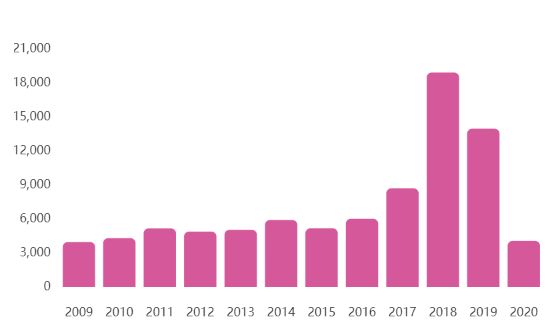

China’s fast-evolving blockchain capabilities: over 4k companies founded in 2020

President Xi Jinping’s backing of blockchain technology in October last year had garnered significant headlines. So what is happening on the blockchain front in China?

While there has not been a significant rise in the figures, however, now there are 27,694 legally registered and operating blockchain companies in China. According to the data from LongHash’s live charts, the coastal province of southeast China, Guangdong continued to have the highest number of blockchain companies in the country. An increase of 5% was noted since January as the number of blockchain companies in the province, at press time, stood at 23,786.

Source: LongHash

Other provinces have seen a slight increase in the number of blockchain companies. Yunan previously had over 5,300 blockchain-based firms, but this number has since declined as it currently stood at 5,277. On the brighter side, the number of blockchain-powered companies that were founded in 2020 stood at 4,069. Three months ago, this value was at a little over 700.

Source: LongHash

China’s ambitious blockchain initiative found another push with Blockchain-based Services Network [BSN] that was launched on 25th April. China’s first-ever nationwide blockchain network is backed by the government’s policy think tank the State Information Center [SIC], and jointly developed by state-run telecom China Mobile and the Chinese government-supported payment card network China UnionPay, and Red Date Technology.

This initiative was touted as crucial, as well as a critical part of China’s national blockchain strategy, primarily because it vouched to provide cross-network, cross-regions, and cross-institution global blockchain service infrastructure.

Besides, the big players such as Baidu, Alibaba, Tencent, and JD are working their own blockchain-driven financial service applications. Talking about traditional players, Chinese banks were reportedly planning to leverage blockchains in sectors like trade financing, supply chain management, settlement, digital invoices, and other applications.