Bitcoin’s circulating supply reveals an incomplete picture

It’s a well-known fact that there will only ever be 21 million Bitcoin in existence. The hard cap for the cryptocurrency plays out every four years when the reward halving manifests, altering its supply schedule by half, thereby controlling inflation and avoiding artificial manipulation. But, with the supply steady, how many Bitcoins have already been mined, and does it tell the complete picture?

The answer to the first question is simple. Just over 18.29 million Bitcoins have been mined, over 87 percent of the total supply with 2.7 million in reserve. Around 144 blocks, resulting in 12.5 Bitcoins per block or 1,800 Bitcoins, are mined every day, a figure that will soon drop by half come May.

Now, moving on to the second question, does it tell the complete picture? Well, while the first notion suggests that 18.29 million Bitcoins are already mined, it does not mean that they are active and in circulation.

According to Unchained Capital, on 1 April 2020, the HODL Wave which looks at unspent output from Bitcoin [UTXO] on an age band specifically on the 2-3 years scale dropped below 15 percent, with the same at 14.98 percent, at press time. This means that roughly 15 percent of all Bitcoin ever mined has been sitting idle for 2-3 years.

That 15 percent amounts to 2.74 million Bitcoins; if priced at the press time market value of $6,330, the total value comes to be $17.26 billion.

Fun Fact: The last time the 2-3 year HODL Wave age band represented ~15% (2.25m) of available #BTC was November 2015, when BTC was $345

Today, ~15% (2.74m) of all BTC has been sitting idle for 2-3 years, and the price is ~$6,500 https://t.co/by2nmlXQIJ pic.twitter.com/eum0itEzbI

— Unchained Capital (@unchainedcap) March 31, 2020

Looking further at more short-term age scales, unmoved Bitcoin under between 18 to 24 months was at 5.36 percent, between 12 to 18 months was at 10.73 percent, and between 6 to 12 months was at 13.96 percent, according to Unchained Capital’s data.

With almost a sixth of Bitcoin in circulating supply unmoved over such a large time frame, where are the other Bitcoins being stored? While addresses are the organic storehouse of Bitcoin, exchanges have been gaining a large share over the past few years.

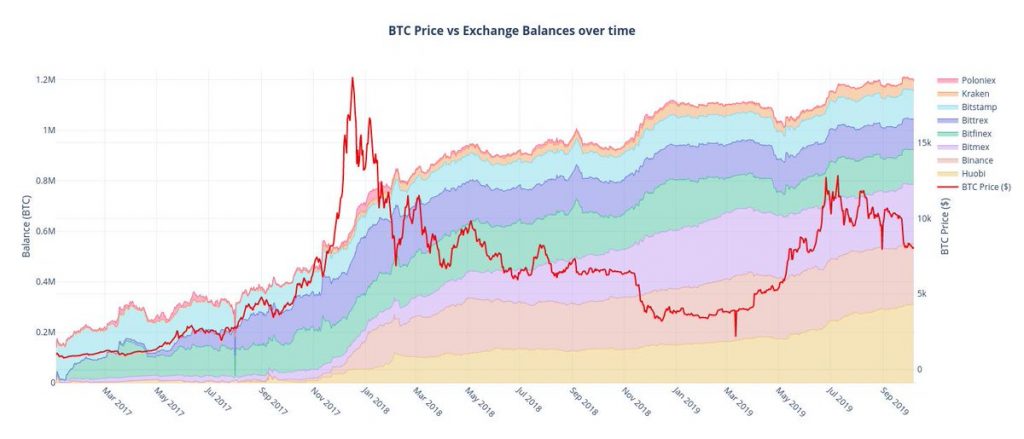

Since the bull run of 2017 and the winter that followed, many exchanges have been set up and services expanded, resulting in an increase in Bitcoin hodling, with Token Analyst referring to exchanges as the ‘biggest HODLers.’

Source: TokenAnalyst, Twitter

And how much of the supply is hoarded by exchanges? Around the same as the number of idle Bitcoin.

CoinShares Board member Ryan Radloff in a blogpost had laid out the Bitcoin by amount and supply held in large exchanges. Based on his assessments, Coinbase was the biggest HODLer with 856,000 BTC in supply [when Bitcoin sold at under $5,000], with other exchanges like Binance, Bittrex, Bitfinex, Bitstamp, Huobi, Kraken and BitMEX in the mix.

The total BTC held by exchanges and other “intermediaries” which included storage-units like Grayscale’s Bitcoin Trust and BitMEX’s Insurance Fund, was at 16.6 percent.

Hence, looking at the larger picture, Bitcoin’s circulating supply is half-baked. While 87 percent of Bitcoins are mined, 15 percent have been idle for 2-3 years, and 16 percent have been hodled by exchanges.