Ethereum Index emerges top performer with 14.7% returns

As May concluded, the cryptocurrency market took a sigh of relief as it was able to close on a positive note. The fifth month of the year saw volatility creep back into the market, contributing to drastic changes in the trading activities of the industry’s users. Similarly, the sudden push in Bitcoin’s price provided a much-needed pump to the altcoin markets too.

Bitcoin, while it was returning 16.16% before May, was returning 26.52% by the end of May. Similarly, the world’s second-largest cryptocurrency, Ethereum [ETH], reported a YTD of 72.94%.

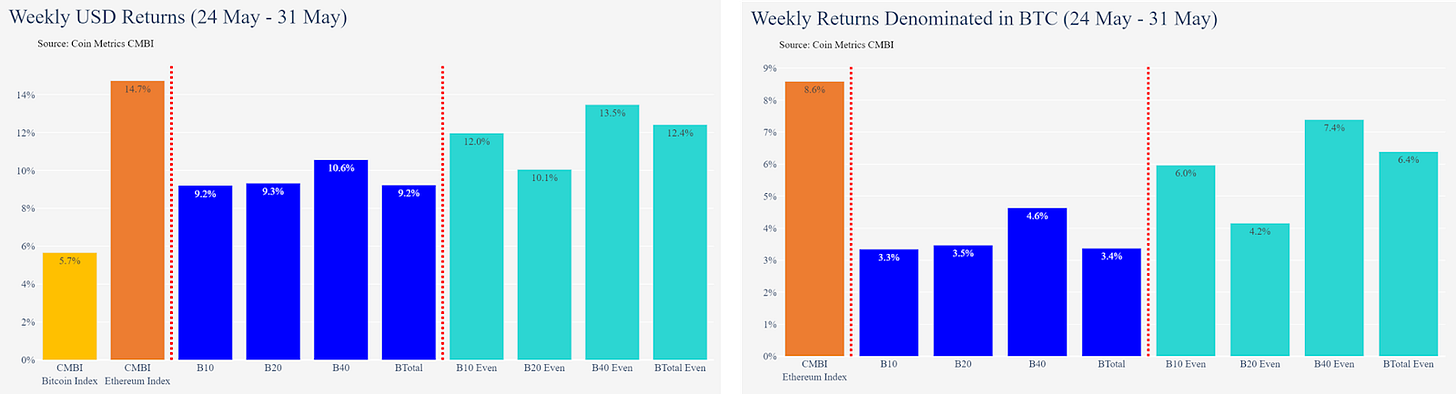

This growth of Bitcoin and altcoins was visible in CoinMetrics’ Bletchley Index too. According to CoinMetrics’ latest report, the last week of May saw recovery from most CMBI and Bletchley indexes. However, the top performer was still the CMBI Etheruem Index, having fallen by just 1% last week. It was returning 14.7%, while the CMBI Bitcoin Index reported a growth of 5.7%, after noting a loss of -7.8% the previous week.

Source: CoinMetrics

Similarly, all other indexes like Bletchley 10, 20, and 40 were in the negative over the previous week, but managed to climb up this week to report 9.2%, 9.3%, and 10.6% in growth, respectively.

According to the previous indication, the weekly returns denominated in BTC, Ethereum were still the leader, and this week too, ETH returned 8.6% when denominated in BTC. While the market’s major cryptos were set on a recovery path, its small-cap assets also noted restricted growth. The B10 assets were at a loss of 0.8% last week; however, this week, the index returned 3.3%. Small-cap assets like B40, which were returning almost 7% last week, noted a slowdown and were returning 4.6%.

Despite such restricted growth, however, all of the Bletchley indexes noted returns between 9% and 11%, indicating uniform strength of the market across all large, mid, and small-cap assets.

As Bitcoin’s price surged at the beginning of June itself, the other assets’ caps may also reflect this positive surge in the next week’s index with higher returns.