Bitcoin: 4 reasons why we are in the early bull-run stage

How do we know we are in a bull run? Early 2017 did not show signs of what could occur by the end of 2017. However, bitcoin and the crypto ecosystem seems to be already in the bull run.

Bitcoin has, briefly, breached the $12,000 level, however, failed to sustain it. Regardless, the bullish feeling still remains for the whole of crypto. New projects are being launched and tokens are hitting new highs as well.

Unlike 2017, this time around there’s projects defi siphoning millions in the name of yield farming. Either way, millions are being poured into unaudited projects that promise yields of 1000% APY.

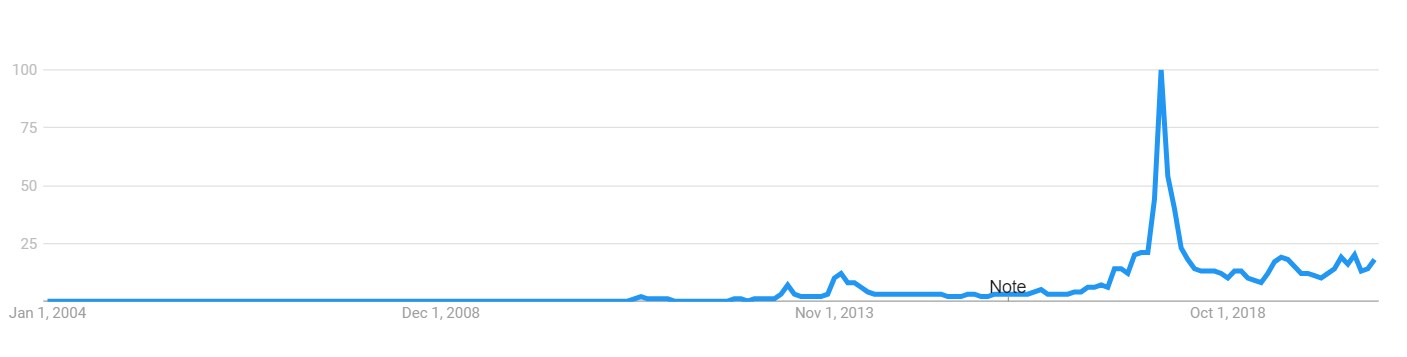

Google Trends

Source: Google

Google trends show ‘bitcoin’ keyword interest at a level higher than early 2017 and even late 2017. In fact, this level was seen twice since 2018 due to momentary bull runs during Jun 2018, June 2019, and February 2020. However, with the way things are looking, this level will be breached.

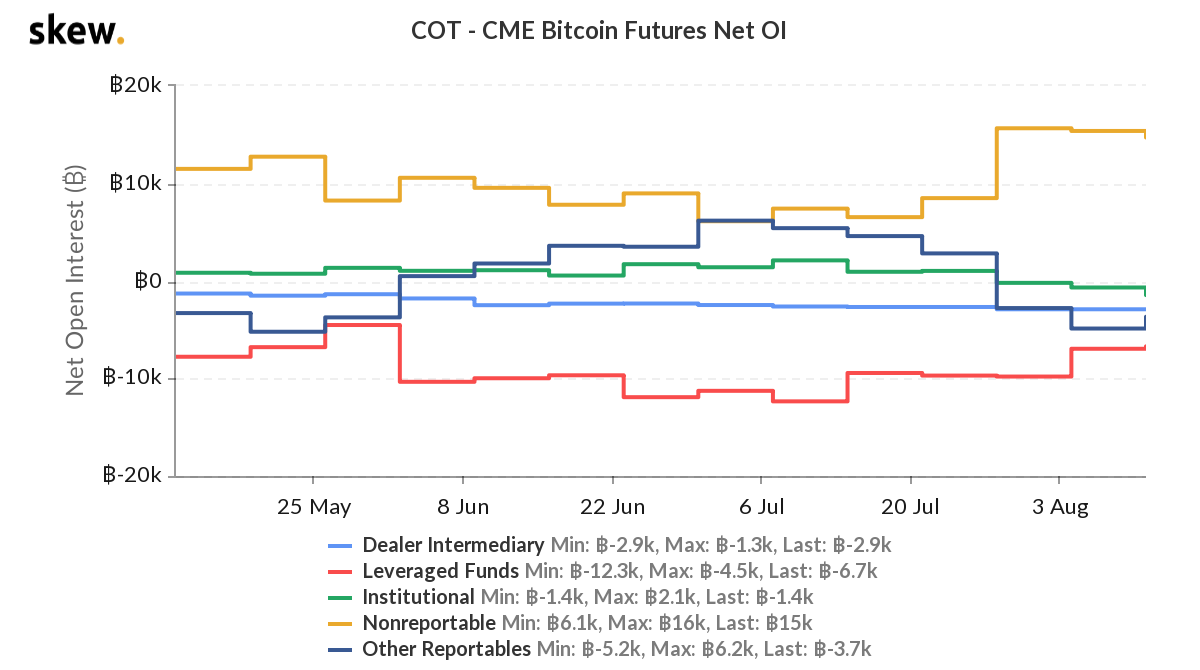

CME & CoT Report

Source: Skew

CoT report showed that the retail [yellow] is the most bullish with a long position worth 15K BTC. An interesting development is a decline in leveraged funds’ position aka hedge funds. The current short position by leveraged funds is at 6.7K BTC only.

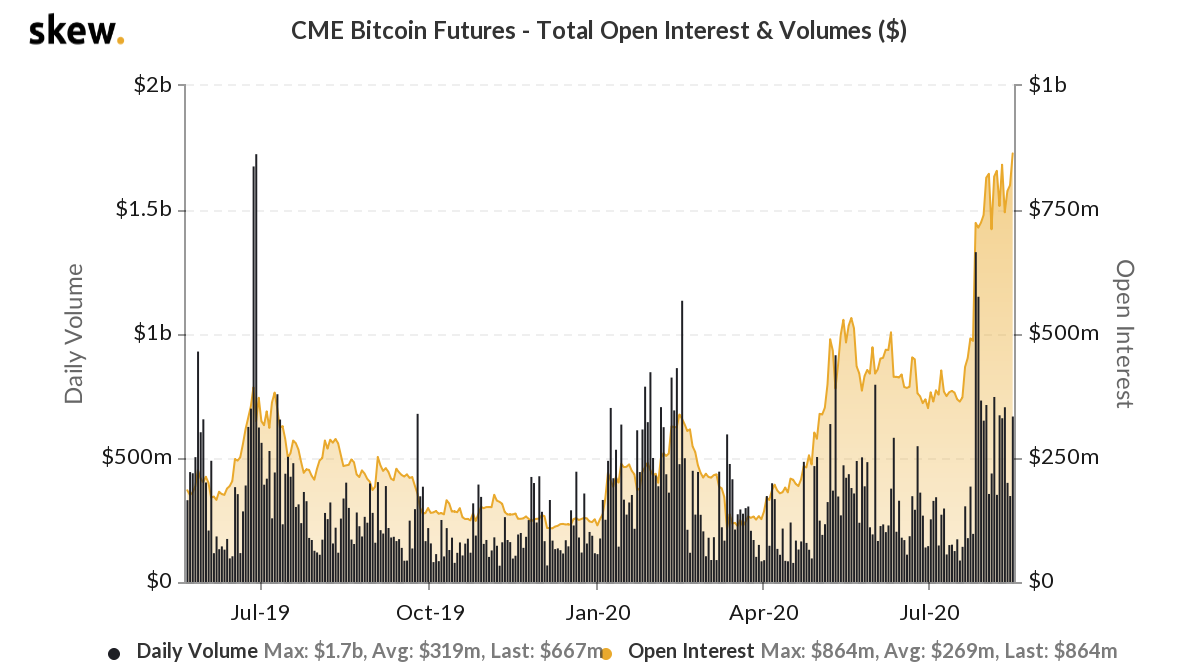

Source: Skew

This is proof that retail investors’ extreme bullishness. Adding to this is OI on CME for bitcoin futures, which has hit a new high at $864 million. This indicates that bitcoin is being actively speculated on.

Macro outlook

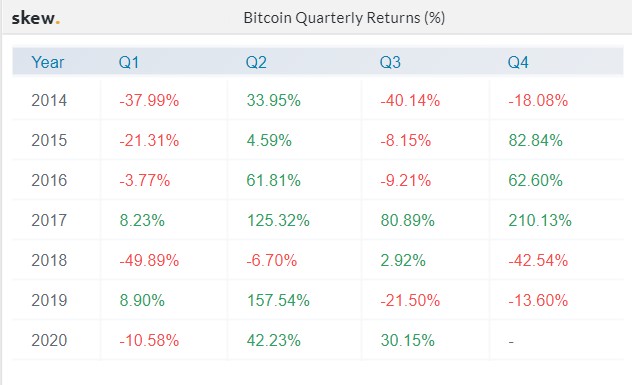

Source: Skew

Macro outlook shows that bitcoin has had two successful quarters with an average surge of 36%. Moreover, two consecutive quarters were last seen in 2017 and was followed up with the most explosive close of 210.13% surge in the last quarter.

DeFi

Defi is a huge tool in bringing back volatility to the cryptocurrency ecosystem, especially with the yield farming hype train. Perhaps, the first successful beginnings of yield farming can be attributed to Compound’s COMP token. Since then, there have been plenty yield farming projects and tokens, but the most hyped one is YAM without a doubt.

Yam project saw $350+ million worth of assets staked in the 24-30 hours of its launch, however, the project failed as the creator admitted. Yam token crashed violently and lost 90% of its value.

Although defi has been an extremely high-yielding sector, it is still in the experimental phase, and it’s better to stick with audited platforms.

Parallels can be drawn between defi and ICO. In 2017 bull run ICOs played a huge role in creating the frenzy and hype that allowed a downpour of capital, similarly, defi is also facilitating a huge influx of capital.

If that was not enough, the most recent development is the development of a meme coin [MEME] by the community that accrued a total value of $1.2 million.