Litecoin’s correction to $73 may not be all bad news

The digital asset market’s collective bullish rally has continued over the past week, with Litecoin being one of the market’s top benefactors. At press time, the crypto-asset had managed to trump EOS to the 6th position on CoinMarketCap, with a market cap of $5.24 billion. Litecoin also registered a spike of 2.13 percent over the past 24 hours.

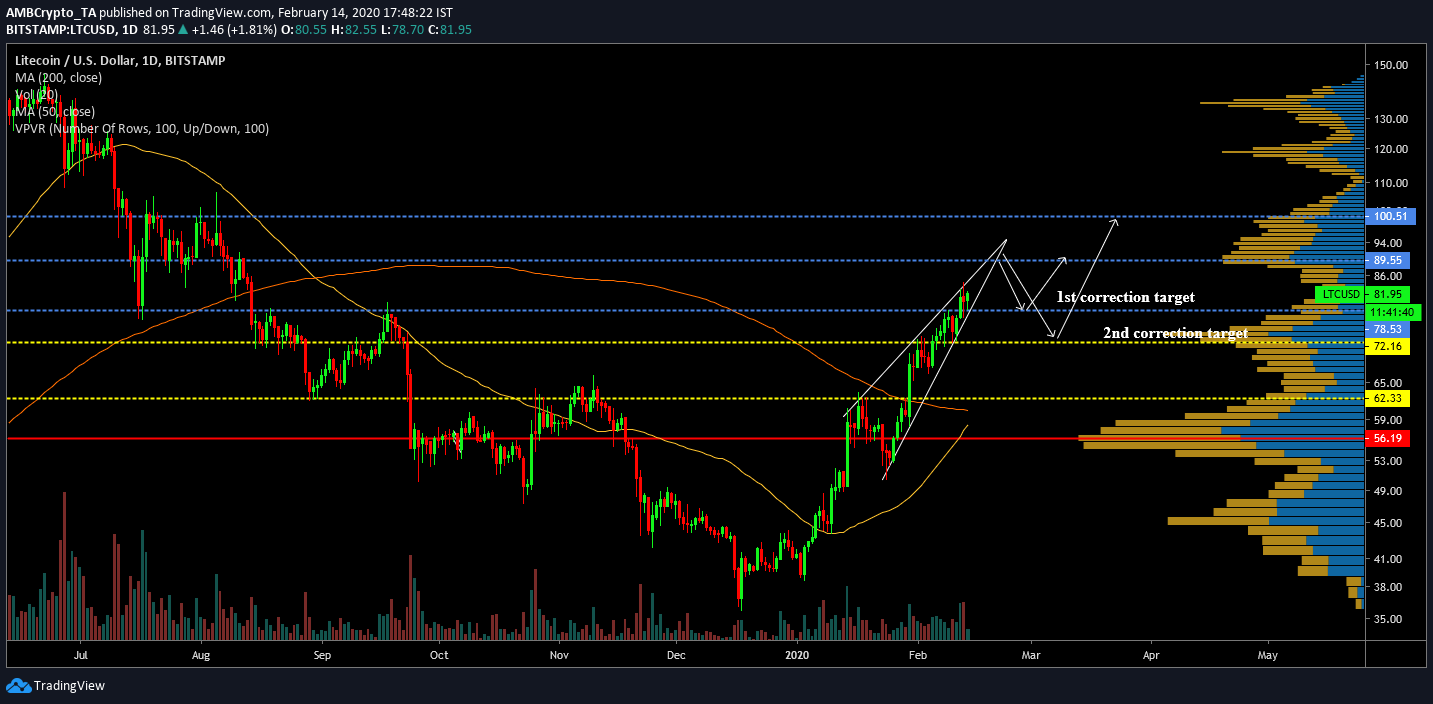

1-day chart

Source: LTC/USD on Trading View

The 1-day chart for Litecoin has been extremely bullish since the start of 2020 as the crypto-asset breached a major resistance at $62.33 and $72.16 within the first 40 days of the year. At press time, the price movement of Litecoin had given rise to the formation of a rising wedge. Here, it is important to note that over the past week, Litecoin did not register major corrections, a fact that may increase the possibility of a pullback over the next week. The formation of the above pattern inclines towards the same sentiment and a correction seems due for the LTC shortly.

On 12 February, Litecoin managed to surge past another resistance at $78.53, targeting the next resistance at $89.55. The chart highlighted that corrections may take either of the two paths in the market. A minor correction down to $78.52 is the 1st target zone for a retrace and bounce-back, after which the token should continue surging towards the resistance at $89.55. However, a pullback down to $72.16 held a higher probability. In hindsight, a correction down to $72.89 may trigger a substantial surge above $100 by mid-March.

According to the VPVR indicator, the trading volume has been significantly higher in the $72 range over the past month, forming a strong band of support at that position. Selling pressure could be countered with buying pressure at this range for a definite period.

The trading volume has also been decreasing on the charts, awaiting a reversal over the next week.

Source: Coinmetrics

However, Bitcoin’s movement on the chart may have a significant part to play in Litecoin’s future. The correlation index between Bitcoin and Litecoin was 0.807, at press time, a figure which was last observed in May 2019. Over that period, the industry was experiencing a bullish rally as well, with Litecoin surging over $100 by 15 May.

Conclusion

A minor correction down to $78 or a major slump to $72 should surface for Litecoin in the next two weeks. However, the apparent bullish momentum and Bitcoin’s movement may alter the future trend for the 6th largest crypto-asset.