How decisive are traders with Bitcoin above $15,000?

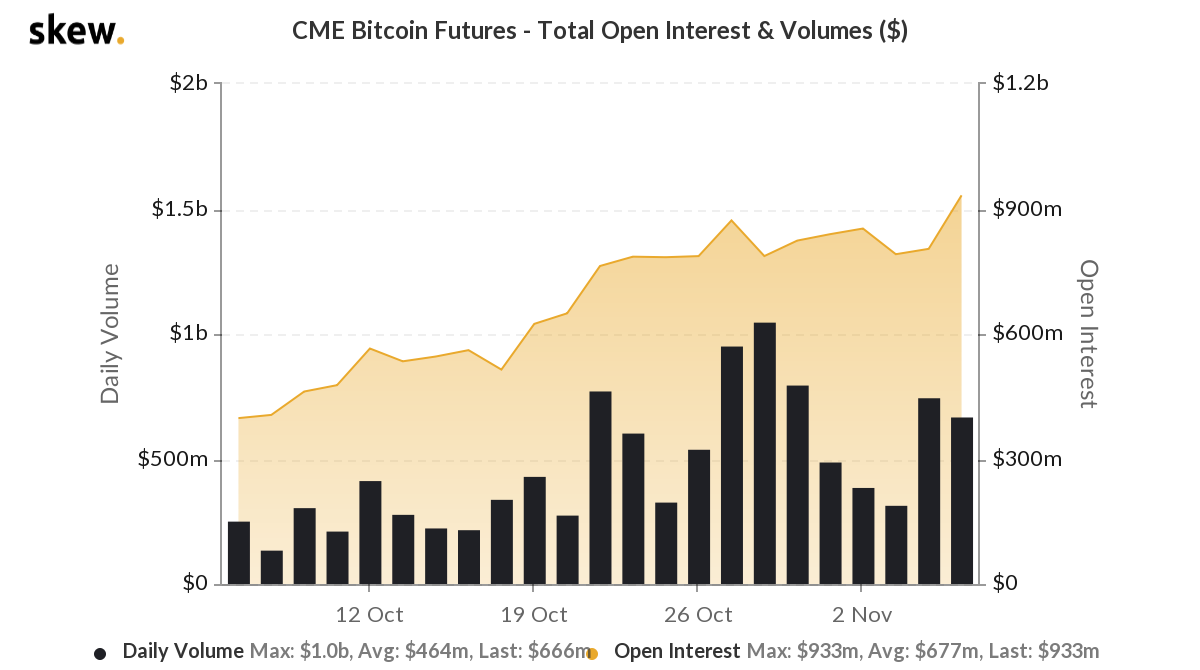

As Bitcoin hit 2020’s ATH at nearly $15800, open interest on top derivatives exchanges like CME and Bakkt went up. On CME, where top institutions trade, the open interest increased by 16% to $933 Million.

CME futures open interest and volume || Source: Skew

Based on data from Skew, open interest has climbed up, however, trade volume did not increase proportionately. It averaged at nearly $666 Million. Trade volume had hit $1 Billion on CME in the last week of October. Smart money is interested, however, it seems to be indecisive.

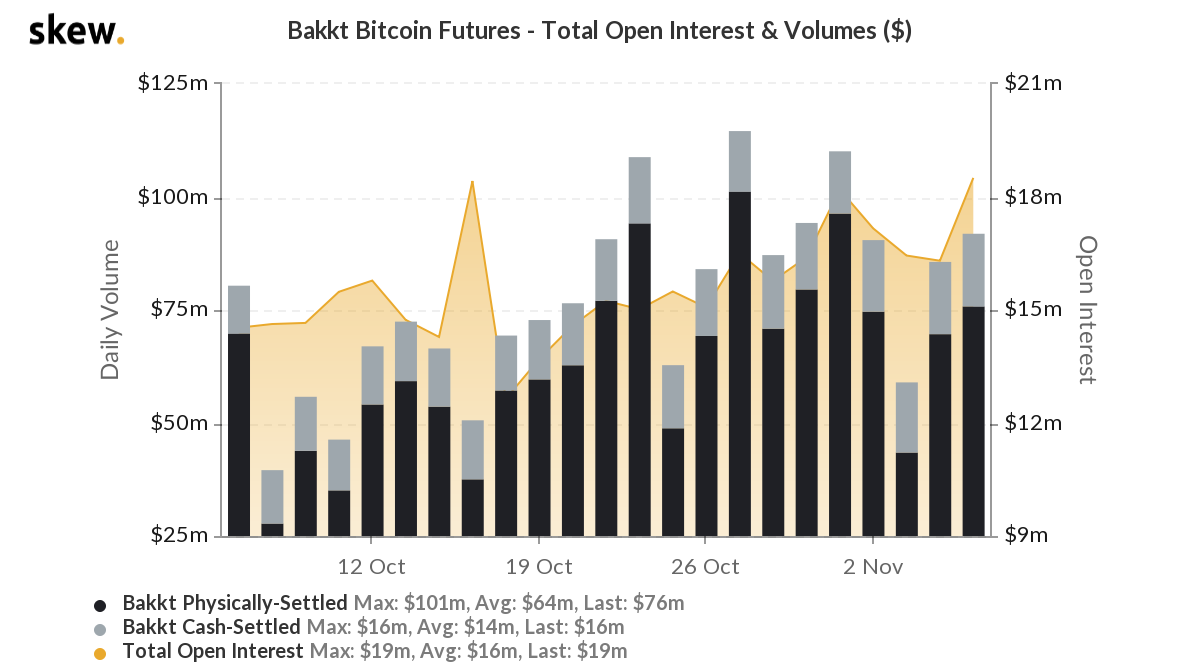

On Bakkt, as Bitcoin’s price went up, the volume of physically settled Bitcoin Futures exceeded cash-settled. The reason may be that margin on cash-settled futures relies heavily on price, volatility, and volume on hand-picked spot exchanges. The current price rally to $15800 may or may not be sustained, likewise the volatility on both spot and derivatives exchanges continues to remain high.

Bakkt Bitcoin Futures || Source: Skew

Based on data from Skew, open interest is up and trade volume crossed $76 Million but the level is still not as high as mid-October. The cumulative trade volume on derivatives exchanges remained above the monthly average, however, it did not hit new or previous ATH.

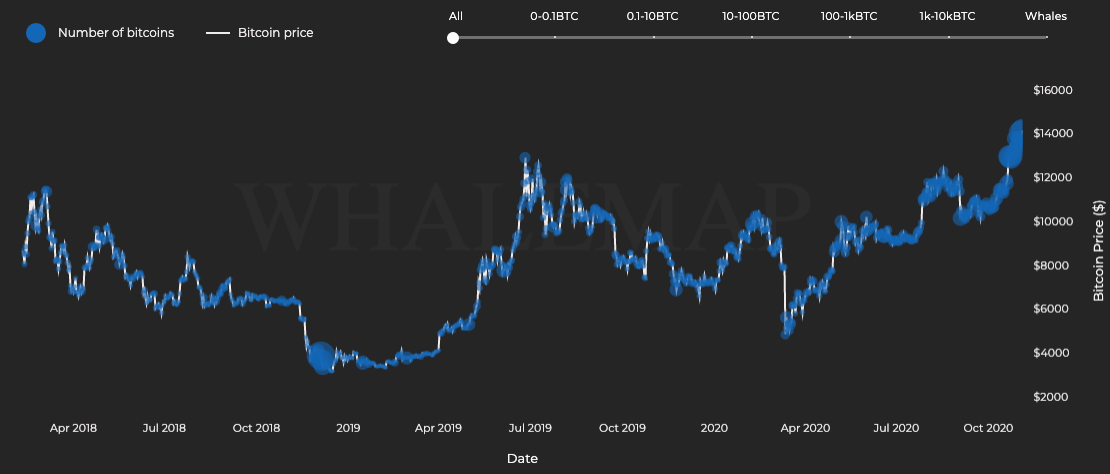

Other metrics like the map of unspent Bitcoin show that there’s accumulation even at the current price level. Accumulation started above $10000 and it still persists. Institutions like MicroStrategy and Square entered when the price was near $10000. Accumulating at $15000 would mean, nearly twice the fair value and a huge premium on every Bitcoin purchased or accumulated by them. It may therefore be derived that, a correction is bound to occur, to drop the price to $10000, for further accumulation by smart money.

Map of unspent Bitcoins || Source: Whalemaps

As smart money remains indecisive, retail traders continue trading on derivatives exchanges. However, making big trade moves is not ideally recommended as more Bitcoin is leaving exchanges and hitting private wallets. Miners who HODLed for the past two months, maybe ready to sell finally and this could possibly increase the sell-side pressure on spot exchanges.

Before buying/ selling at the current price level, retail traders can check the spread and depth of order book on spot exchanges. On derivatives exchanges, currently Buy liquidations are 3 times that of sell liquidations in the past 24 hours. This gives further evidence of the indecisiveness and the odds stacked up in long and short positions at the current price level, as volatility continues to remain high.