Bitcoin supply at 22-month low: What’s your plan?

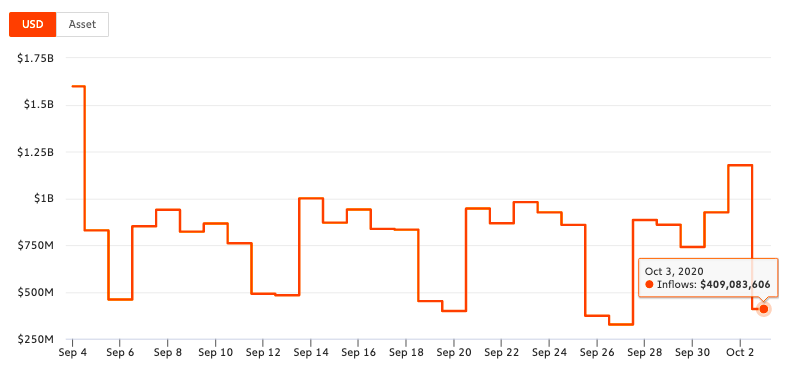

Bitcoin active supply with a 1-day Moving Average has hit a 22-month low. The last time when BTC supply dropped to this level, the price was in the $3.5 to $3.7k range. Since the last week of September 2020, miners started HODLing and this has changed the dynamics of supply. At $409 million, BTC inflow to exchanges has dropped 65% since the start of October 2020.

Source: Chainalysis

Based on data from Chainalysis, a pattern has emerged in Bitcoin Inflow to exchanges, and if it is followed, supply may go up in the next few days/weeks. However, if it continues at this level, retail traders may need a change of strategy. When BTC supply on exchanges is low, corresponding to low demand, there is room for price manipulation by whales/ HODLers.

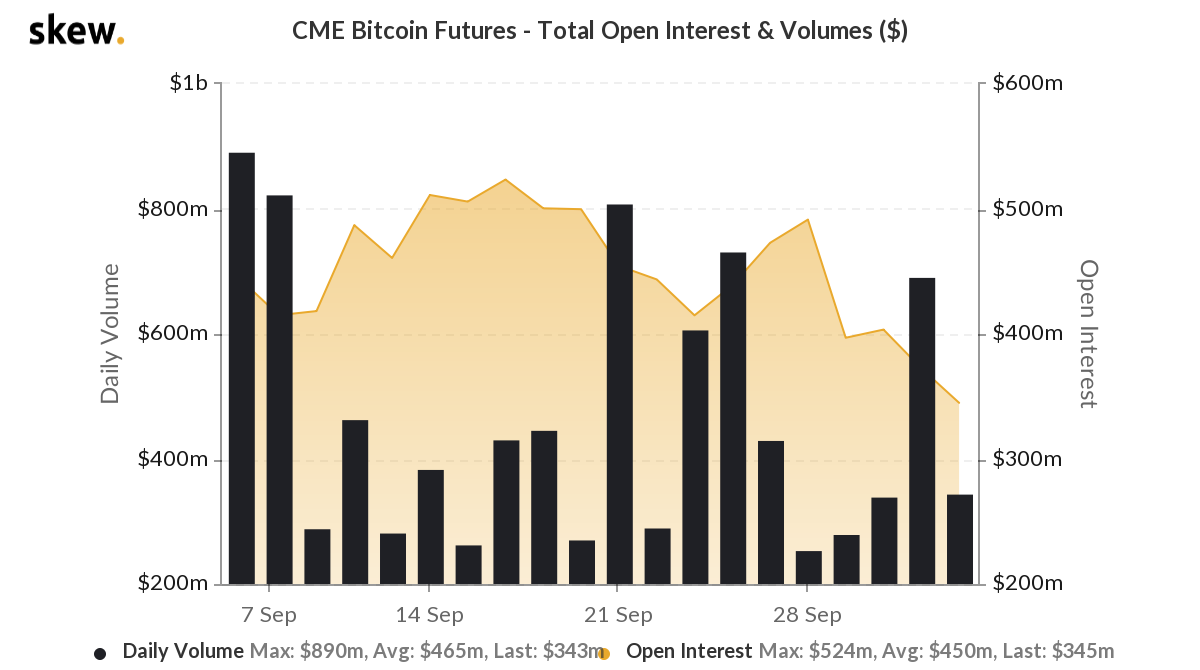

In the past two days, there have been instances of HODLers selling Bitcoin purchased in December 2017 and January 2018. Since volume is low, on spot exchanges, price manipulation becomes easier. On the side whales/ institutions have reduced their activity on derivatives exchanges like CME and trade volume was low throughout September, with the exception of a few days.

Unlike derivatives exchanges, on spot exchange orders in the magnitude of 3-5k BTC are enough to change the price. When the supply is low, volatility is high and this impacts the strategy of retail investors. Few large orders are enough to start panic buying/selling by retail investors. This has happened previously in the March 12 sell-off when retail investors started panic selling. However, such events are followed by a further drop in price, when there is a massive buyback.

Co-founder of a gaming clips app, and crypto trader Posty’s tweet highlights such a scenario.

Source: Twitter

To protect your portfolio from such events, it is advisable to read the market and exchange before making a move. If you are risk-averse, a market with low volume/ high volatility may not be your best bet. Instead, consider diversifying investment further and building a day trading portfolio with assets that rank in Top 25 in market capitalization, and have high trade volume. The remainder can be invested in Bitcoin. However, this would be the opposite for traders who believe in high-risk reward, and this may be the best time to up your stake in Bitcoin. There is a possibility that a sudden price change occurs, as large orders skew the charts this way or that.