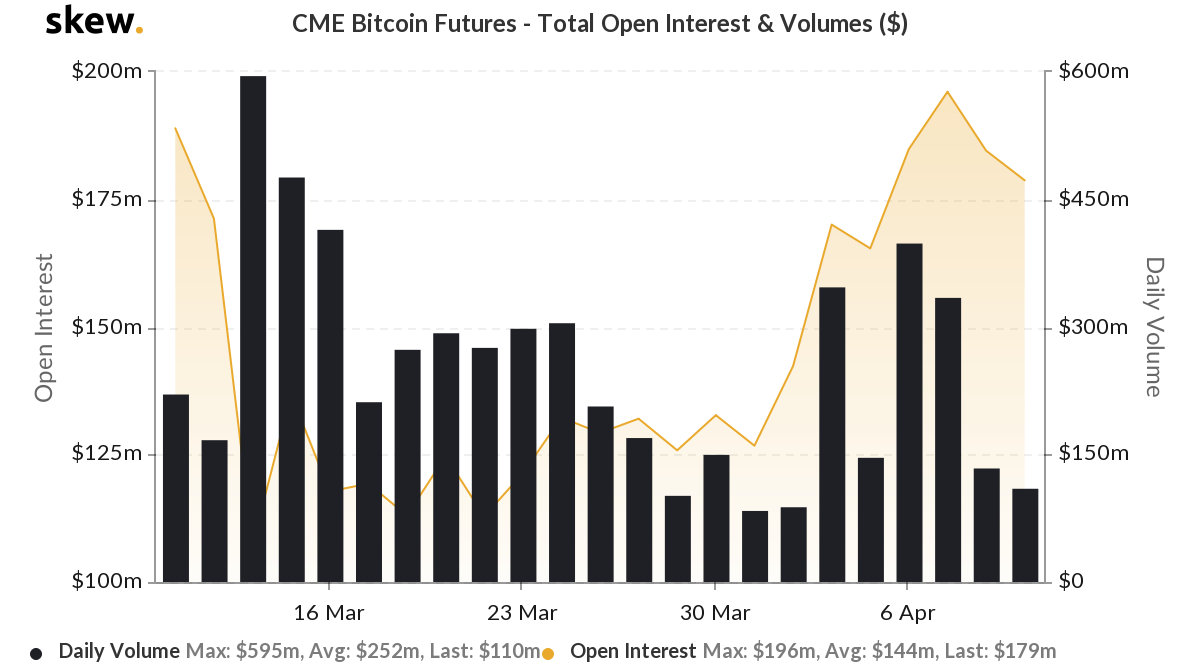

Source: skew

Further, over the past few days, according to market data from Skew markets, Bitcoin has witnessed a spike in terms of its daily volume and Open Interest on the Chicago Mercantile Exchange [CME]. Since the start of the month, the OI increased from $126 million to over $196 million, something that may imply that institutional investors have not written off Bitcoin entirely.

With regard to institutional investment in crypto, McCauley also pointed out how custody of digital assets like cryptocurrencies continues to be a challenge and a worry when it comes to adoption. He added,

“A core problem in crypto that needed to be solved for institutional investors, which is the safe storage of their keys. There’s this problem called custody which really is about holding the keys and allowing institutional investors to do everything they would want.”