Does Bitcoin’s ‘buy today, sell tomorrow’ strategy always work?

To the investment world, Bitcoin just doesn’t make sense. An asset with no financials, no quarterly earnings reports, no management to speak for it on investor calls, no valuations, no annual report, no head office, nothing. How does one value something like this in order to invest in it? There’s a simple answer – They don’t.

Bitcoin is more or less seen as an asset of the future. And for an asset of the future, you don’t look at present fundamentals, not just because there are none, but because you can’t evaluate it correctly. For this reason and more, Bitcoin is popular among a lot of traders. The fickle, fast-moving, and shrewd operators of the markets who don’t care about the worth of an asset, as long as it gives them a return. Let’s look at Bitcoin’s market based on the perspective of these people.

In order to consider this, let’s take a neutral stance. Let’s look at the Bitcoin market as a buy-today-sell-tomorrow kind, rather than a hodl for weeks, or make a handful intra-day trades kind. In part, because this would still come under the category of trading, but mainly because it’s easier to pull out the daily close price of Bitcoin, rather than its hourly, or even by-minute estimates.

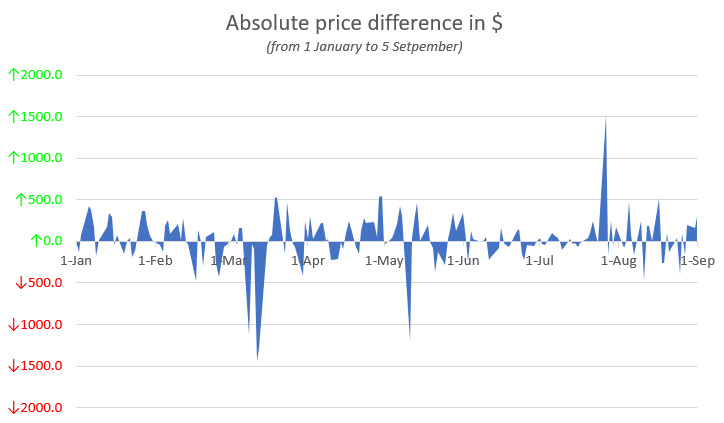

Right, with that sorted, let’s get into the numbers. If you simply and blindly conducted a buy-today sell tomorrow strategy for all the eight completed months and the first 5 days of September, how much would you have made? Before answering this, bear in mind that Bitcoin began the year at $7,500, broke past $10,000 twice, before breaking down to $4,000. It’s now up over $10,000 again. Oh, and two weeks ago, it was over $12,000. Back to the question, how much do you think you’d have made?

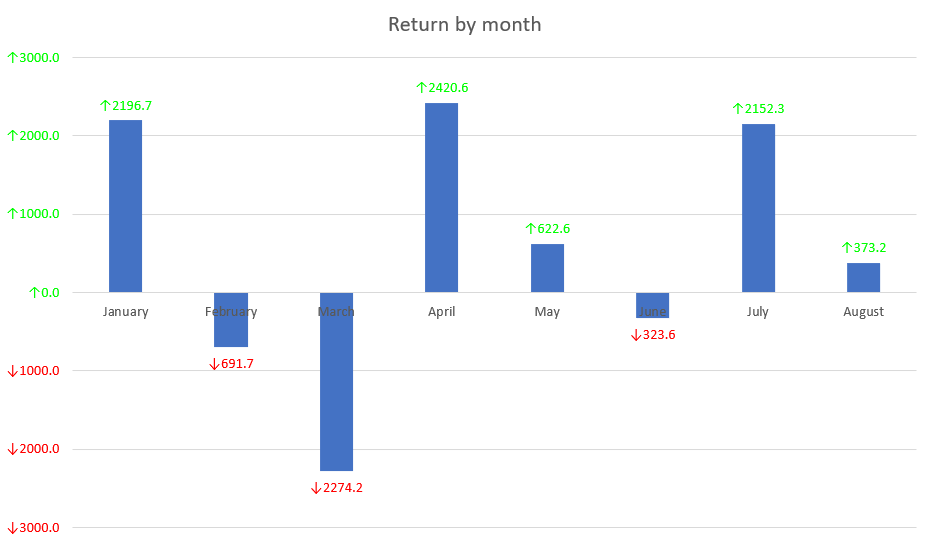

Well, it’s a cool $2,993, or an average of 21.15 percent by buying and selling each day for 8 months. Granted, that’s too many transactions, 248 to be exact, and it doesn’t include order and withdrawal fees, but it’s still a good amount, isn’t it? In fact, if you would’ve ended your long trading game on 31 August, rather than 5 September, you would’ve made $4,476 or a 35.3 percent return by avoiding the 3 September drop from $12,000 to $10,000. In terms of a monthly return, five of the eight months returned positive and three negative. The positive returns totaled $7,765 and the negative $3,289.

So, make of that what you will, but it does go on to state that Bitcoin trading on a day-to-day basis, provided you have the time, capital, and an exchange that doesn’t eat up a lot in fees, will allow you to make a good profit for yourself.

Source: Coinstats