How Binance’s Q3 troubles impacted BNB Chain

- The activity of Binance in Q3 was marred with a number of problems

- This negatively impacted the performance of BNB Chain during that quarter

The headwinds faced by leading cryptocurrency exchange Binance [BNB] during the third quarter of the year negatively impacted the performance of Layer 1 (L1) blockchain BNB Chain, Messari found in a new report.

Read Binance Coin’s [BNB] Price Prediction 2023-24

During the quarter, Binance faced several challenges, including lost partnerships, business closures, layoffs, and executive resignations.

All of these, compounded by the allegations levied against the exchange by the Securities and Exchange Commission (SEC) in Q2, resulted in a 25% decline in the BNB’s value.

In June, the regulator filed a lawsuit against Binance, claiming that it had violated securities laws by offering and selling unregistered securities to its users.

Highlighting the extent of the decline in the coin’s value, Messari noted –

“By contrast, the entire market value only dropped by 9% QoQ. And some Layer-1s, notably Solana and XRP Ledger, grew by 17% and 12%, respectively.”

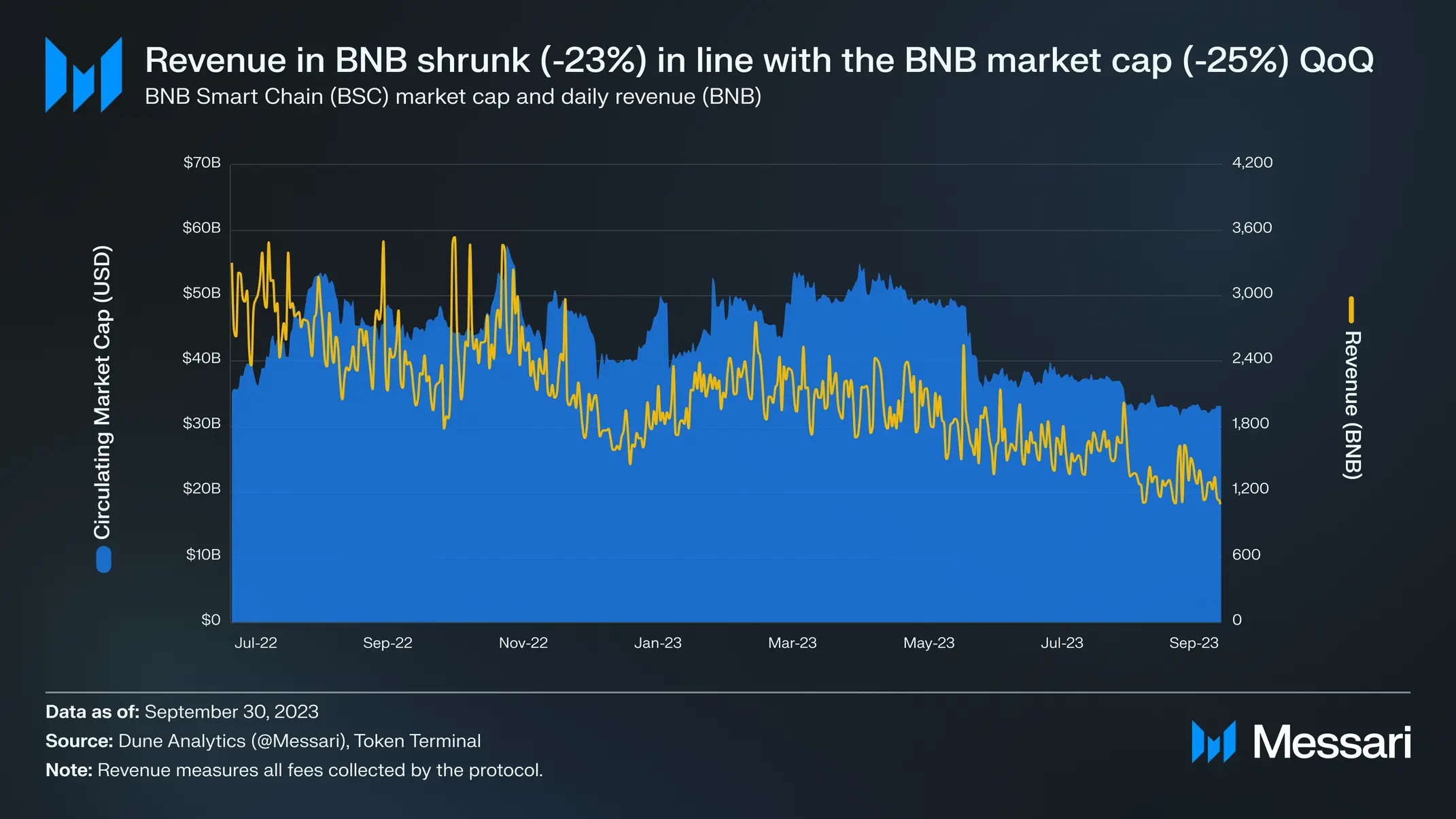

Due to the decline in the coin’s price and its market capitalization, the network’s revenue denominated in BNB fell. During the quarter, the protocol’s revenue measured in BNB totaled 135,000 BNB, dropping by 23% from the 176,000 BNB recorded in Q2.

The correlation between Binance and BNB Chain

While Binance has stated several times that it does not own the BNB Chain, the troubles faced by the exchange led to a drop in demand for the L1 network. During the quarter, BNB Chain experienced a decline in network activity.

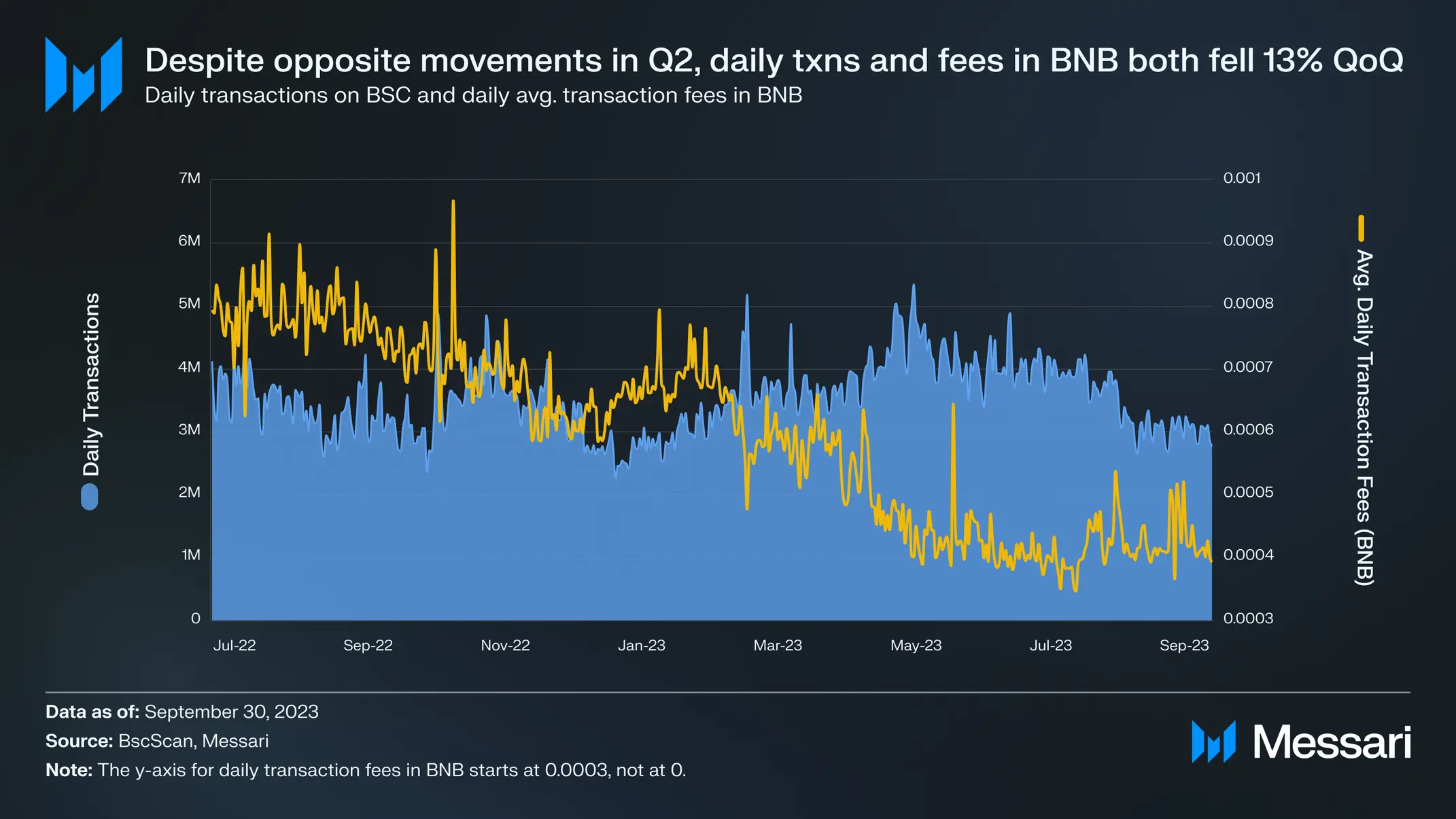

According to Messari, the average count of daily transactions completed on the network was 3.5 million, decreasing by 14% quarter-over-quarter (QoQ). This resulted from a corresponding decline in the average number of daily active addresses on BNB Chain within the same period.

As the transaction count fell, fees charged per transaction plummeted. During the quarter, this dipped by almost 15%.

Messari opined,

“The drop suggests that users in Q3 were performing less complex tasks on BSC, potentially affecting the QoQ fall in fee price and revenue.”

Regarding BNB Chain’s decentralized finance (DeFi) vertical, it witnessed a 23% decline in total value locked (TVL). This was primarily due to the general decline suffered by the DeFi market during the quarter.

Is your portfolio green? Check out the BNB Profit Calculator

According to data from DefiLlama, the TVL across all protocols dropped by 15% between July and September.

Providing a glimmer of relief, the chain’s NFTs ecosystem saw some growth. According to Messari:

“The NFT space on BSC performed the strongest among other sectors. Secondary sales volume in BNB increased by 15%, and unique buyers and sellers also grew by 20% and 12%, respectively.”