For Cardano, is a retracement to $0.051 inevitable?

Since the fag end of April, the world’s eleventh largest cryptocurrency, Cardano, has enjoyed a tremendous run, price-wise. In fact, it would seem that the losses incurred on Black Thursday are now a distant nightmare for Cardano after its positive price action continued to do well over the month of May. Despite a fall that amounted to over 20 percent loss in price in the early hours of 10 May, Cardano’s price has since bounced back.

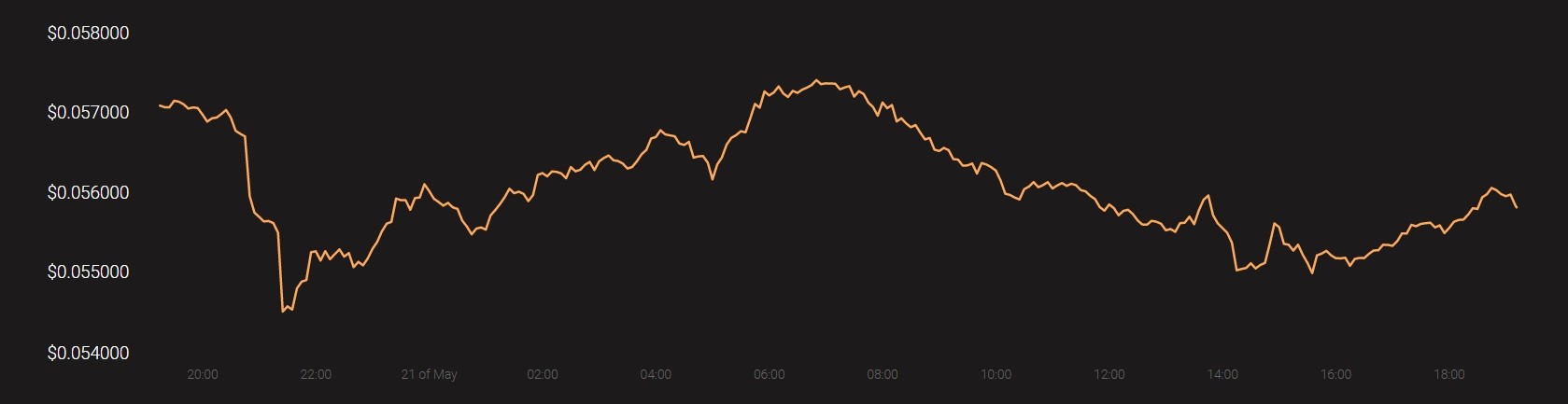

Source: Coinstats

At the time of writing, Cardano was trading at $0.55, while registering a market capitalization of $1.4 billion. Over the past 24-hours, Cardano also noted a trading volume of $216 million.

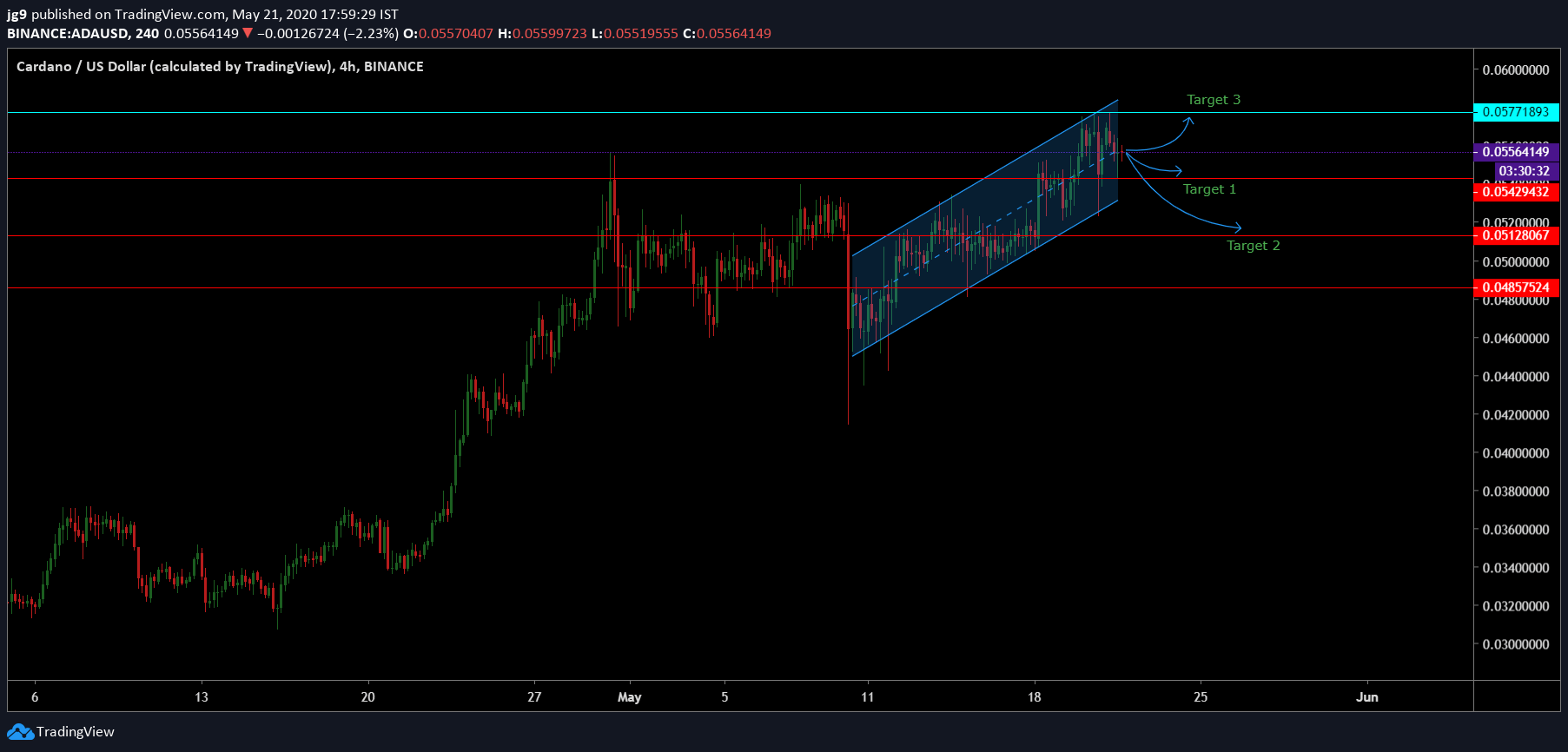

4-hour chart

Source: ADA/USD, TradingView

As per the 4-hour chart, Cardano’s price has been in an ascending channel for over a week. In such a scenario, the price of Cardano is likely to see a drop, as is the expected breakout for the price after such a price formation.

At press time, Cardano had three crucial points of support at $0.054, $0.051, and $0.048. At the time, the trading price of Cardano was very close to the support at Target 1 – $0.054 and may see it moves towards this point in the short-term. However, Target 2 at $0.051 and Target 3 at $0.048 are likely to be Cardano’s destination, price-wise, over the next few weeks. However, if the uptrend were to continue for a longer period, the price might touch the resistance at $0.057 over the next few days.

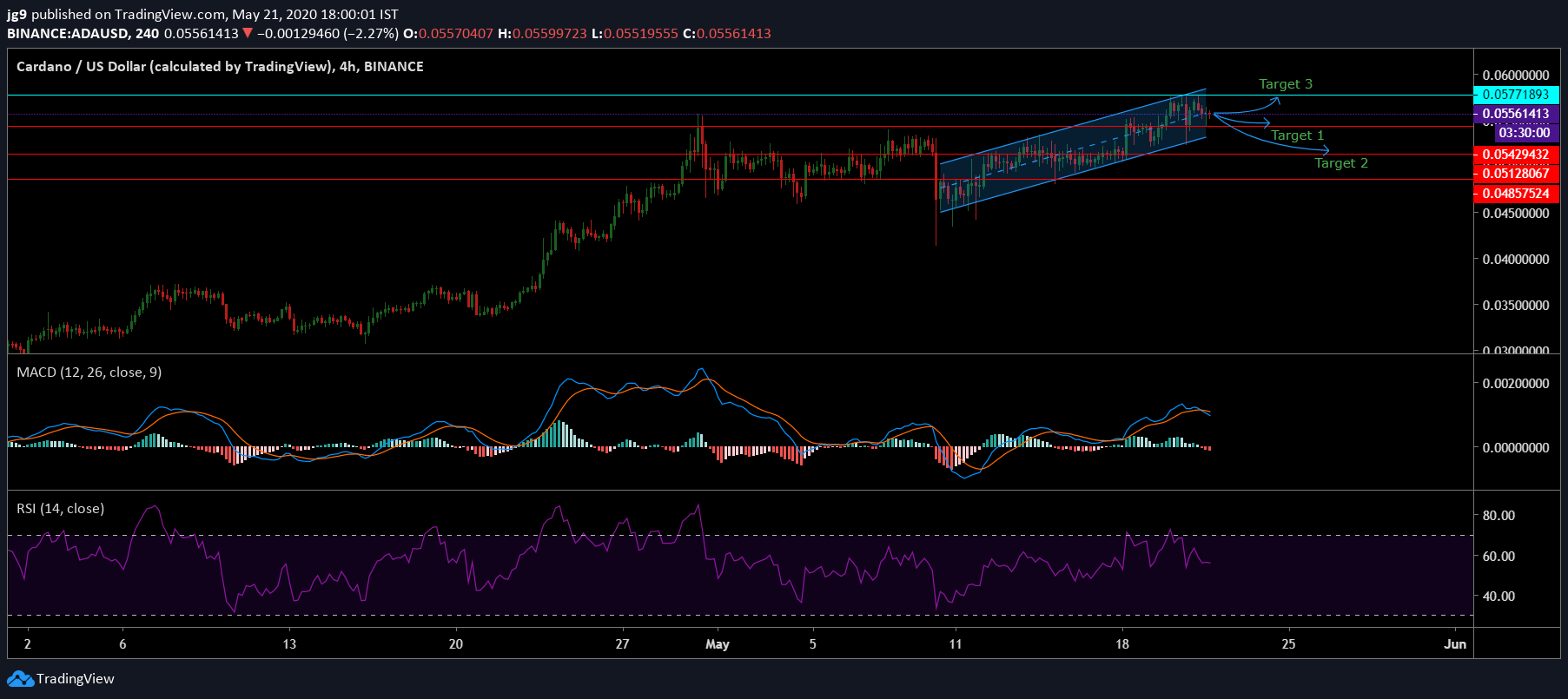

Source: ADA/USD, TradingView

On the 4-hour chart, the MACD indicator had just undergone a bearish crossover as the signal line just moved above the MACD line. Further, the RSI indicator echoed a similar sentiment as it was also moving south towards the oversold zone.

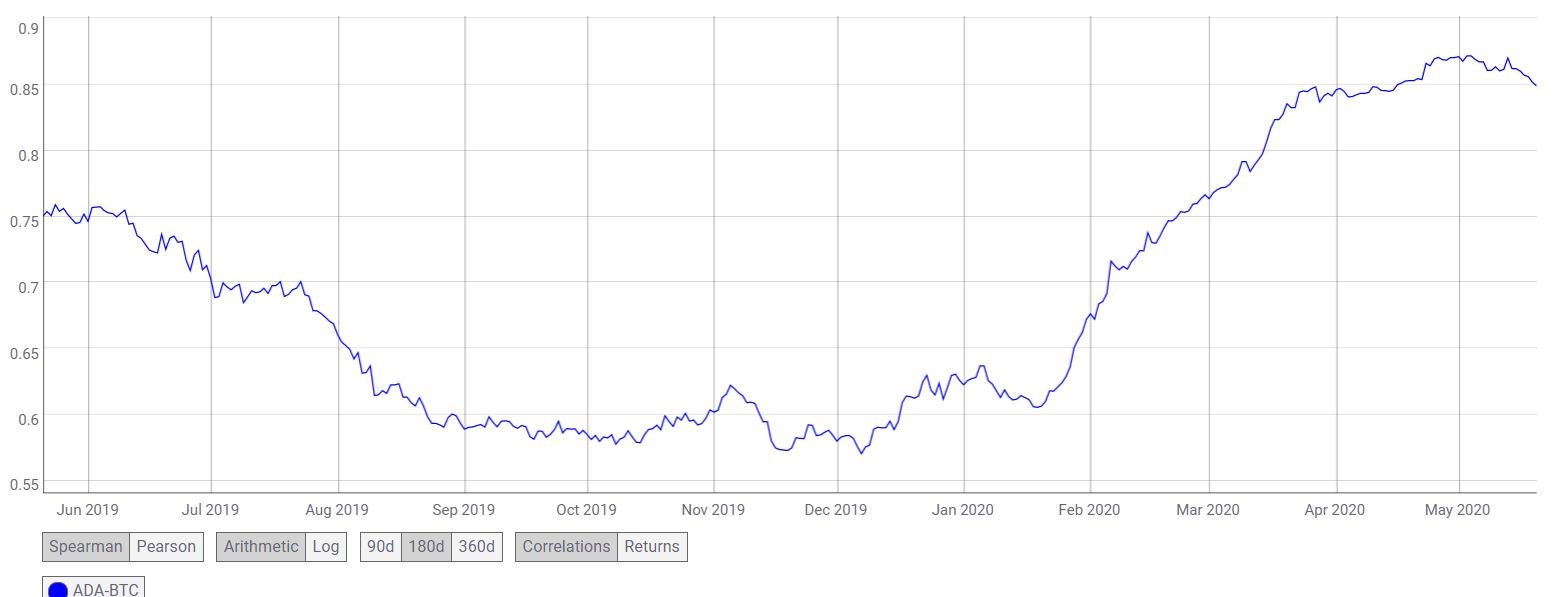

Source: CoinMetrics

Interestingly, in a year’s time, Cardano’s correlation to the world’s largest cryptocurrency, Bitcoin, has not been higher. Over the past three months alone, the correlation has risen from 0.62 to close to 0.84.

Conclusion

Cardano’s price is likely to see a dip over the course of the next few days and is likely to head towards Target 1 at $0.054. However, in the coming week or so, the price may even fall further to Target 2 – $0.051, a development that will result in a 7 percent drop in price. In what is an unlikely scenario, Cardano may also move northwards and continue the uptrend towards Target 3. However, it is likely to see the price fall as it’s a breakout of the ascending channel formation.