Is DeFi eating Wall Street?

Will DeFi with its inverse BTC correlation eat Wall Street? In his latest tweet, Tyler Winklevoss of Gemini Exchange mentioned that “DeFi is the software that is starting to eat Wall Street”. Since DeFi’s market capitalization is still one-third of XRP’s market capitalization there may be room for growth. As Tyler argues, DeFi may eat Wall Street, though not just yet. DeFi’s top project YFI’s market capitalization is still one-third of EOS’s market capitalization. Based on data from coinmarketcap.com, EOS ranks in the top 15 cryptocurrencies based on market capitalization.

Source: Twitter

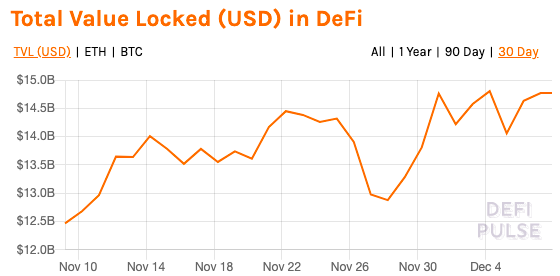

In the past 24 hours, DeFi’s market capitalization has increased by 0.7%, and trading volume has increased by 27.7%. The trading volume in the past 24 hours increased by 11.9%. These statistics indicate the daily growth of DeFi. Against 7 day growth, in the past 30 days alone, DeFi has grown from $12.46 Billion to $14.77 Billion.

TVL in DeFi || Source: DeFiPulse

Based on the weekly and monthly returns, DeFi’s statistics have shown more growth potential compared to BTC or ETH. In the past four weeks as Bitcoin hit new ATH and struggled to make it past $20000, several DeFi projects have offered double-digit returns, making their way to trader’s portfolios. Top Institutions like GrayScale have started adding altcoins to their portfolio, and despite the fear that institutions may directly move on from Bitcoin to top altcoins, the returns chart offers a different perspective on the argument that there may be further institutional buying in DeFi.

Source: Twitter

While top cryptocurrencies like Bitcoin are facing challenges like a limited supply of 21 Million, network congestion, or a lack of scalability DeFi projects like $AKRO and $ADEL which were initially undervalued are now merged with $YFI. This means new vaults, new institutional apps, and strategies.

Though DeFi has an inverse correlation with Bitcoin, returns on DeFi haven’t dropped against Bitcoin’s price. As Bitcoin continues to trade at the $19000 level, waiting to cross $20000 just yet, it is under increased selling pressure on spot exchanges. Bitcoin’s price rally is a polarizing one, and DeFi may have room for vertical growth. The inverse correlation may have a positive impact on DeFi’s price rally. Additionally, ETH 2.0’s launch and increased activity may have paved the path for DeFi projects to scale further.