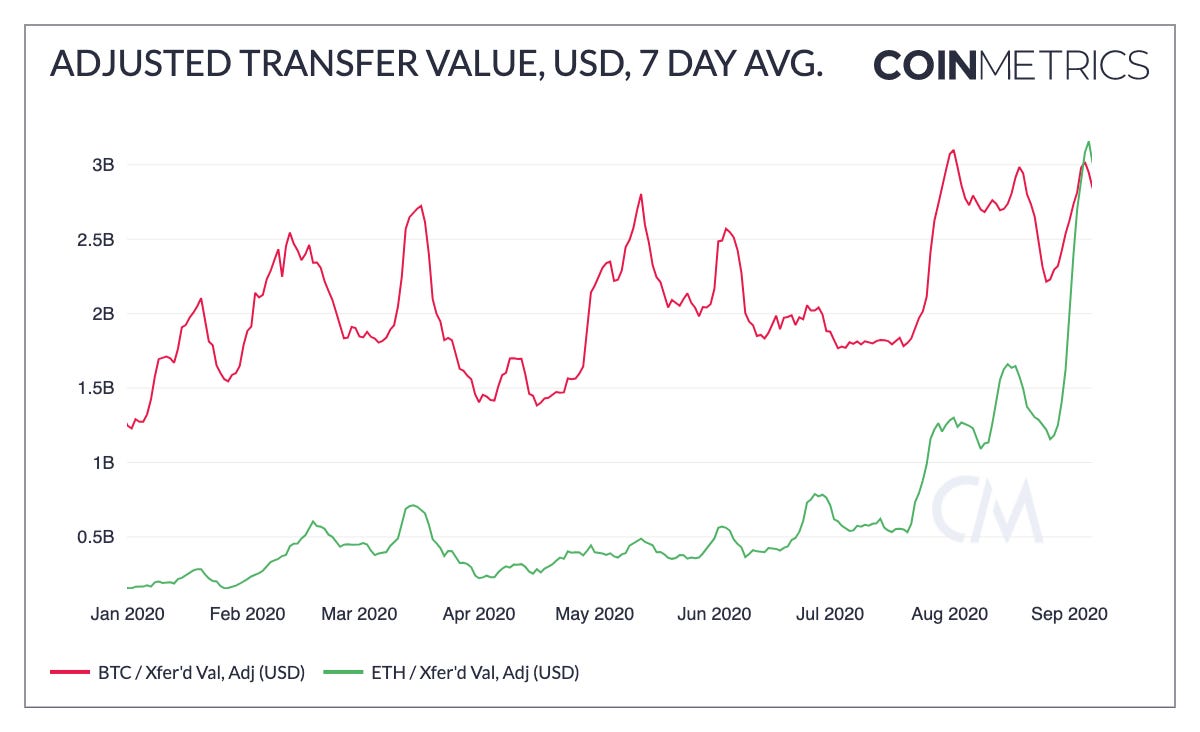

Ethereum dominates Bitcoin in weekly transfers – A 2022-23 kinda thing?

Since the beginning of September, most of the market’s attention has been on the price of Bitcoin, Ethereum, and a few of the top altcoins, with the industry continuing to tackle intense bearish pressure, at press time. Amidst all the noise, however, on-chain development seems to have been forgotten somewhat, with the new Coinmetrics report highlighting that the space noted an important turnover recently.

According to the report, Ethereum’s 7-day average adjusted transfer value recently flipped Bitcoin’s on the 5th of September. On that particular day, the 7-day average value transferred on ETH was close to $3.08 billion, in comparison to Bitcoin’s $3.01 billion.

Source: Coinmetrics

Additionally, it was revealed that the average value on Ethereum was higher than Bitcoin’s for the next two days too. Although Ethereum had crossed Bitcoin’s average value transferred on a day-to-day basis earlier in the year, this is the first time in two years that Ethereum has overtaken Bitcoin’s 7-day average value.

One of the major reasons behind the same is undoubtedly the influence of DeFi apps built on top of Ethereum. The report said,

“Adding fuel to the fire, yearn.finance recently launched their yETH vault which allows users to earn interest on locked ETH. At the time of writing over 200,000 ETH has been locked into the yETH vault.”

A temporary takeover in 2018; a permanent affair in 2020?

Now, back in 2018, when Ethereum’s 7-day average transferred value had overtaken Bitcoin, it was short-lived because it happened towards the back-end of the 1st major bull run for cryptocurrencies. There was a lot of FUD and asset movement, and everything seemed pretty temporary during that period of hype.

Things have changed dramatically in 2020, however, and this time, Ethereum might stay ahead in terms of value transferred for good. It all comes down to how the ecosystem has developed over the last few years.

The innovation and development surrounding Ethereum over the last 24-months have carried a sense of legitimacy, not hype, with DeFi, at the time of writing, emerging as a space with real potential.

To be fair, DeFi is certainly at an early stage too, one that is reminiscent of the ICOs of 2017, but at its core, it can be an extremely important tool for the future.

The idea of authorizing loans without the involvement of a centralized authority, which can be created within seconds, is an enticing concept and with time and refinement, it might become technologically sound as well.

In a practical sense, recent market activity has already indicated that it works on a fundamental level, but there are several illicit projects that are also tarnishing the name of DeFi. Filteration will come though, sooner or later.

In a DeFi-centric Future, Ethereum will be Paradise

Without getting too ahead of ourselves, Bitcoin will possibly overtake Ethereum’s 7-day average value transferred once again thanks to its sheer dominance with respect to market cap. However, in a year or two from now, a DeFi-perfect ecosystem will push Ethereum above Bitcoin, and it will become a permanent reality for both parties.

Bitcoin’s blockchain will accommodate the digital gold narrative and the most expensive cryptocurrency, while Ethereum will possibly fulfill the initial objective of digital assets.