Here’s why Ethereum’s trading at a 500% premium on Grayscale

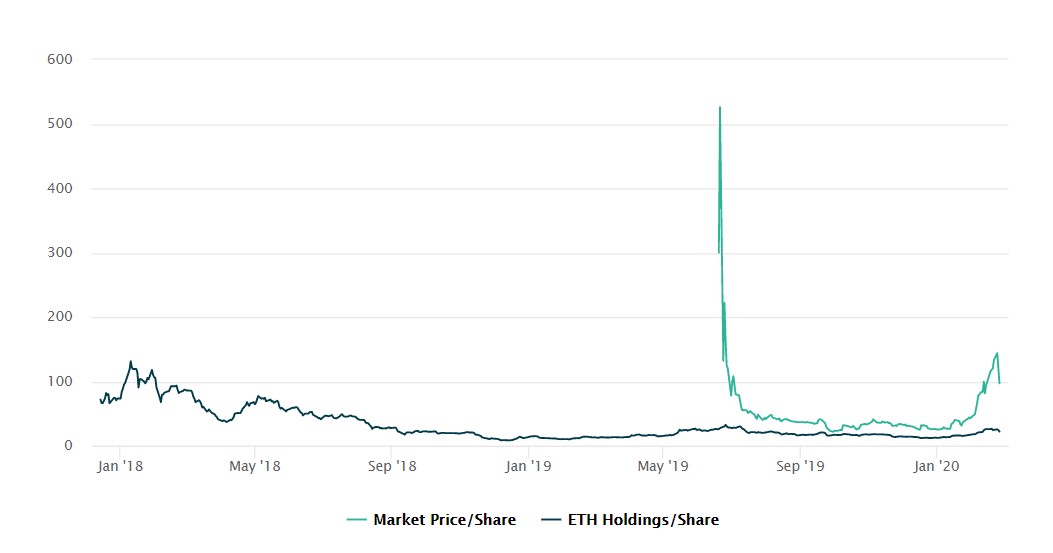

Grayscale’s Ethereum Trust [ETHE] hit a premium of 465% a few days after the spot prices rallied to a local top. ETH’s spot price hit a new yearly high ($289) on 15 February 2020. 10 days later, Grayscale Ethereum trust’s market price per share surged to $143.75, possibly due to demand from institutional investors.

A premium of 465% puts 1 ETH valued at a whopping $1,518, with an existing ETH per share of 0.09464578. This unusually high premium, especially considering yesterday’s collapse, leads to a belief that institutional investors are taking a huge leap into digital currencies.

Source: Grayscale

Grayscale has long been leading the digital currency investment race for institutions. Like most institutional investing platforms, Grayscale offers a wide range of investment vehicles that allow investors to reap the benefits of digital currencies, without actually holding them.

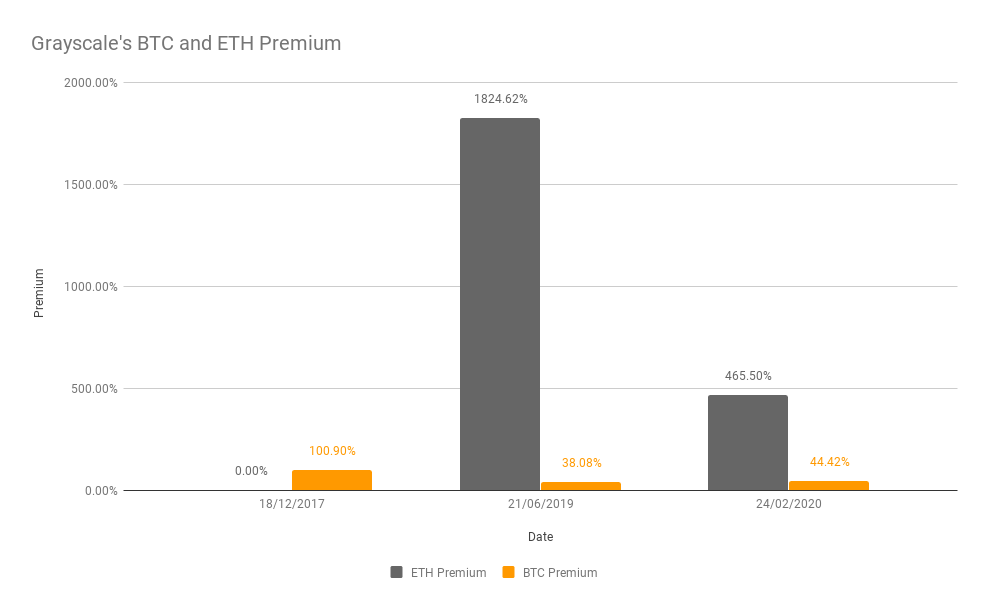

Source: Grayscale

Why Premium?

The reason why this surge is not normal can only be understood when compared to Grayscale’s Bitcoin Trust [GBTC] and its premium. Although Bitcoin is the most sought-after investment asset for both retail and institutions, GBTC did not see a massive premium surge.

In contrast, Ethereum’s surge was more of an isolated incident. Institutions’ affinity to Ethereum was clear when Grayscale first added Ethereum to its investment vehicle in mid-2019. Soon, the market price per share of ETHE surged to $526, making 1 ETH worth $5,557, i.e., the institutional investors were willing to pay $5,557 for 1 ETH, something that invariably shows the demand for the smart contracts platform, Ethereum.

The total assets under management for ETHE is $171.4 million and 7.78 million outstanding shares as of 27 February 2020. This shies in comparison to GBTC, which is worth $2.6 billion and has 304 million outstanding shares.

A similar case was observed for ETHE since its inception.

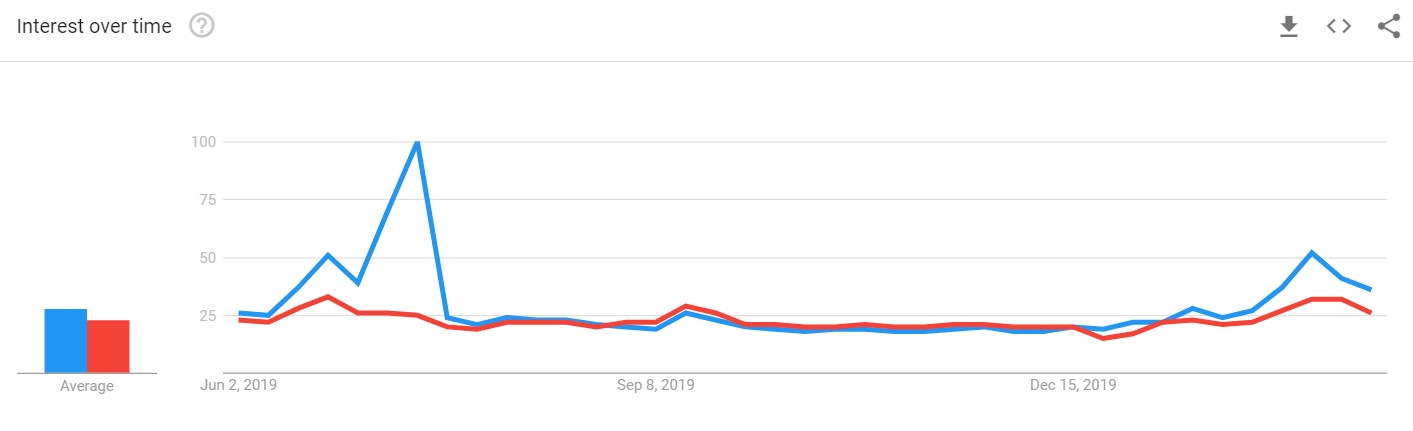

Source: Google Trends

Further, Google trends for Ethereum also confirm a rise in interest since February 2020.

Perhaps, the reason for the surge in institutional interest is due to the nature of Grayscale’s investment vehicles. Grayscale’s products allow investors to reap the benefits of the underlying assets, without the hassle of holding them and the risks associated with them.