Bitcoin’s tryst with $7,500 may be short lived despite imminent halving

In less than 20 days, Bitcoin will undergo its third halving, with a major price swing in the works. The direction of this swing, however, is anyone’s guess. With the market debating the ‘priced-in’ or not nature of the imminent supply schedule shift, it’s important to look at participants who’ve put their money where their mouth, or rather contracts are.

Traders, especially those hedging the price fallout or breakout using derivative contracts, are leaning in the direction of the former and not the latter. According to data from skew markets, Bitcoin options contract, point to the rise of selling pressure the week before the halving sets in.

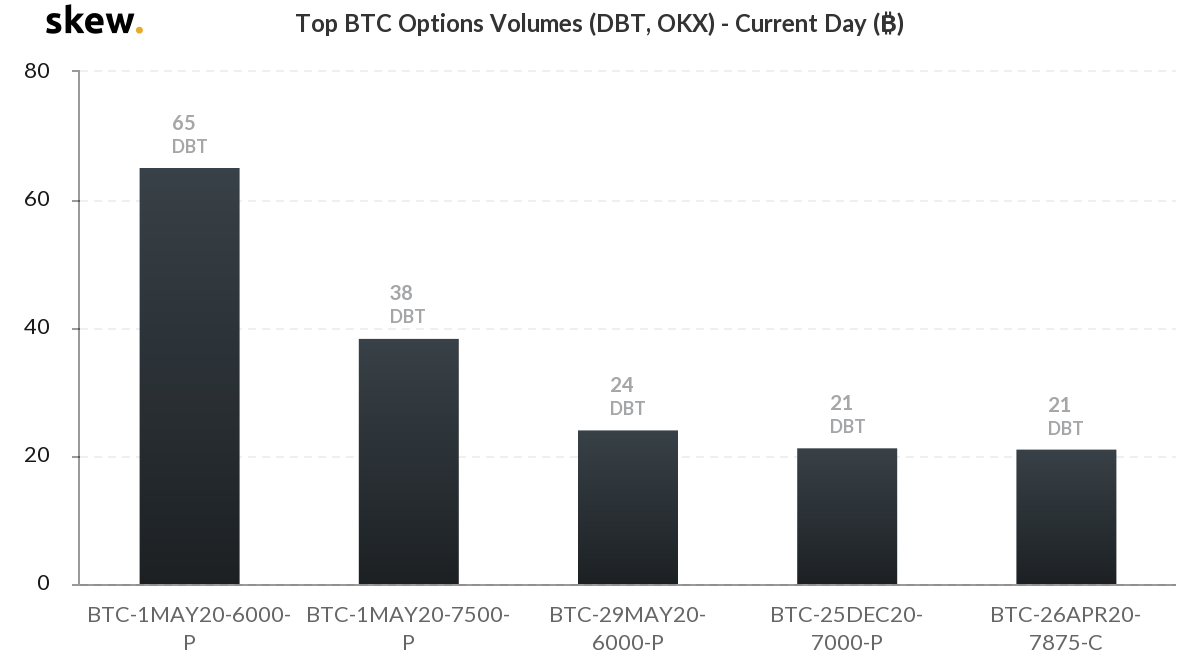

BTC Options volume | Source: skew

Looking at the current day top contracts traded across BTC Options exchanges like Deribit, OKEx and LedgerX, all of the top-5 contracts are put, or options to sell contracts. The highest traded contracts are priced at $6,000, with an expiry of 1 May 2020, which means that the holders of this contracts are expecting the price to fall to said level, in less than a week’s time, and are looking to sell the contract then. Two other contracts bear the same strike price, with an expiry of 8 May and 29 May respectively.

Among the two other contracts in the top-5, one is maintaining a price of $7,500 roughly close to the press time price and the other is expecting a small price drop to $7,000, but in the long term of 25 December 2020. Regardless, of the degree of the price drop, and the timing of it, traders are expecting a drop nonetheless, despite the halving scheduled for early-May, and the expected balancing effect which will take place to ensure mining, even with the decrease of incentives from 12.5 BTC per block to 6.25 BTC per block.

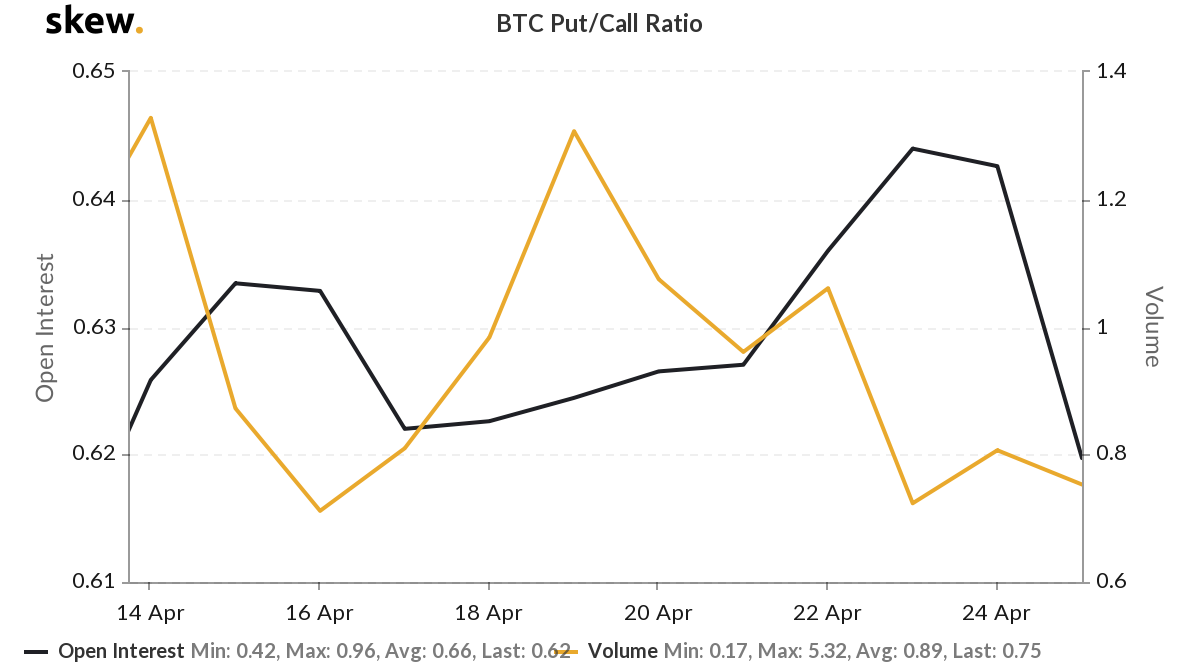

BTC Options put-call ratio volume and OI | Source: skew

While puts are dominating calls for the current day, the larger picture suggests a switchover, even if it does not manifest in the next few days. The open interest of puts-to-calls which was trending up since March 22, up by 45 percent from 0.44 to 0.64, for the first time, in over a month, dropped indicating a pullback of puts to a relative rise in calls. The volume also supported this with a decrease in the ratio from 1.31 a week ago, to 0.75 at press time.

The current day pressure shows mounting puts over calls, with most bearish contracts expiring in the near term, while the larger picture indicates a rising call pressure over puts, once the halving is done with.