Bitcoin SV long-term Price Analysis: 19 November

Bitcoin SV is currently stuck in a strong resistance range. In the past articles, we had discussed this particular range between $150 and $165 and collective bullish market sentiment also did not assist in a positive breach. The spike over the past 24-hour indicated a minor re-test at $180, but it quickly dropped below $165 yet again. The long-term trend might be strongly bearish for Bitcoin SV now.

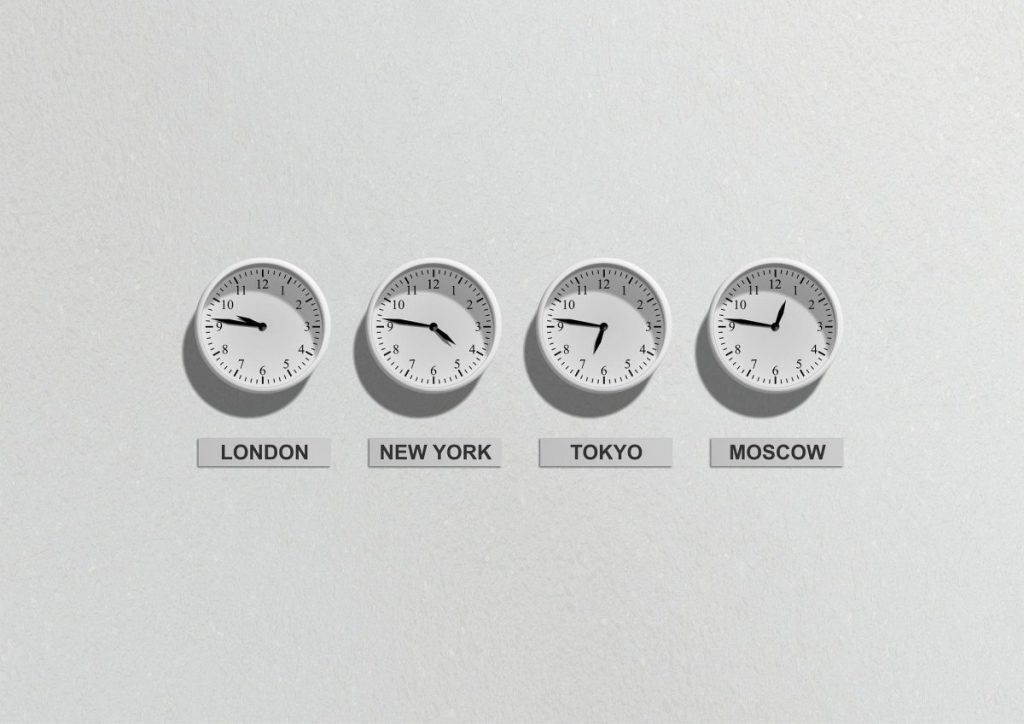

Bitcoin SV 1-day chart

Source: BSV/USD on Trading View

Bitcoin SV’s story has been the same since September. Any bullish spike allows the asset to move above $165 but the price correction brings it down again. Resistance at $180 has been barely crossed and for a majority of the period, the asset has remained under $165.

At press time, Bitcoin SV is currently indicative of a descending triangle, which implied a further bearish outlook. Considering the collective market trend might shift as well, BSV will be under the impression of breaking down under the pattern.

The immediate support below the pattern is at $136 which was briefly only once since March 2020. The declining trading volume suggested the lack of significant activity for BSV. 50-Moving Average also exhibited an overhead resistance above the price candles.

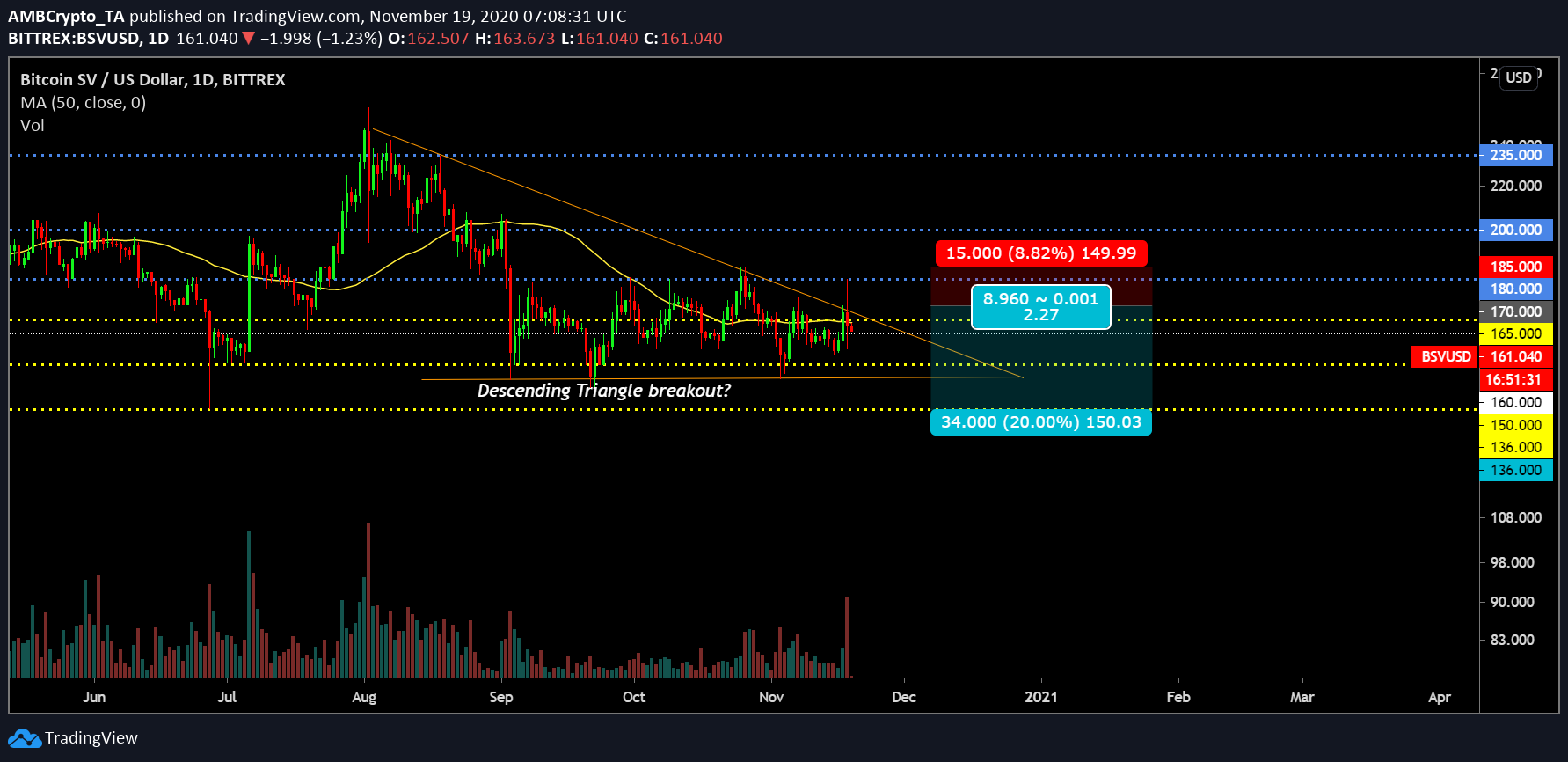

Rationale

Source: BSV/USD on Trading View

The market indicators were currently all over the place but can be speculated to be eventually bearish. Stochastic RSI suggested a position near the overbought zone, and reversal would mean price decline. Bitcoin Mining Profitability is currently towards year high range, which means miners have more incentive to move away from Bitcoin SV.

Lastly, Awesome Oscillator pictured undecided momentum in the charts, indicating the absence of both bulls and bears at the moment.

Important Range

Resistance: $180, $165

Support: $150, $144, $136

Entry for Short Position: $170

Take Profit: $136

Stop Loss: $185

Risk/Reward Ratio: 2,27x

Conclusion

The trend is unlikely to become bullish for Bitcoin SV if the collective market appears to undergo a correction. Bitcoin SV did not exhibit any momentum on its own and it is currently oscillating between the same price range since September.