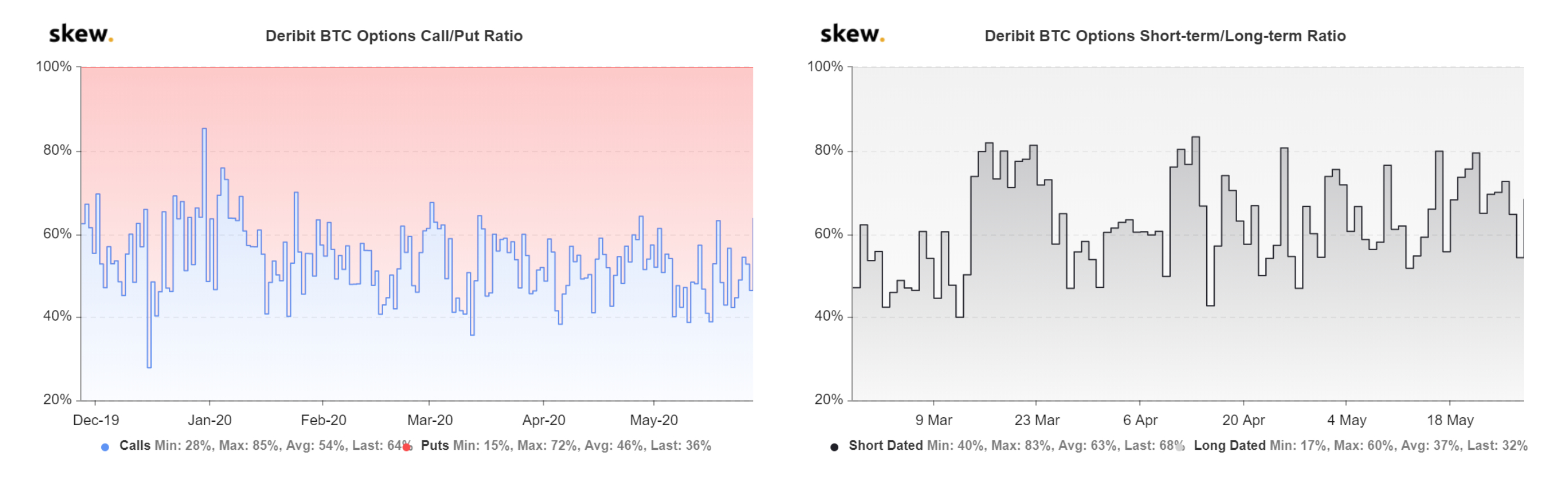

Short-dated Bitcoin options and call surge

As Bitcoin fails to breach $9,216 level for the 7th consecutive day, the chances of a drop in price seem more likely. However, the Bitcoin options markets indicate otherwise with the simultaneous surge of short-dated Bitcoin options and calls.

Bitcoin Option

Source: Skew

There is a stark increase in the short-term Bitcoin options [seen on the right]. To be precise, the short-dated options, as of today, have increased to 69% from 54% [as of yesterday]. This indicates that investors speculating on short-term price movements are more. Combining this information with the call/put ratio, the direction of these can be determined. As of May 28, the calls have increased to 61% while puts only stand at 39.

In addition to this, the OI will decline as ~33,00 BTC options [worth $302 million] are supposed to expire tomorrow. Even though options, futures, and other Bitcoin products have an influence on the price, the options investors who are betting on price surging might be disappointed when the price drops.

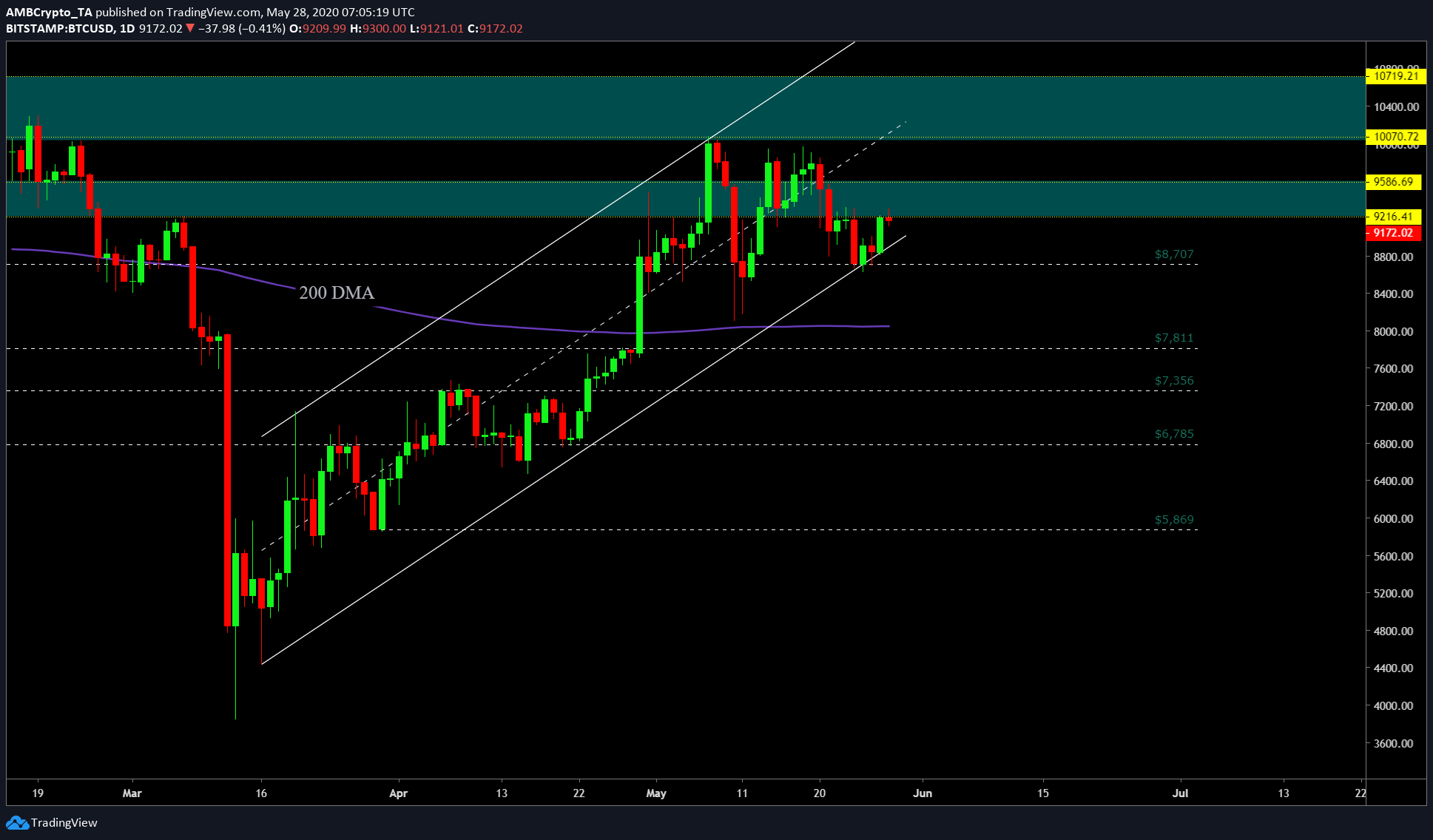

Spot Price

BTCUSD TradingView

The spot price of Bitcoin showed the formation of an upward sloping parallel channel, which indicates a bearish breakout. As mentioned in a few other articles, this channel has been forming since the March 12 drop and hence, the breakout will be something to keep an eye out for. Technically, the breakout from this pattern should take the price down to sub-$8,000 levels, but since there is a 200-DMA [purple] before this target, the breakout might end there.

At press time, the 200-DMA is at $8,040, the point where the price bounced off during the May 10, drop. So, the chances of price testing the 200-DMA are more, hence, the price will not follow the short-term speculators who are expecting the price to surge higher. A possibility of price dipping below the 200-DMA can also be entertained considering the size and duration of the pattern formed.

It should also be noted that the only time when the price has not followed the breakout is in times of excessive pressure, like during a bull run or sudden market crashes like the Black Thursday.