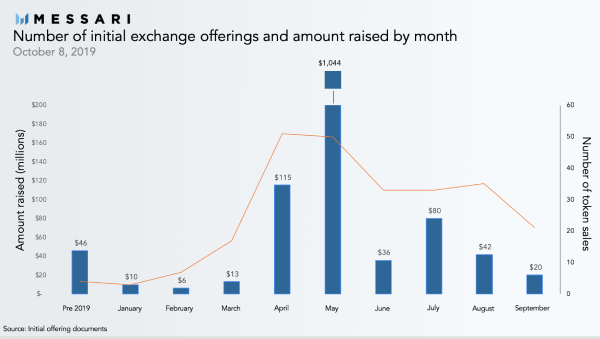

IEOs took off, exhibited positive dynamics during 2019 bull run

IEOs have been a trend in 2019 and so far, they have been viewed as a lucrative investment opportunity by many in the cryptospace. IEOs peaked in Spring this year, around the same time when the bulls made an official exit from the relentless crypto-winter. The latest Messari research report highlighted the same. The report, after analyzing over 250 IEO offering docs across 20 exchanges, concluded that only a few exchanges conducted token sales before 2019. However, it wasn’t until this year that IEOs actually gained traction.

Source: Messari

The data showed that in May alone, nearly 60 token sales raised $1,044 million. Many exchanges since have followed Binance’s suit, and most followed a similar pattern according to the research, “spiking upon listing and then falling back to earth.” Investors putting their money into Binance’s IEOs saw better returns than others, the research observed.

According to a market analysis compiled by DataLight, IEOs in 2019 have shown an overall positive dynamic, with ZB.com seeing an average return of 368%, while on OKEx, the average return per project was 192%.

Messari’s Jack Purdy stated,

“ICOs were marked by the “shitcoin waterfall” – where large discounts were given to early investors and then dumped on retail. IEOs have actually reversed this trend with many sales priced below the private round price. In conclusion, IEOs are the next logical step in token sales where third parties perform some of the work traditionally done by investment banks to underwrite, price and syndicate these offerings…”

Initial coin offerings [ICOs] during 2017 saw the price of most of these tokens surge massively. The price of the same tokens fell sharply in 2018. While a few projects were subsequently abandoned, many of those which were still operating never recovered from the crash. In the case of ICOs, anyone with a whitepaper could raise money from investors without the latter knowing the technology behind it. With no third-party entities to monitor these ICOs, scammers leveraged this opportunity and did not deliver what was promised to investors.

IEOs, on the other hand, are exchange-based. Hence, the entire mechanism is monitored by the exchange itself. With a lower risk factor, this new approach to crypto-banking is catching the interest of ICOs and traders across the world.