Ripple’s ODL in Australia records new ATH

An increasing number of firms have now started to leverage Ripple and its remittance platform ODL, which essentially facilitates cross-border transactions utilizing XRP. Over the last couple of months, Ripple’s Australian corridor has become increasingly popular and XRP liquidity via the corridor, BTC Markets has reached a fresh all-time high.

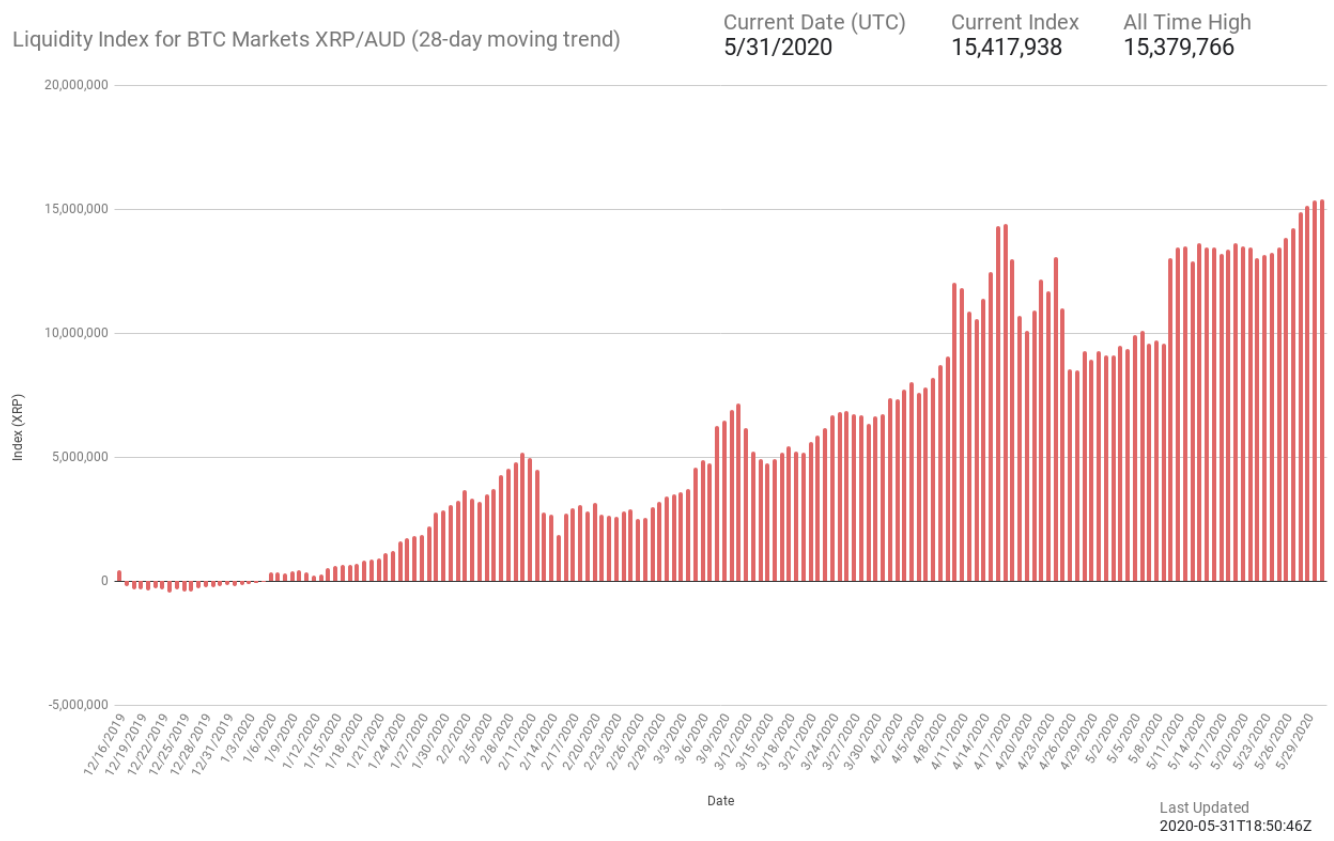

According to the Liquidity Index Bot, the Twitter bot which tracks the liquidity index of XRP on various corridors, revealed today that the liquidity index for BTC Markets for the pair XRP/AUD soared all the way to 15.417 million on 29th May as its the progress for the day stood at 79%.

Source: Twitter | Liquidity Index Bot

Since the beginning of the year, the XRP/AUD index noted a tremendous surge. Its previous high stood at 15.379 million. The figures have been on a rise despite XRP’s flat price action. The XRP liquidity on Australia’s BTC market gained significant traction in the first week of January 2020.

However, in the last week of April leading up to the first week of May, the figures slumped coinciding with XRP’s bearish price movement. As the cryptocurrency market went into recovery mode, the figure for XRP/AUD improved and since then has maintained a steady rise despite a minor pullback.

Recently, the CEO of Australia-based BTCMarkets Caroline Bowler had revealed that the exchange observed 5 percent growth week-over-week and that it has been averaging 84 percent growth and a 15 percent rise in volume since January.

“..what we’re seeing with ODL, just to give you this as context, I think we’re averaging about a 5% week-over-week growth since January in terms of volume coming through our exchange on XRP.”

There is a rise in enterprise adoption of the blockchain firm Ripple and the cryptocurrency XRP in Australia for the purpose of cross-border payments in Australia. Ripple partnered with the exchange in late 2019 and according to its CEO Bowler, the growing volume had a “positive” impact on XRP’s price. She also went on to add that,

“Most people recognize the problems with cross-border payments especially in Australia where businesses often need to pay suppliers based outside the country. Using XRP to cut transaction fees and make same-day payments brings real benefits and fixes the problems of the existing system. XRP is a bridge between traditional financial institutions and the new world of fintech.”

Interestingly, it is not just the Australian corridor that has witnessed a rise in liquidity. Even the Mexico corridor with XRP/MXN on Bitso also witnessed a surge to 37.15 million on the 27th of May.

In addition to these developments, Ripple also released one billion XRP for sale to investors from the company’s escrow account.