Litecoin’s breach below $50 surrenders early positive sentiment

After briefly indicating a break away from February’s bearish period, March sprung a surprise after the collective cryptocurrency market suffered one of the worst depreciation periods of 2020.

At press time, Litecoin was priced at under $50, with its market cap just above $3 billion. Over the past day, its valuation has slumped by 4.74 percent, but the token did register a decent 24-hour trading volume of $3.78 billion.

1-day chart

Source: LTC/USD on Trading View

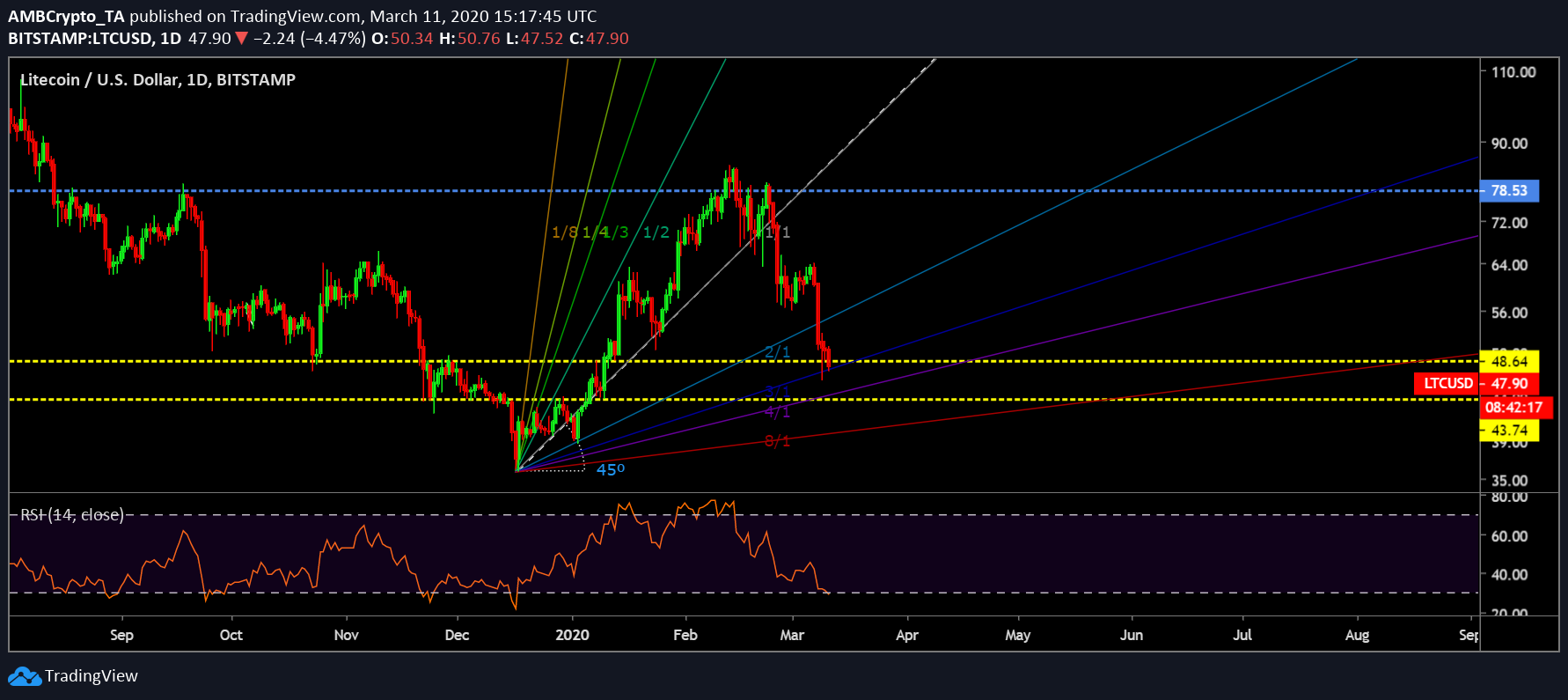

Since 7 March, Litecoin has registered a decline of 25.65 percent, with the price quickly depreciating from $63.98, all the way down below $50. On observing the above chart, it can be identified that the recent bearish breakout took place after the formation of an inverted head-and-shoulder pattern. Registering a high at $85 and a local shoulder top at $64, the price breached under the neckline, paving the way for a significant pullback.

The trend has drastically shifted over the past few days as the price stumbled under key support levels at $63.68 and the Point-of-Control at $58.39, The price, at press time, was hovering just above $48.40 support, with a move below $43.74 signaling dire bearish consequences.

An important reversal in trend has also been observed in terms of the 200-Moving Average as the indicator turned into an active resistance, at press time. Trading Volume at the present price point is also weak, underlining the possibility of further decline, according to the VPVR indicator.

Although a recovery should surface on the charts after such a quick slump, it is unlikely Litecoin would be able to climb above $60 over the next couple of weeks.

Gann Fan-RSI turn bearish

Source: LTC/USD on Trading View

The long-term indicators do not present a scenario for a bullish rally, with LTC’s price meditating under the 2:1 ratio line in the Gann fan indicator. Any consolidation under the 1:1 ratio is considered bearish and hence, a presence under the 2:1 line may suggest that Litecoin’s bullish rally in the near-term is unlikely.

The RSI indicator suggested increasing selling pressure, with a host of investors now exiting the market.

Conclusion

Litecoin’s 2020 started on a bright note but since Mid-February, things have appeared gloomy for Bitcoin’s silver counterpart.